Question: What happens when a firm operates at excess capacity. (a) Hexicon Inc manufactures andmarkets automatic washing machines. Among the many hundreds ofcomponents which it purchases

What happens when a firm operates at excess capacity.

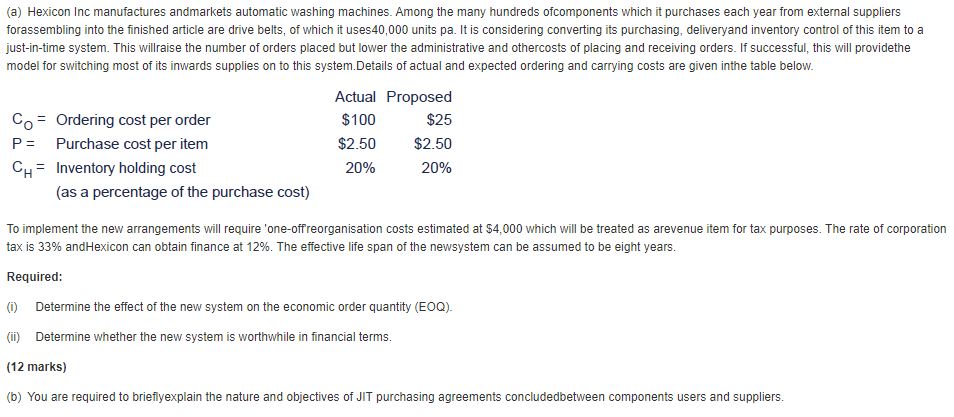

(a) Hexicon Inc manufactures andmarkets automatic washing machines. Among the many hundreds ofcomponents which it purchases each year from external suppliers forassembling into the finished article are drive belts, of which it uses40,000 units pa. It is considering converting its purchasing, deliveryand inventory control of this item to a just-in-time system. This willraise the number of orders placed but lower the administrative and othercosts of placing and receiving orders. If successful, this will providethe model for switching most of its inwards supplies on to this system. Details of actual and expected ordering and carrying costs are given inthe table below. Actual Proposed Co = Ordering cost per order $100 $25 P= Purchase cost per item $2.50 $2.50 CH = Inventory holding cost 20% 20% (as a percentage of the purchase cost) To implement the new arrangements will require 'one-offreorganisation costs estimated at $4,000 which will be treated as arevenue item for tax purposes. The rate of corporation tax is 33% andHexicon can obtain finance at 12%. The effective life span of the newsystem can be assumed to be eight years. Required: (i) Determine the effect of the new system on the economic order quantity (EOQ). (ii) Determine whether the new system is worthwhile in financial terms. (12 marks) (b) You are required to brieflyexplain the nature and objectives of JIT purchasing agreements concludedbetween components users and suppliers.A modeller has proposed the following model for earnings and the price-earnings ratio for the stockmarket E(D) = E(1- 1) Pretty(!) PE(!) = UPF + (PE(1 - 1) - UpE) + Epp(!) where En) = earnings index at time t PE(n) = price/earnings ratio at time / C, He, Her are constant parameters (Assume 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts