Question: What I have written down is confirmed correct from my professor. The ABC Corporation is considering the purchase of a new packaging machine for its

What I have written down is confirmed correct from my professor.

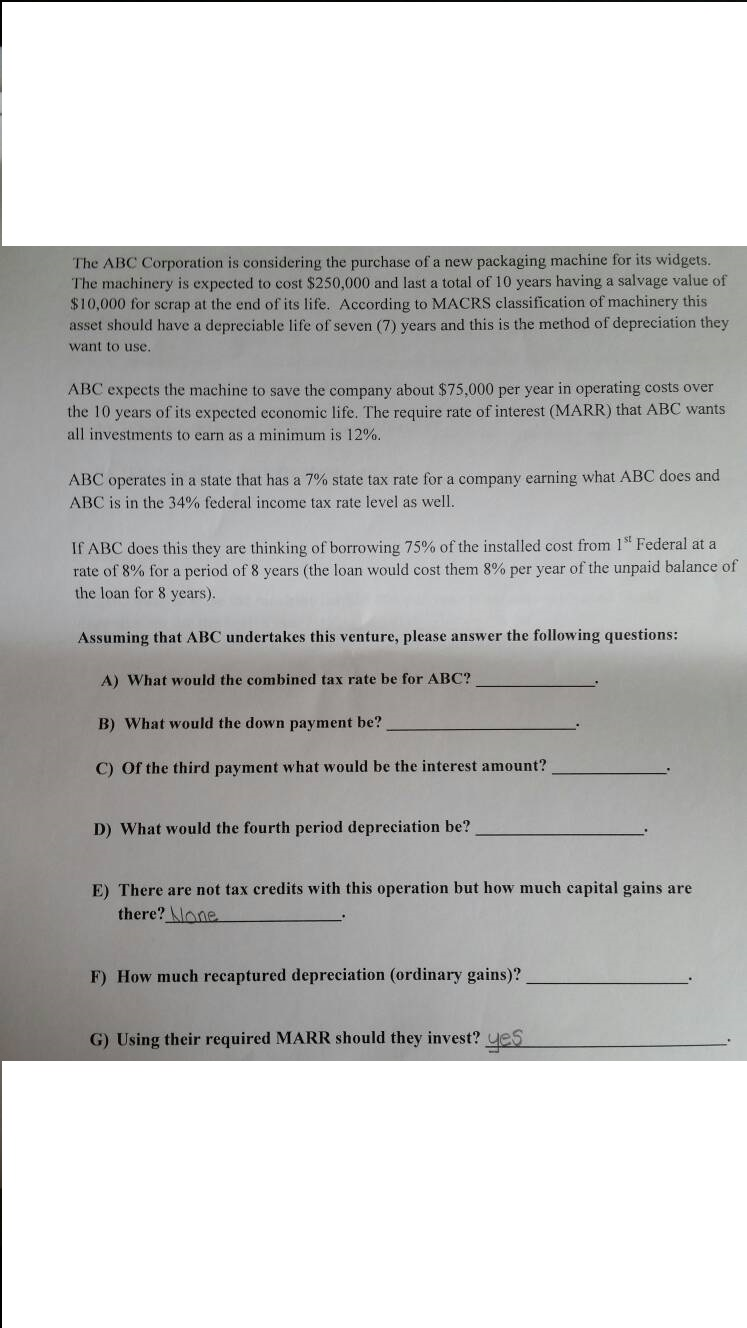

The ABC Corporation is considering the purchase of a new packaging machine for its widgets. The machinery is expected to cost $250,000 and last a total of 10 years having a salvage value of $10,000 for scrap at the end of its life. According to MACRS classification of machinery this asset should have a depreciable life of seven (7) years and this is the method of depreciation they want to use. ABC expects the machine to save the company about $75,000 per year in operating costs over the 10 years of its expected economic life. The require rate of interest (MARR) that ABC wants all investments to earn as a minimum is 12%. ABC operates in a state that has a 7% state tax rate for a company earning what ABC does and ABC is in the 34% federal income tax rate level as well. If AI3C does this they are thinking of borrowing 75% of the installed cost from 1st Federal at a rate of 8% for a period of 8 years (the loan would cost them 8% per year of the unpaid balance of the loan for 8 years). Assuming that ABC undertakes this venture, please answer the following questions: A) What would the combined tax rate be for ABC? B) What would the down payment be? C) Of the third payment what would be the interest amount? D) What would the fourth period depreciation be?E) There are not tax credits with this operation but how much capital gains are there? F) How much recaptured depreciation (ordinary gains)? G) Using their required MARR should they invest? The ABC Corporation is considering the purchase of a new packaging machine for its widgets. The machinery is expected to cost $250,000 and last a total of 10 years having a salvage value of $10,000 for scrap at the end of its life. According to MACRS classification of machinery this asset should have a depreciable life of seven (7) years and this is the method of depreciation they want to use. ABC expects the machine to save the company about $75,000 per year in operating costs over the 10 years of its expected economic life. The require rate of interest (MARR) that ABC wants all investments to earn as a minimum is 12%. ABC operates in a state that has a 7% state tax rate for a company earning what ABC does and ABC is in the 34% federal income tax rate level as well. If AI3C does this they are thinking of borrowing 75% of the installed cost from 1st Federal at a rate of 8% for a period of 8 years (the loan would cost them 8% per year of the unpaid balance of the loan for 8 years). Assuming that ABC undertakes this venture, please answer the following questions: A) What would the combined tax rate be for ABC? B) What would the down payment be? C) Of the third payment what would be the interest amount? D) What would the fourth period depreciation be?E) There are not tax credits with this operation but how much capital gains are there? F) How much recaptured depreciation (ordinary gains)? G) Using their required MARR should they invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts