Question: what formula do I use in excel to get these numbers? and there is the question B) Net Present value = Present of Future cash

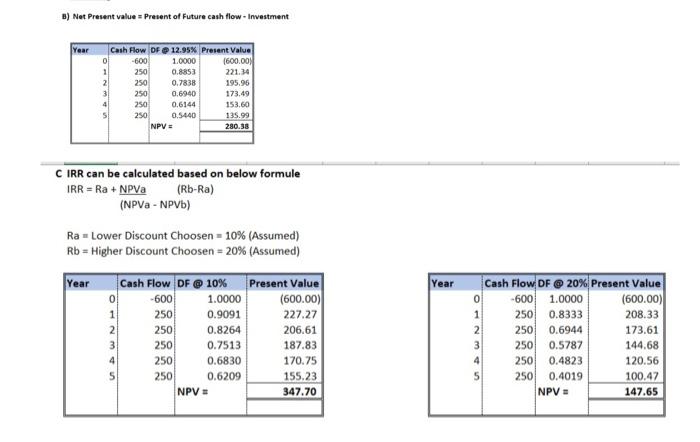

B) Net Present value = Present of Future cash flow - Investment Year Cash Flow DF 12.95% Present Value 0 -600 1.0000 1600.00 1 250 0.8853 221.34 21 250 0.7838 195.96 3 250 0.6940 173.49 4 250 0.6144 153.60 250 0.5440 135.99 NPV = 280.38 C IRR can be calculated based on below formule IRR = Ra + NPVA (Rb-Ra) (NPVA - NPVb) Ra = Lower Discount Choosen = 10% (Assumed) Rb = Higher Discount Choosen = 20% (Assumed) Year Year Cash Flow DF @ 10% 0 -600 1.0000 1 250 0.9091 2 250 0.8264 3 250 0.7513 4 250 0.6830 250 0.6209 NPV = Present Value (600.00) 227.27 206.61 187.83 170.75 155.23 347.70 0 1 2 3 4 5 Cash Flow DF 20% Present Value -600 1.0000 (600.00) 250 0.8333 208.33 250 0.6944 173.61 250 0.5787 144.68 250 0.4823 120.56 250 0.4019 100.47 NPV = 147.65 a Dore Gold Mining Corporation (DGM) is a US based mining corporation that has a gold deposit in northern BC which the company is looking into developing. The total estimated cost of building the underground mine is $600 million and the working capital for the project is expected to be $100 million. The CFO of the company is conducting a financial feasibility study to assess whether the company should develop the project at this time. He observed the long-term expected return on the stock market of 10% where DGM's stock is traded. He also observed the US treasury bills yielding 2%. The project will be financed with a combination of public debt through a bond issue (30%) and common stock (70%). DGM corporate tax rate is 30%. DGM has a beta of 1.8. For the debt portion of the capital, the company is issuing a five-year bond with a 7% coupon which is the company's before tax cost of debt. On an annual basis, the project's expected revenue is $500 million, while operating costs and depreciation are expected to be $200 million and $50 million, respectively over a period of five years. At the end of the project (end of year 5) the company expects to incur reclamation costs of $80 million, realize after-tax proceeds from sale of equipment of $70 million and have the working capital released. The CFO needs your help with the following: A) Calculate the WACC (2 Marks) B) Calculate the project Net Present Value (NPV) (1 Mark) C) Calculate the project's IRR (1 Mark) D) Is this a good project for the company to take on and why/why not? (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts