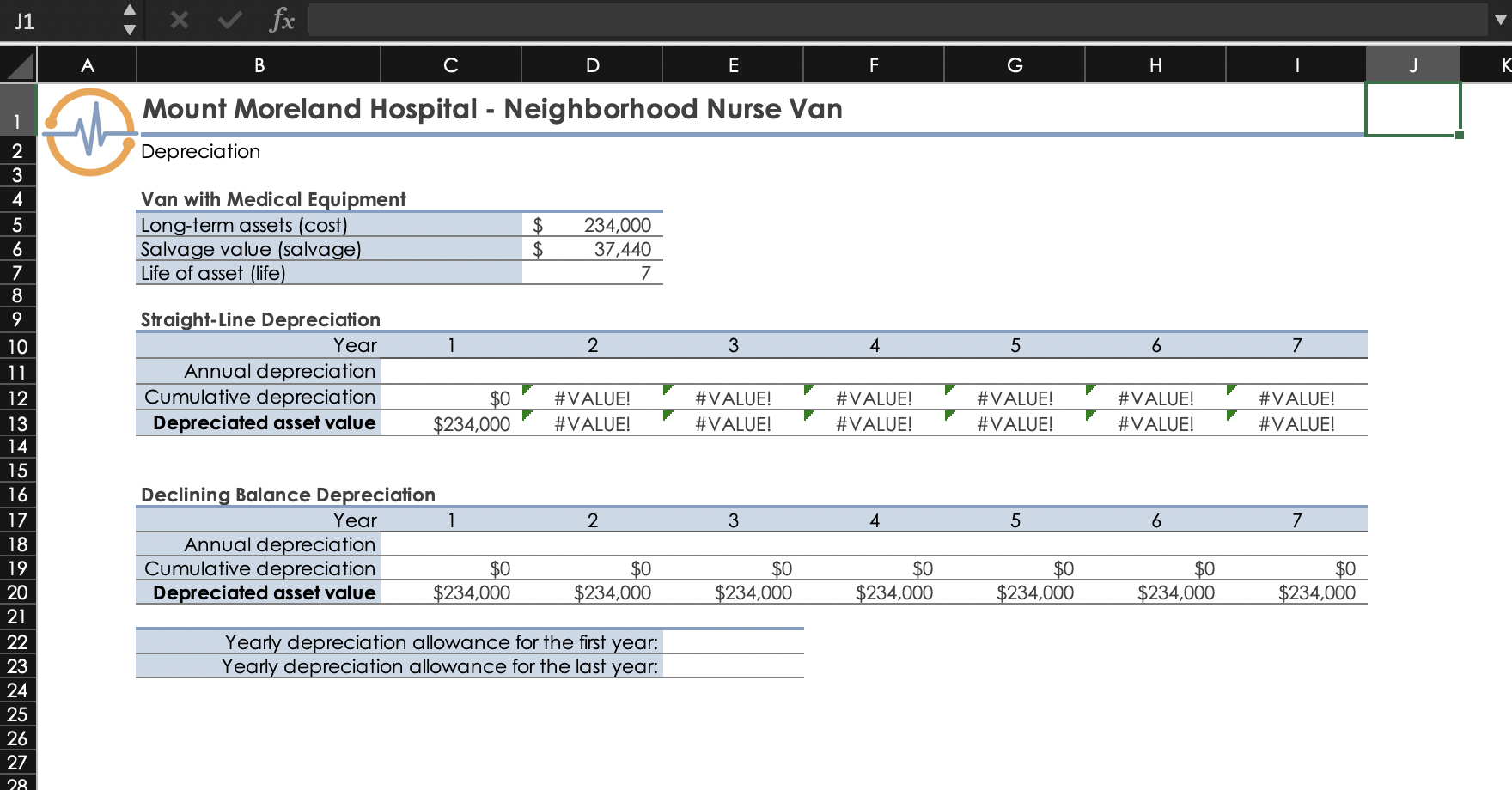

Question: What formula should I use to do this problem? J1 ! _ fx J K Mount Moreland Hospital - Neighborhood Nurse Van Depreciation 2 3

What formula should I use to do this problem?

J1 ! _ fx J K Mount Moreland Hospital - Neighborhood Nurse Van Depreciation 2 3 Van with Medical Equipment Long-term assets (cost) Salvage value (salvage) Life of asset (life) 234,000 37,440 6 9 1 2 3 4 5 6 7 10 11 12 13 Straight-Line Depreciation Year Annual depreciation Cumulative depreciation Depreciated asset value $0" #VALUE! $234,000 #VALUE! " #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 14 15 16 2 3 4 5 6 7 17 18 Declining Balance Depreciation Year 1 Annual depreciation Cumulative depreciation $0 Depreciated asset value $234,000 19 $0 $234,000 $0 $234,000 $0 $234,000 $0 $234,000 $0 $234,000 20 $234,000 21 22 Yearly depreciation allowance for the first year: Yearly depreciation allowance for the last year: 23 24 25 26 27 28 Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the #VALUE! error in cell 012 is causing the other errors in the worksheet. Use Trace Precedents arrows to find the source of the error in cell D12. Correct the error so that the formula in cell D12 calculates the cumulative straight- line depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2. J1 ! _ fx J K Mount Moreland Hospital - Neighborhood Nurse Van Depreciation 2 3 Van with Medical Equipment Long-term assets (cost) Salvage value (salvage) Life of asset (life) 234,000 37,440 6 9 1 2 3 4 5 6 7 10 11 12 13 Straight-Line Depreciation Year Annual depreciation Cumulative depreciation Depreciated asset value $0" #VALUE! $234,000 #VALUE! " #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 14 15 16 2 3 4 5 6 7 17 18 Declining Balance Depreciation Year 1 Annual depreciation Cumulative depreciation $0 Depreciated asset value $234,000 19 $0 $234,000 $0 $234,000 $0 $234,000 $0 $234,000 $0 $234,000 20 $234,000 21 22 Yearly depreciation allowance for the first year: Yearly depreciation allowance for the last year: 23 24 25 26 27 28 Go to the Depreciation worksheet. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations. Correct the errors as follows: a. Use Trace Dependents arrows to determine whether the #VALUE! error in cell 012 is causing the other errors in the worksheet. Use Trace Precedents arrows to find the source of the error in cell D12. Correct the error so that the formula in cell D12 calculates the cumulative straight- line depreciation of the medical van by adding the Cumulative depreciation value in Year 1 to the Annual depreciation value in Year 2Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock