Question: What is the book value adjusted WACC for Clark Explorers at a tax rate of 35%? b. What is the market value adjusted WACC for

What is the book value adjusted WACC for Clark Explorers at a tax rate of 35%?

b.What is the market value adjusted WACC for Clark Explorers at a tax rate of 30%?

What is the book value adjusted WACC for Clark Explorers at a tax rate of 30%?

c.What is the market value adjusted WACC for Clark Explorers at a tax rate of 15%?

What is the book value adjusted WACC for Clark Explorers at a tax rate of 15%?

d.What is the market value adjusted WACC for Clark Explorers at a tax rate of 5%?

What is the book value adjusted WACC for Clark Explorers at a tax rate of 5%?

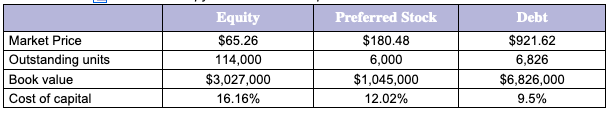

Adjusted WACC. Clark Explorers, Inc., an engineering firm, has the following capital structure: 3. Using market value and book value (separately, of course), find the adjusted WACC for Clark Explorers at the following tax rates: a. 35% b. 30% c. 15% d. 5% a. What is the market value adjusted WACC for Clark Explorers at a tax rate of 35%? % (Round to two decimal places.) Debt Market Price Outstanding units Book value Cost of capital Equity $65.26 114,000 $3,027,000 16.16% Preferred Stock $180.48 6,000 $1,045,000 12.02% $921.62 6,826 $6,826,000 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts