Question: What is the appropriate discount factor to use for evaluating the tent project? To implement the project, the firm has to invest funds as shown

What is the appropriate discount factor to use for evaluating the tent project?

To implement the project, the firm has to invest funds as shown in the following table:

| Year 0 | Year 1 |

| $12 million | Production and selling of commercial appliances starts |

MACRS depreciation will be used.

To facilitate the operation of manufacturing the tents, the company will have to allocate funds to net working capital (NWC) equivalent to 10% of annual sales. The investment in NWC will be recovered at the end of the project.

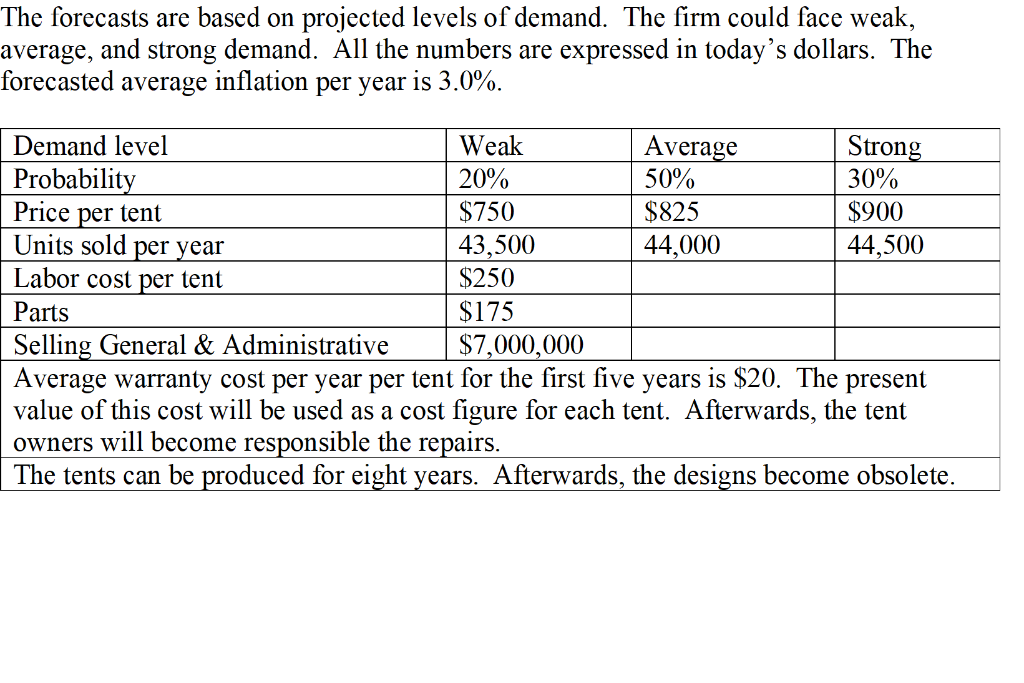

The forecasts are based on projected levels of demand. The firm could face weak average, and strong demand. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0% Demand level Probability Price per tent Units sold per vear Labor cost per tent Parts Selling General & Administrative Average warranty cost per year per tent for the first five years is $20. The present value of this cost will be used as a cost figure for each tent. Afterwards, the tent owners will become responsible the repairs The tents can be produced for eight years. Afterwards, the designs become obsolete Weak 20% S750 43,500 250 $175 $7,000,000 Average 50% $825 44,000 Stron 30% $900 44,500 The forecasts are based on projected levels of demand. The firm could face weak average, and strong demand. All the numbers are expressed in today's dollars. The forecasted average inflation per year is 3.0% Demand level Probability Price per tent Units sold per vear Labor cost per tent Parts Selling General & Administrative Average warranty cost per year per tent for the first five years is $20. The present value of this cost will be used as a cost figure for each tent. Afterwards, the tent owners will become responsible the repairs The tents can be produced for eight years. Afterwards, the designs become obsolete Weak 20% S750 43,500 250 $175 $7,000,000 Average 50% $825 44,000 Stron 30% $900 44,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts