Question: Old MathJax webview Old MathJax webview 7. Using the financial statements given, answer the following: (a) If there were 20 million common shares in issue,

Old MathJax webview

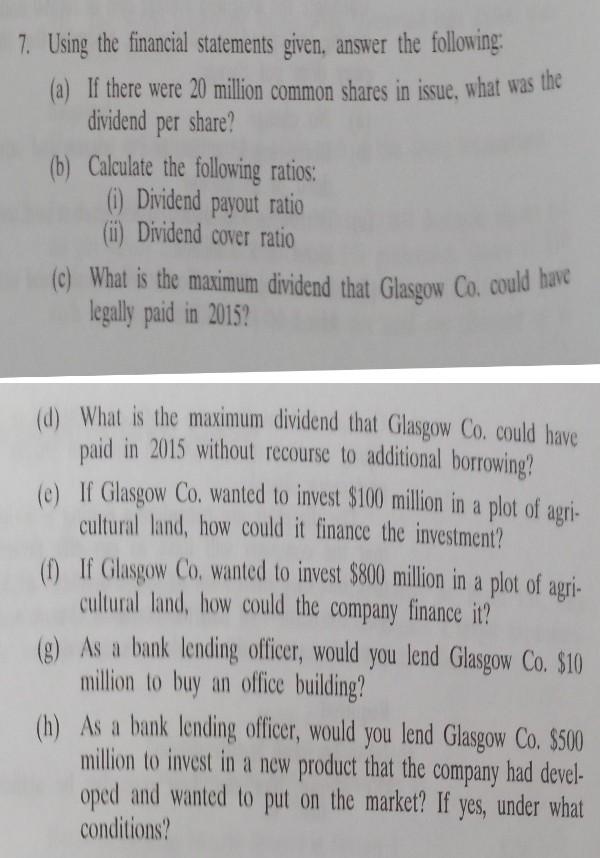

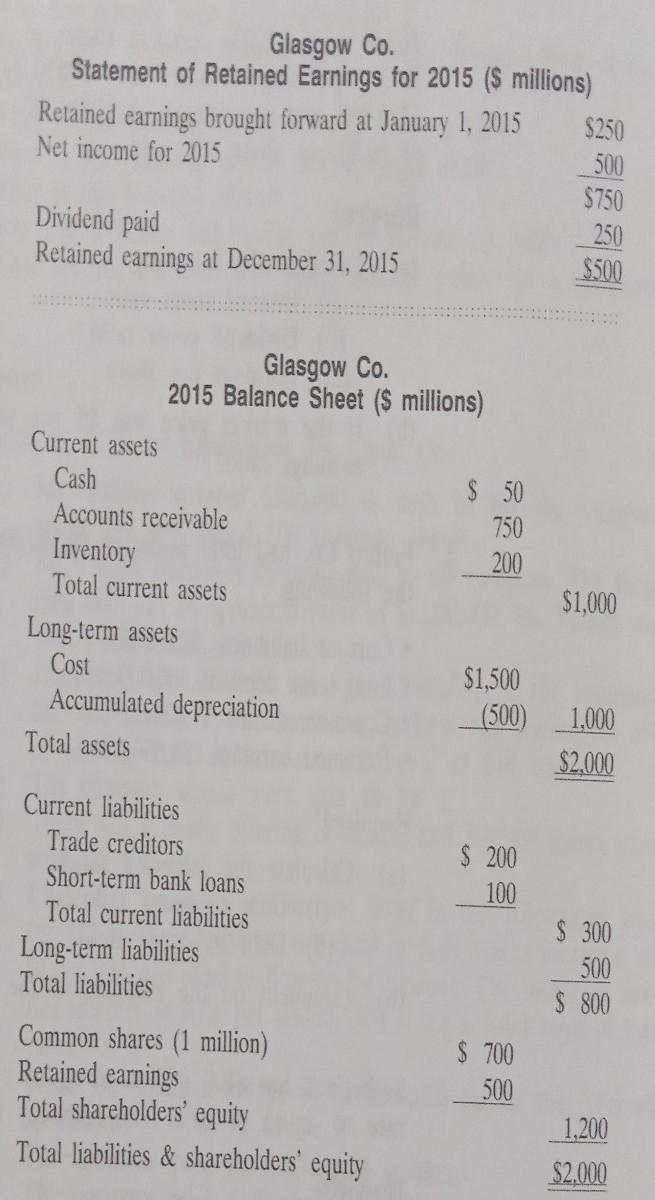

7. Using the financial statements given, answer the following: (a) If there were 20 million common shares in issue, what was the dividend per share? (b) Calculate the following ratios: i) Dividend payout ratio (ii) Dividend cover ratio (c) What is the maximum dividend that Glasgow Co. could have legally paid in 2015 a (d) What is the maximum dividend that Glasgow Co. could have paid in 2015 without recourse to additional borrowing? (e) If Glasgow Co. wanted to invest $100 million in a plot of agri- cultural land, how could it finance the investment? (1) If Glasgow Co wanted to invest $800 million in a plot of agri- cultural land, how could the company finance it? (g) As a bank lending officer, would you lend Glasgow Co. $10 million to buy an office building? (h) As a bank lending officer, would you lend Glasgow Co. $500 million to invest in a new product that the company had devel- oped and wanted to put on the market? If yes, under what , conditions? Glasgow Co. Statement of Retained Earnings for 2015 ($ millions) Retained earnings brought forward at January 1, 2015 $250 Net income for 2015 500 $750 Dividend paid 250 Retained earnings at December 31, 2015 $500 Glasgow Co. 2015 Balance Sheet (s millions) Current assets Cash $ 50 Accounts receivable 750 Inventory 200 Total current assets Long-term assets Cost $1,500 Accumulated depreciation (500) Total assets $1,000 1,000 $2.000 Current liabilities Trade creditors Short-term bank loans Total current liabilities Long-term liabilities Total liabilities $ 200 100 $ 300 500 $ 800 Common shares (1 million) Retained earnings Total shareholders' equity Total liabilities & shareholders' equity $ 700 500 1,200 $2.000 7. Using the financial statements given, answer the following: (a) If there were 20 million common shares in issue, what was the dividend per share? (b) Calculate the following ratios: i) Dividend payout ratio (ii) Dividend cover ratio (c) What is the maximum dividend that Glasgow Co. could have legally paid in 2015 a (d) What is the maximum dividend that Glasgow Co. could have paid in 2015 without recourse to additional borrowing? (e) If Glasgow Co. wanted to invest $100 million in a plot of agri- cultural land, how could it finance the investment? (1) If Glasgow Co wanted to invest $800 million in a plot of agri- cultural land, how could the company finance it? (g) As a bank lending officer, would you lend Glasgow Co. $10 million to buy an office building? (h) As a bank lending officer, would you lend Glasgow Co. $500 million to invest in a new product that the company had devel- oped and wanted to put on the market? If yes, under what , conditions? Glasgow Co. Statement of Retained Earnings for 2015 ($ millions) Retained earnings brought forward at January 1, 2015 $250 Net income for 2015 500 $750 Dividend paid 250 Retained earnings at December 31, 2015 $500 Glasgow Co. 2015 Balance Sheet (s millions) Current assets Cash $ 50 Accounts receivable 750 Inventory 200 Total current assets Long-term assets Cost $1,500 Accumulated depreciation (500) Total assets $1,000 1,000 $2.000 Current liabilities Trade creditors Short-term bank loans Total current liabilities Long-term liabilities Total liabilities $ 200 100 $ 300 500 $ 800 Common shares (1 million) Retained earnings Total shareholders' equity Total liabilities & shareholders' equity $ 700 500 1,200 $2.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts