Question: what is the answer Question 11 (1 point) On September 1, Fintan Inc. purchased a 75% interest in Quiana Ltd. for $1,200,000 cash. Fintan reports

what is the answer

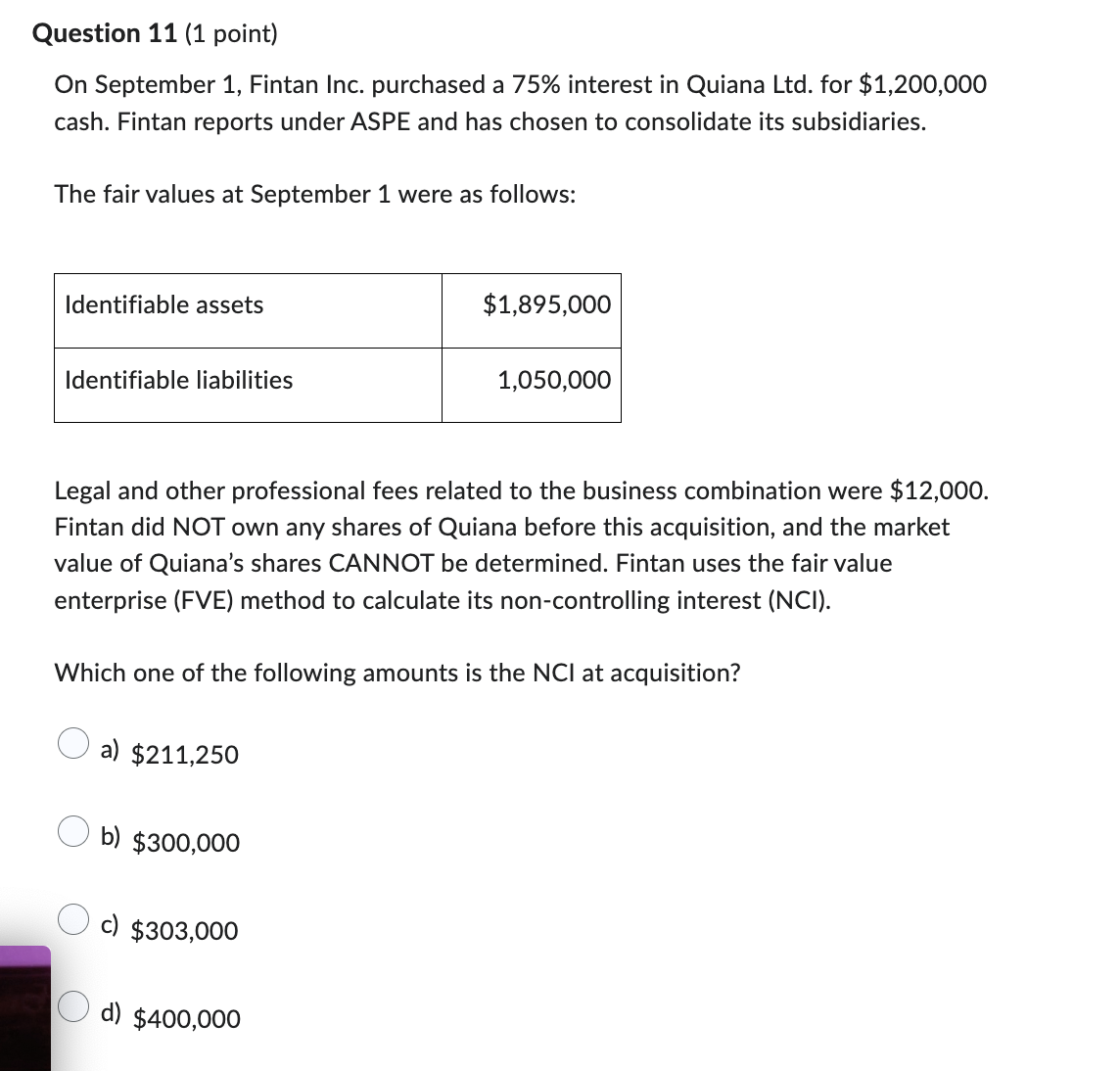

Question 11 (1 point) On September 1, Fintan Inc. purchased a 75% interest in Quiana Ltd. for $1,200,000 cash. Fintan reports under ASPE and has chosen to consolidate its subsidiaries. The fair values at September 1 were as follows: Identifiable assets $1,895,000 Identifiable liabilities 1,050,000 Legal and other professional fees related to the business combination were $12,000. Fintan did NOT own any shares of Quiana before this acquisition, and the market value of Quiana's shares CANNOT be determined. Fintan uses the fair value enterprise (FVE) method to calculate its non-controlling interest (NCI). Which one of the following amounts is the NCI at acquisition? a) $211,250 (b) $300,000 O c) $303,000 O d) $400,000

Question 11 (1 point) On September 1, Fintan Inc. purchased a 75% interest in Quiana Ltd. for $1,200,000 cash. Fintan reports under ASPE and has chosen to consolidate its subsidiaries. The fair values at September 1 were as follows: Identifiable assets $1,895,000 Identifiable liabilities 1,050,000 Legal and other professional fees related to the business combination were $12,000. Fintan did NOT own any shares of Quiana before this acquisition, and the market value of Quiana's shares CANNOT be determined. Fintan uses the fair value enterprise (FVE) method to calculate its non-controlling interest (NCI). Which one of the following amounts is the NCI at acquisition? a) $211,250 (b) $300,000 O c) $303,000 O d) $400,000 Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock