Question: What is the cost of equity using CAPM? What is the cost of equity using the Dividend Discount Model? Bond Maturity (Years) Annual Coupon

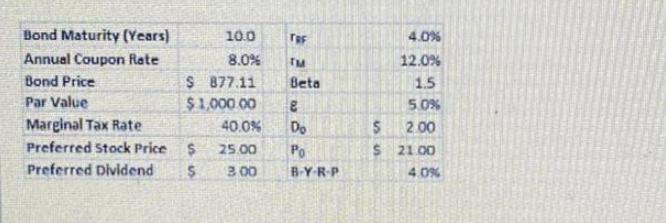

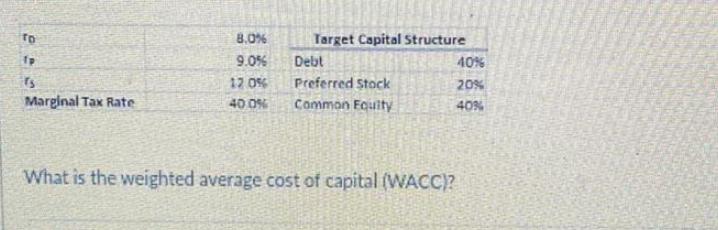

What is the cost of equity using CAPM? What is the cost of equity using the Dividend Discount Model? Bond Maturity (Years) Annual Coupon Rate Bond Price Par Value Marginal Tax Rate Preferred Stock Price Preferred Dividend 10.0 8.0% $ 877.11 $1,000.00 $ 25.00 3.00 S TOF TM Beta 8 40.0% Do Po B-Y-R-P 4.0% 12.0% 1.5 5.0% 2.00 $ 21.00 4.0% 55 To 23 Marginal Tax Rate 8.0% 9.0% 12.0% 40.0% Target Capital Structure Debt Preferred Stock Common Equity What is the weighted average cost of capital (WACC)? 40% 20% 40%

Step by Step Solution

There are 3 Steps involved in it

The questions displayed in the images are asking how to calculate the cost of equity using the Capit... View full answer

Get step-by-step solutions from verified subject matter experts