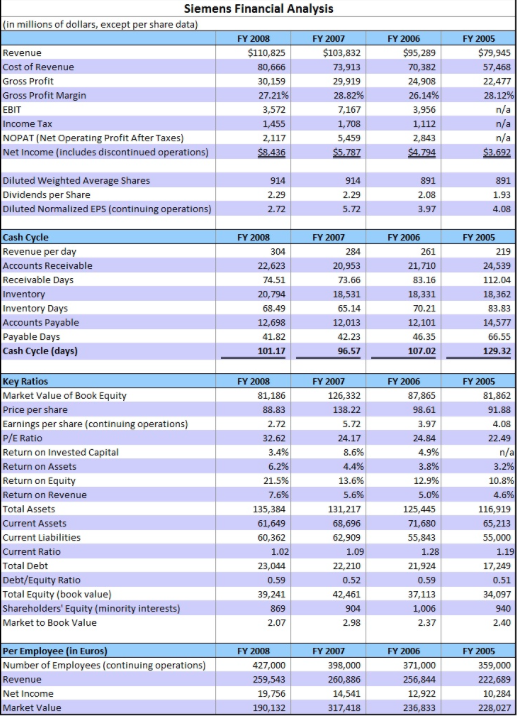

Question: What formula are they using to find dividends per share? Siemens Financial Analysis FY 2008 FY 2007 FY 2006 FY 2005 $95,289 $79,945 Cost of

What formula are they using to find dividends per share?

Siemens Financial Analysis FY 2008 FY 2007 FY 2006 FY 2005 $95,289 $79,945 Cost of Revenue Gross Profit Gross Profit Margin EBIT Income Tax NOPAT (Net Operating Profit After Taxes) Net Income (includes discontinued operations) 73,913 29,919 28.82% 7,167 80,666 30,159 27.21% 24,908 26,14% 28.12% 2,117 Diluted Weighted Average Shares Dividends per Share Diluted Normalized EPS (continuing operations) FY 2008 FY 2007 FY 2006 FY 2005 Revenue per day Accounts Receivable Receivable Days 304 22,623 219 20,953 21,710 112.04 20,794 68.49 12,698 18,531 18,331 18,362 Inventory Days 12,013 Payable Days Cash Cycle (days) 12,101 46.35 107.02 66.55 101.17 96.57 129.32 FY 2008 FY 2007 FY 2006 FY 2005 Key Ratios Market Value of Book Equity Price per share Earnings per share (continuing operations) 81,186 81,862 91.88 126,332 87,865 24.17 8.6% 4.4% 13.6% 5.6% 131,217 68,696 62,909 32.62 n/ Return on Invested Capital Return on Assets Return on Equity Return on Revenue Total Assets Current Assets Current Liabilities Current Ratio Total Debt Debt/Equity Ratio Total Equity (book value) Shareholders' Equity (minority interests) Market to Book Value 21.5% 7.6% 12.9% 10.8% 135,384 61,649 60,362 125,445 55,843 21,924 116,919 65,213 23,044 17,249 42,461 904 2.98 34,097 940 39,241 1,006 2.37 869 2.07 FY 2008 FY 2007 FY 2006 FY 2005 Number of Employees (continuing operations) Revenue Net Income Market Value 427,000 259,543 19,756 190,132 359,000 222,689 10,284 228,027 398,000 371,000 14,541 317,418 12,922 236,833

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts