You have been provided with information on the price of Avocados in the U.S before (free...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

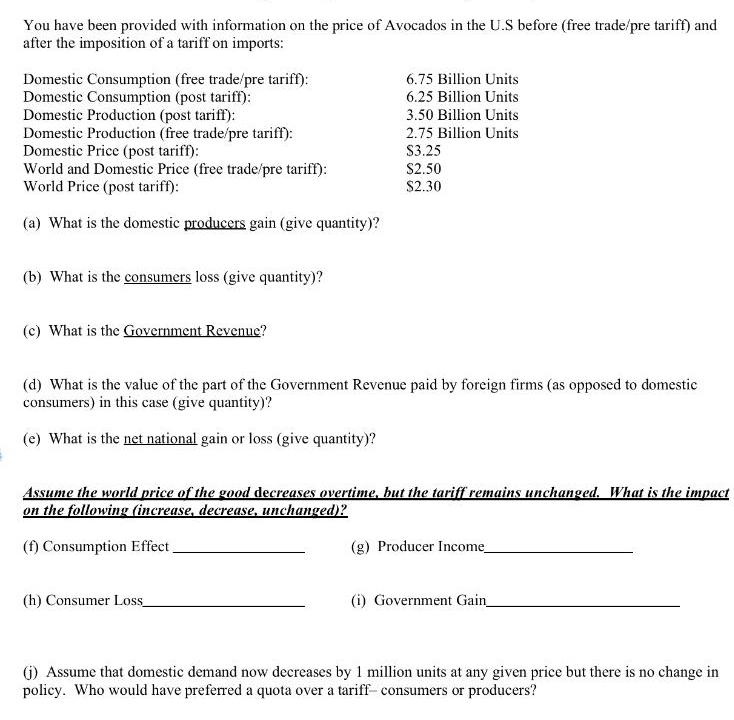

You have been provided with information on the price of Avocados in the U.S before (free trade/pre tariff) and after the imposition of a tariff on imports: Domestic Consumption (free trade/pre tariff): Domestic Consumption (post tariff): Domestic Production (post tariff): Domestic Production (free trade/pre tariff): Domestic Price (post tariff): World and Domestic Price (free trade/pre tariff): World Price (post tariff): (a) What is the domestic producers gain (give quantity)? (b) What is the consumers loss (give quantity)? (c) What is the Government Revenue? 6.75 Billion Units 6.25 Billion Units 3.50 Billion Units 2.75 Billion Units $3.25 $2.50 $2.30 (d) What is the value of the part of the Government Revenue paid by foreign firms (as opposed to domestic consumers) in this case (give quantity)? (e) What is the net national gain or loss (give quantity)? Assume the world price of the good decreases overtime, but the tariff remains unchanged. What is the impact on the following (increase, decrease, unchanged)? (f) Consumption Effect. (h) Consumer Loss_ (g) Producer Income__ (i) Government Gain_ (j) Assume that domestic demand now decreases by 1 million units at any given price but there is no change in policy. Who would have preferred a quota over a tariff- consumers or producers? You have been provided with information on the price of Avocados in the U.S before (free trade/pre tariff) and after the imposition of a tariff on imports: Domestic Consumption (free trade/pre tariff): Domestic Consumption (post tariff): Domestic Production (post tariff): Domestic Production (free trade/pre tariff): Domestic Price (post tariff): World and Domestic Price (free trade/pre tariff): World Price (post tariff): (a) What is the domestic producers gain (give quantity)? (b) What is the consumers loss (give quantity)? (c) What is the Government Revenue? 6.75 Billion Units 6.25 Billion Units 3.50 Billion Units 2.75 Billion Units $3.25 $2.50 $2.30 (d) What is the value of the part of the Government Revenue paid by foreign firms (as opposed to domestic consumers) in this case (give quantity)? (e) What is the net national gain or loss (give quantity)? Assume the world price of the good decreases overtime, but the tariff remains unchanged. What is the impact on the following (increase, decrease, unchanged)? (f) Consumption Effect. (h) Consumer Loss_ (g) Producer Income__ (i) Government Gain_ (j) Assume that domestic demand now decreases by 1 million units at any given price but there is no change in policy. Who would have preferred a quota over a tariff- consumers or producers?

Expert Answer:

Answer rating: 100% (QA)

a The domestic producers gain is the change in total production from pretariff levels to posttariff ... View the full answer

Related Book For

Posted Date:

Students also viewed these economics questions

-

5) Consider a product with constant annual demand of 900 units, fixed ordering cost of $80 per order, and inventory cost of 10% per unit per year. The product's cost price is $100 per unit. It is...

-

How long will it take to produce 1.00 103 kg of magnesium metal by the electrolysis of molten magnesium chloride using a current of 5.00 104 A?

-

How long will it take to build up a fund of $10 000 by saving $300 at the end of every 6 months at 4.5% compounded semi- annually?

-

Parisian Cosmetics Company is planning a one-month campaign for September to promote sales of one of its two cosmetics products. A total of $140,000 has been budgeted for advertising, contests,...

-

In the United States, laws mandating that companies be responsible for take back of electronic wastes are becoming prevalent at the state level. Today, there are more than 70,000 remanufacturing...

-

Show that the Fourier transform of an imaginary and odd sequence is real and odd.

-

T. Christian Cooper was a partner to Sanders and Richard Campbell d/b/a The Mullen Company. In 2001, Cooper helped bring about a management agreement between The Mullen Co. and Newnan Crossing...

-

Rocket Company produces small gasoline-powered engines for model airplanes. Mr. Clemens, Rockets CFO, has presented you with the following cost information: Direct Materials Inventory, beginning.......

-

Find an application of OLAP (online analytical processing) for FIU. How can FIU use multidimensional analytical queries to generate BI? Some examples?

-

a. What is the cost per camera (ignoring taxes) for Edwards Electronics and for Sears? b. For each store, what is the minimum selling price required to cover cost, over-head, and desired profits? c....

-

Which of the following is not immune from state income taxation, even if P.L. 86-272 is in effect? a. Sale of office equipment that is used in the taxpayers business. b. Sale of office equipment that...

-

Sue plans to save $4,500, $0, and $5,500 at the end of Years 1 to 3, respectively. What will her investment account be worth at the end of the Year 4 if she earns an annual rate of 4.15 percent?

-

An amusement park charges $25.00 per ticket for children under 12 years of age and $50.00 per ticket for anyone 12 years of age or older. The firm has estimated that the price elasticity of demand...

-

Which Organizational citizenship behavior or task performance more important, why?

-

Write a thesis statement based on the two stories Paul's Case and To Room Nineteen including the following categories : how paul and susan intially lived their lives as per societal norms; their self...

-

Question 1 Identify three (3) communication methods and/or media explaining the advantages and disadvantages of each using the table below. Method of Communication Advantages Disadvantages Question 2...

-

What is the second step in developing an interview? Explain

-

Juarez worked for Westarz Homes at construction sites for five years. Bever was a superintendent at construction sites, supervising subcontractors and moving trash from sites to landfills. He...

-

Which of the indicators in Fig. could be used for doing the titrations in Exercises 65 and 67? Fig Pheadl Red

-

As O2(l) is cooled at 1 atm, it freezes at 54.5 K to form solid I. At a lower temperature, solid I rearranges to solid II, which has a different crystal structure. Thermal measurements show that H...

-

The Ostwald process for the commercial production of nitric acid from ammonia and oxygen involves the following steps: 4NH3(g) + 5O2(g) 4NO(g) + 6H2O(g) 2NO(g) + O2(g) 2NO2(g) 3NO2(g) + H2O(l) ...

-

During the process of XCI, which chromosome expresses the Xist gene and which one expresses the Tsix gene? a. Xist is expressed only by Xa, and Tsix is expressed only by Xi. b. Xist is expressed only...

-

The effects of paramutation may vary with regard to a. the likelihood that the parmutagenic allele will alter the paramutable allele. b. the stability of the paramutagenic allele over the course of...

-

If the VIN3 gene had a loss-of-function mutation, how do you think that would affect the phenotypes of summer-annual and winter-annual Arabidopsis plants? a. Neither type would flower. b. Both types...

Study smarter with the SolutionInn App