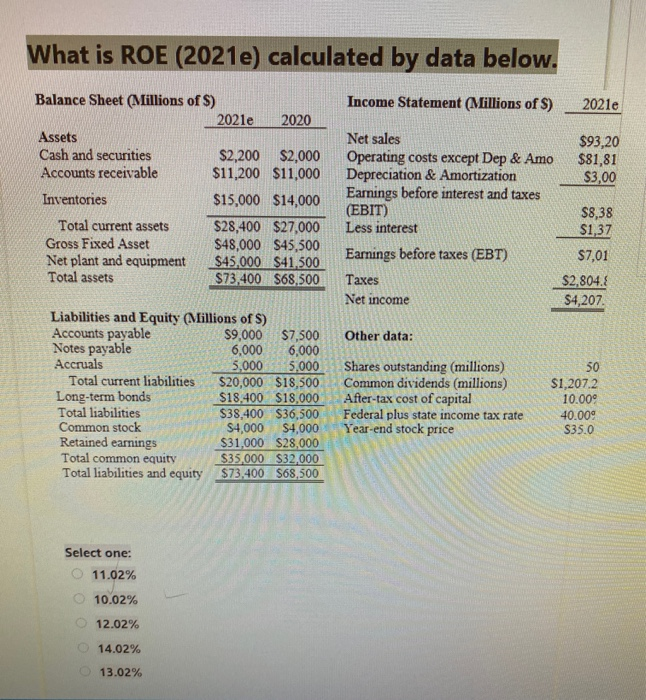

Question: What is ROE (2021e) calculated by data below. Income Statement (Millions of S) 2021e Balance Sheet (Millions of S) 2021e 2020 Assets Cash and securities

What is ROE (2021e) calculated by data below. Income Statement (Millions of S) 2021e Balance Sheet (Millions of S) 2021e 2020 Assets Cash and securities $2,200 $2,000 Accounts receivable $11,200 $11,000 Inventories $15,000 $14,000 Total current assets $28,400 $27,000 Gross Fixed Asset $48,000 $45,500 Net plant and equipment $45,000 $41.500 Total assets $73,400 $68,500 Net sales $93,20 Operating costs except Dep & Amo $81,81 Depreciation & Amortization $3,00 Earnings before interest and taxes (EBIT) $8,38 Less interest $1,37 Earnings before taxes (EBT) $7,01 Taxes $2,804.2 Net income $4,207 Other data: Liabilities and Equity (Millions of S) Accounts payable $9,000 $7,500 Notes payable 6,000 6,000 Accruals 5,000 5.000 Total current liabilities $20,000 $18,500 Long-term bonds $18.400 $18,000 Total liabilities $38,400 $36,500 Common stock $4,000 $4,000 Retained earnings $31,000 $28,000 Total common equity $35,000 $32,000 Total liabilities and equity $73.400 $68,500 Shares outstanding (millions) Common dividends (millions) After-tax cost of capital Federal plus state income tax rate Year-end stock price 50 $1,207.2 10.000 40.009 $35.0 Select one: 11.02% 10.02% 12.02% 14.02% 13.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts