Question: What is the answer to question d? that the expected return goes down as well as the risk, but the price remains the same since

What is the answer to question d? that the expected return goes down as well as the risk, but the price remains the same since the sharpe-ratio remains unchanged?

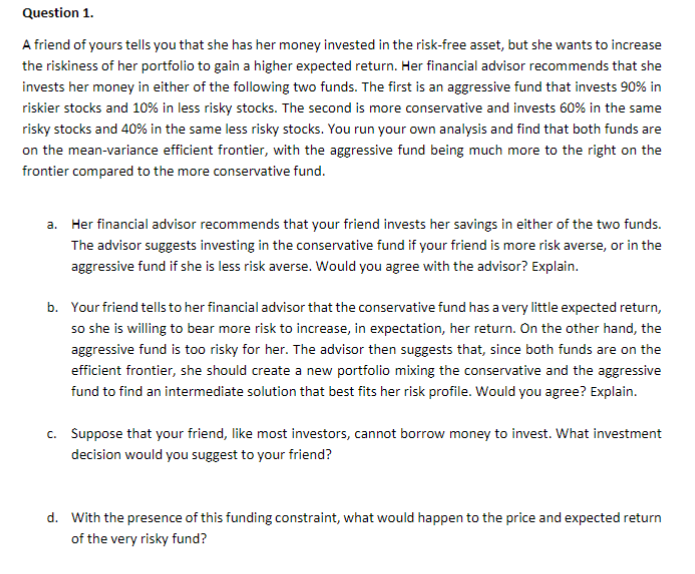

Question 1. A friend of yours tells you that she has her money invested in the risk-free asset, but she wants to increase the riskiness of her portfolio to gain a higher expected return. Her financial advisor recommends that she invests her money in either of the following two funds. The first is an aggressive fund that invests 90% in riskier stocks and 10% in less risky stocks. The second is more conservative and invests 60% in the same risky stocks and 40% in the same less risky stocks. You run your own analysis and find that both funds are on the mean-variance efficient frontier, with the aggressive fund being much more to the right on the frontier compared to the more conservative fund. a. Her financial advisor recommends that your friend invests her savings in either of the two funds. The advisor suggests investing in the conservative fund if your friend is more risk averse, or in the aggressive fund if she is less risk averse. Would you agree with the advisor? Explain. b. Your friend tells to her financial advisor that the conservative fund has a very little expected return, so she is willing to bear more risk to increase, in expectation, her return. On the other hand, the aggressive fund is too risky for her. The advisor then suggests that, since both funds are on the efficient frontier, she should create a new portfolio mixing the conservative and the aggressive fund to find an intermediate solution that best fits her risk profile. Would you agree? Explain. C. Suppose that your friend, like most investors, cannot borrow money to invest. What investment decision would you suggest to your friend? d. With the presence of this funding constraint, what would happen to the price and expected return of the very risky fund? Question 1. A friend of yours tells you that she has her money invested in the risk-free asset, but she wants to increase the riskiness of her portfolio to gain a higher expected return. Her financial advisor recommends that she invests her money in either of the following two funds. The first is an aggressive fund that invests 90% in riskier stocks and 10% in less risky stocks. The second is more conservative and invests 60% in the same risky stocks and 40% in the same less risky stocks. You run your own analysis and find that both funds are on the mean-variance efficient frontier, with the aggressive fund being much more to the right on the frontier compared to the more conservative fund. a. Her financial advisor recommends that your friend invests her savings in either of the two funds. The advisor suggests investing in the conservative fund if your friend is more risk averse, or in the aggressive fund if she is less risk averse. Would you agree with the advisor? Explain. b. Your friend tells to her financial advisor that the conservative fund has a very little expected return, so she is willing to bear more risk to increase, in expectation, her return. On the other hand, the aggressive fund is too risky for her. The advisor then suggests that, since both funds are on the efficient frontier, she should create a new portfolio mixing the conservative and the aggressive fund to find an intermediate solution that best fits her risk profile. Would you agree? Explain. C. Suppose that your friend, like most investors, cannot borrow money to invest. What investment decision would you suggest to your friend? d. With the presence of this funding constraint, what would happen to the price and expected return of the very risky fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts