Question: what is the answer this four problem? let me know!! thank you Interest Expense is classified as a(n): Other Income Selling Expense Administrative Expense Other

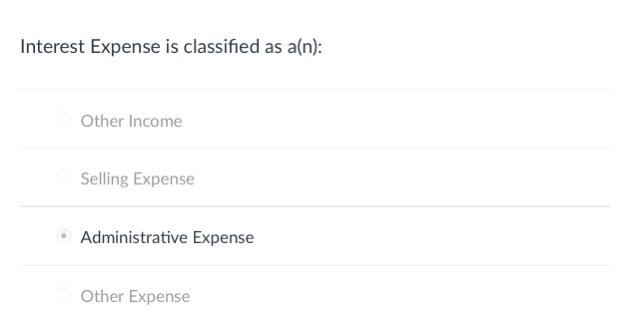

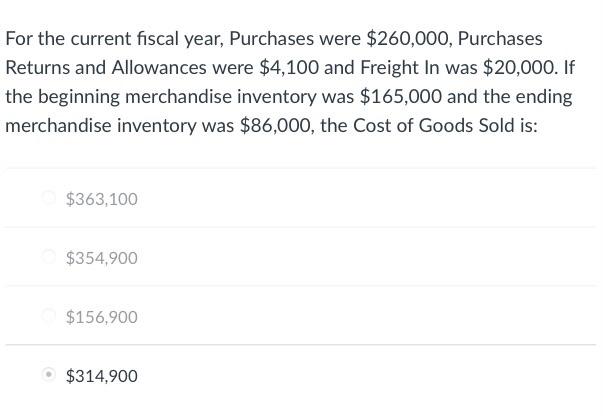

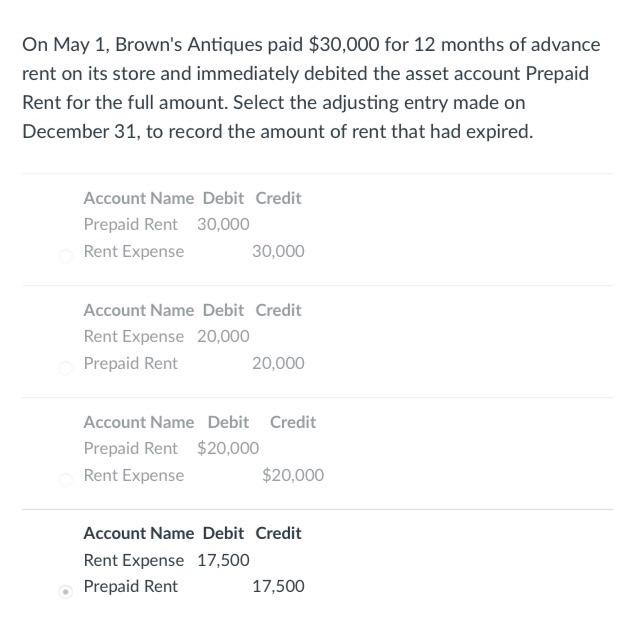

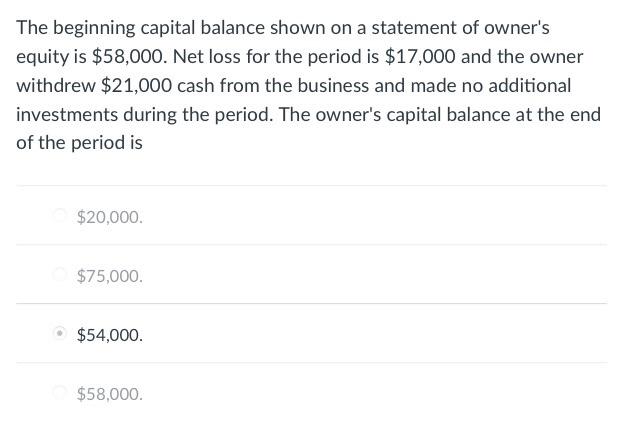

Interest Expense is classified as a(n): Other Income Selling Expense Administrative Expense Other Expense For the current fiscal year, Purchases were $260,000, Purchases Returns and Allowances were $4,100 and Freight In was $20,000. If the beginning merchandise inventory was $165,000 and the ending merchandise inventory was $86,000, the Cost of Goods Sold is: $363,100 $354,900 $156,900 $314,900 On May 1, Brown's Antiques paid $30,000 for 12 months of advance rent on its store and immediately debited the asset account Prepaid Rent for the full amount. Select the adjusting entry made on December 31, to record the amount of rent that had expired. Account Name Debit Credit Prepaid Rent 30,000 Rent Expense 30,000 Account Name Debit Credit Rent Expense 20,000 Prepaid Rent 20,000 Account Name Debit Credit Prepaid Rent $20,000 Rent Expense $20,000 Account Name Debit Credit Rent Expense 17,500 Prepaid Rent 17,500 The beginning capital balance shown on a statement of owner's equity is $58,000. Net loss for the period is $17,000 and the owner withdrew $21,000 cash from the business and made no additional investments during the period. The owner's capital balance at the end of the period is $20,000. $75,000 $54,000. $58,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts