Question: What excel built in function should be used here and how do you do it? Excel's Built-in Financial Functions A Phlipadaquoin is venture capital fund

What excel built in function should be used here and how do you do it?

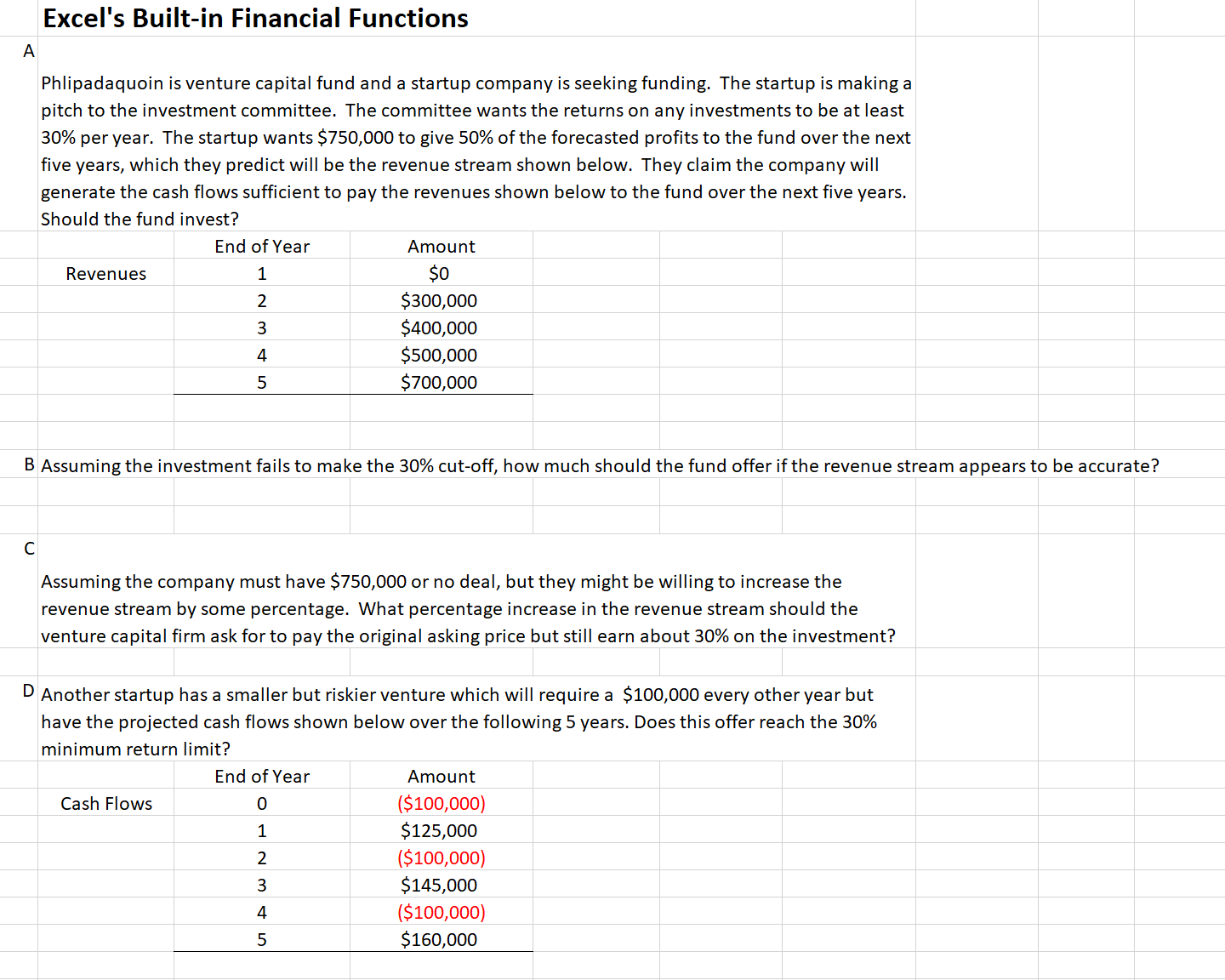

Excel's Built-in Financial Functions A Phlipadaquoin is venture capital fund and a startup company is seeking funding. The startup is making a pitch to the investment committee. The committee wants the returns on any investments to be at least 30% per year. The startup wants $750,000 to give 50% of the forecasted profits to the fund over the next five years, which they predict will be the revenue stream shown below. They claim the company will generate the cash flows sufficient to pay the revenues shown below to the fund over the next five years. Should the fund invest? End of Year Amount Revenues 1 SO W N $300,000 $400,000 4 $500,000 UT $700,000 B Assuming the investment fails to make the 30% cut-off, how much should the fund offer if the revenue stream appears to be accurate? C Assuming the company must have $750,000 or no deal, but they might be willing to increase the revenue stream by some percentage. What percentage increase in the revenue stream should the venture capital firm ask for to pay the original asking price but still earn about 30% on the investment? Another startup has a smaller but riskier venture which will require a $100,000 every other year but have the projected cash flows shown below over the following 5 years. Does this offer reach the 30% minimum return limit? End of Year Amount Cash Flows 0 ($100,000) UI A WNA $125,000 ($100,000) $145,000 ($100,000) $160,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts