Question: What is the cost structure for Stimgro and the margin? Since Stimgro is very profitable, with a good margin, why does it matter if the

What is the cost structure for Stimgro and the margin?

Since Stimgro is very profitable, with a good margin, why does it matter if the cost of MS-7 increases?

- What alternatives are open to Amanda Tellford?

- What are the advantages and disadvantages of each alternative?

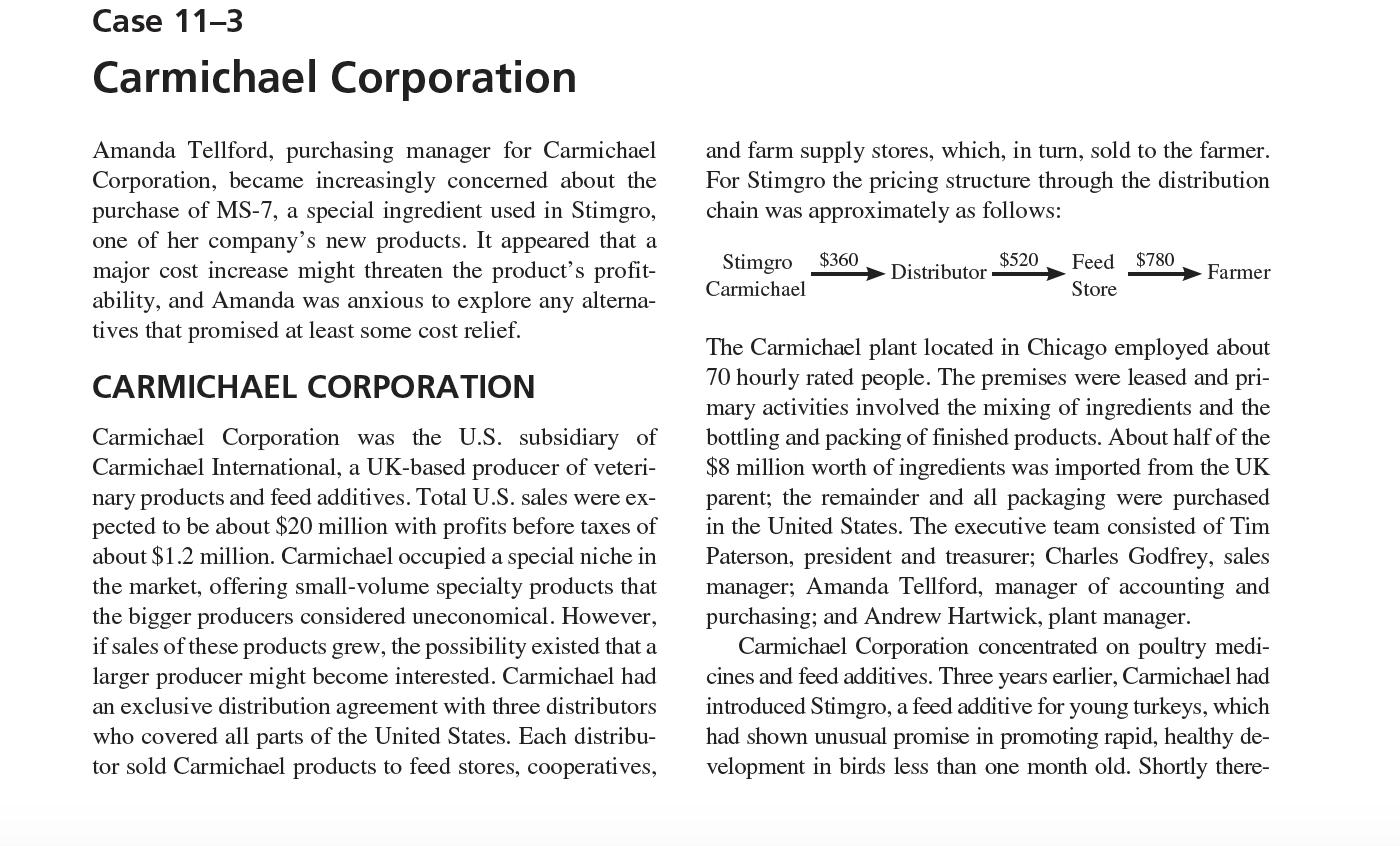

Case 11-3 Carmichael Corporation Amanda Tellford, purchasing manager for Carmichael Corporation, became increasingly concerned about the purchase of MS-7, a special ingredient used in Stimgro, one of her company's new products. It appeared that a major cost increase might threaten the product's profit- ability, and Amanda was anxious to explore any alterna- tives that promised at least some cost relief. and farm supply stores, which, in turn, sold to the farmer. For Stimgro the pricing structure through the distribution chain was approximately as follows: Stimgro $360 $520 Feed $780 Distributor Farmer Carmichael Store The Carmichael plant located in Chicago employed about 70 hourly rated people. The premises were leased and pri- mary activities involved the mixing of ingredients and the bottling and packing of finished products. About half of the $8 million worth of ingredients was imported from the UK parent; the remainder and all packaging were purchased CARMICHAEL CORPORATION Carmichael Corporation was the U.S. subsidiary of Carmichael International, a UK-based producer of veteri- nary products and feed additives. Total U.S. sales were ex- pected to be about $20 million with profits before taxes of about $1.2 million. Carmichael occupied a special niche in the market, offering small-volume specialty products that the bigger producers considered uneconomical. However, if sales of these products grew, the possibility existed that a larger producer might become interested. Carmichael had an exclusive distribution agreement with three distributors who covered all parts of the United States. Each distribu- tor sold Carmichael products to feed stores, cooperatives, in the United States. The executive team consisted of Tim Paterson, president and treasurer; Charles Godfrey, sales manager; Amanda Tellford, manager of accounting and purchasing; and Andrew Hartwick, plant manager. Carmichael Corporation concentrated on poultry medi- cines and feed additives. Three years earlier, Carmichael had introduced Stimgro, a feed additive for young turkeys, which had shown unusual promise in promoting rapid, healthy de- velopment in birds less than one month old. Shortly there-

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts