Question: what is the answer from 25 to 29 please 25) The predetermined overhead allocation rate is calculated by dividing. A) the actual overhead costs by

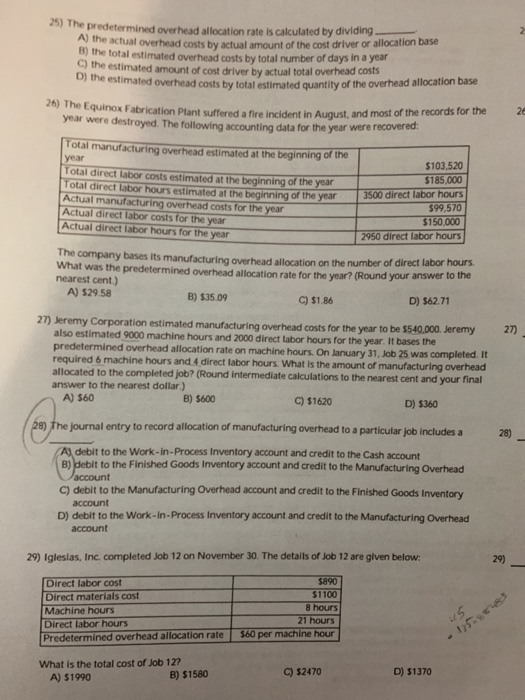

25) The predetermined overhead allocation rate is calculated by dividing. A) the actual overhead costs by actual amount of the cost driver or allocation base B) the total estimated overhead costs by total number of days in a year C) the estimated amount of cost driver by actual total overhead costs D) the estimated overhead costs by total estimated quantity of the overhead allocation base 26) The Equinox Fabrication Plant suffered a fire incident in August, and most of the records for the year were destroyed. The following accounting data for the year were recovered: 26 Total manufacturing overhead estimated at the beginning of the year $103,520 $185,000 3500 direct labor hours $99,570 Total direct labor costs estimated at the beginning of the year Total direct labor hours estimated at the beginning of the year Actual manufacturing overhead costs for the year Actual direct labor costs for the year Actual direct labor hours for the year $150.000 2950 direct labor hours The company bases its manufacturing overhead allocation on the number of direct labor hours. What was the predetermined overhead allocation rate for the year? (Round your answer to the nearest cent.) A) $29.58 B) $35.09 C) $1.86 D) $62.71 27) Jeremy Corporation estimated manufacturing overhead costs for the year to be $540.000. Jeremy also estimated 9000 machine hours and 2000 direct labor hours for the year. It bases the predetermined overhead allocation rate on machine hours. On January 31, Job 25 was completed. It required 6 machine hours and 4 direct labor hours. What is the amount of manufacturing overhead allocated to the completed job? (Round intermediate calculations to the nearest cent and your final answer to the nearest dollar) 27) A) $60 B) $600 C) $1620 D) $360 28) the journal entry to record allocation of manufacturing overhead to a particular job includes a 28) A) debit to the Work-in-Process Inventory account and credit to the Cash account B) debit to the Finished Goods Inventory account and credit to the Manufacturing Overhead account C) debit to the Manufacturing Overhead account and credit to the Finished Goods Inventory account D) debit to the Work-In-Process Inventory account and credit to the Manufacturing Overhead account 29) Igleslas, Inc. completed Job 12 on November 30. The detalls of Job 12 are given below: 29) $890 Direct labor cost Direct materials cost Machine hours Direct labor hours $1100 8 hours 21 hours $60 per machine hour Predetermined overhead allocation rate What is the total cost of Job 12? C) $2470 D) $1370 B) $1580 A) $1990

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts