Question: What is the Current Ratio, Quick Ratio (acid test), Debt Ratio, Interest Coverage Ratio and Asset Turn Over Ratio for both companies, JetBlue and Southwest?

What is the Current Ratio, Quick Ratio (acid test), Debt Ratio, Interest Coverage Ratio and Asset Turn Over Ratio for both companies, JetBlue and Southwest?

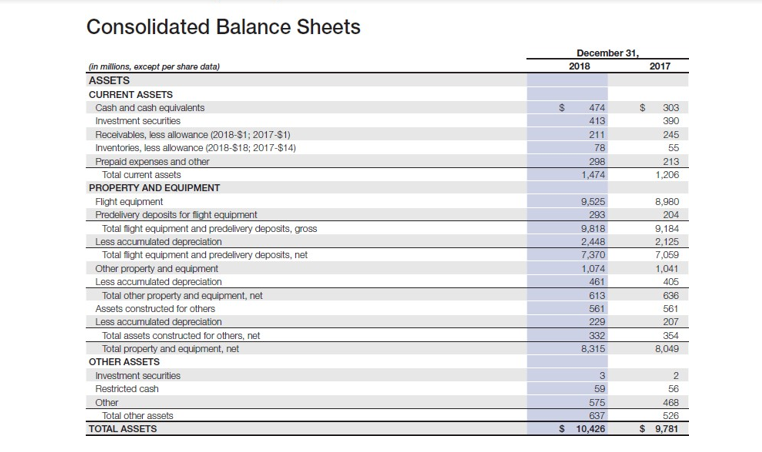

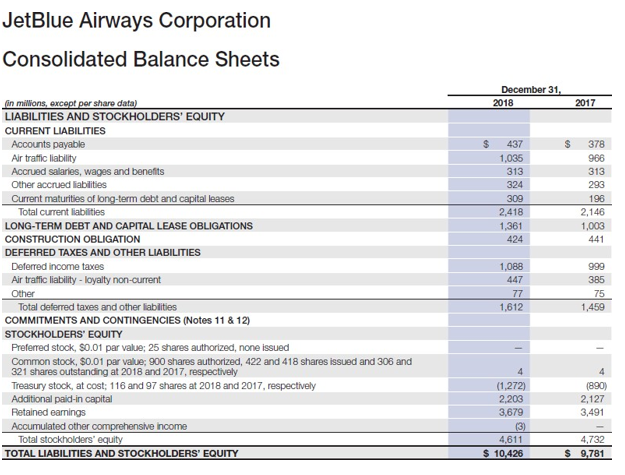

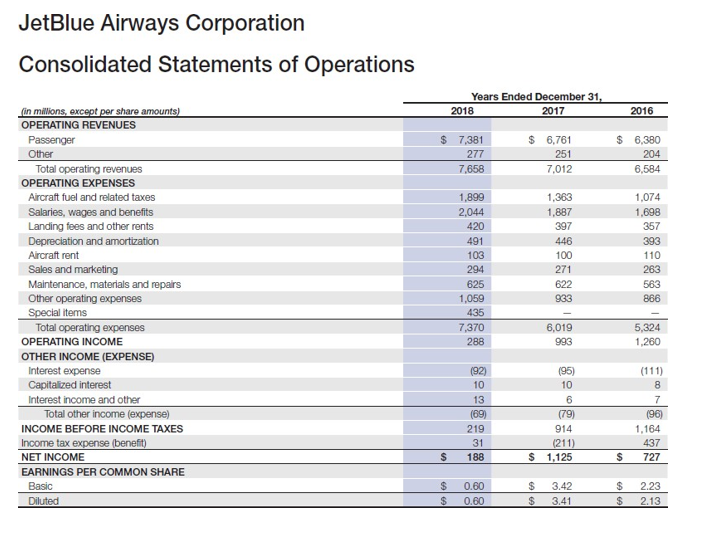

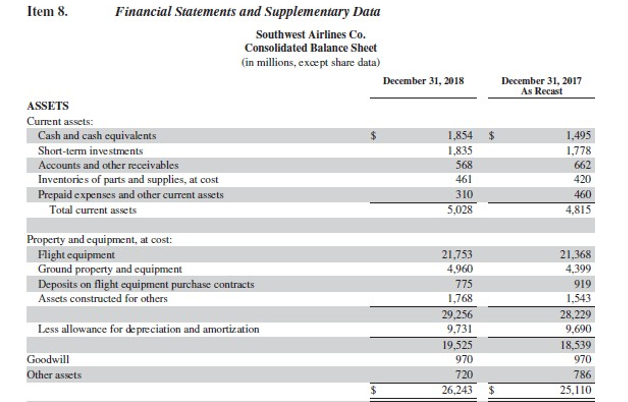

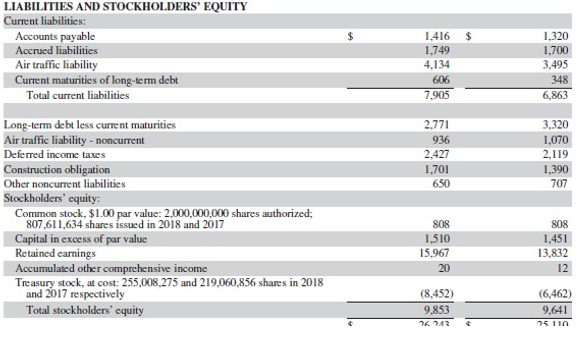

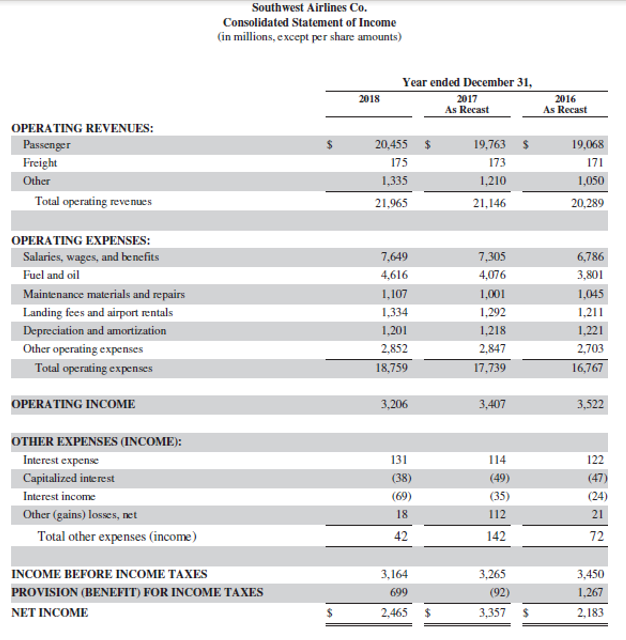

Consolidated Balance Sheets December 31, 2018 2017 $ $ 474 413 211 78 298 1,474 303 390 245 55 213 1,206 (in Millions, except per share data) ASSETS CURRENT ASSETS Cash and cash equivalents Investment securities Receivables, less allowance (2018-$1; 2017-$1) Inventories, less allowance (2018-$18; 2017-$14) Prepaid expenses and other Total current assets PROPERTY AND EQUIPMENT Flight equipment Predelivery deposits for flight equipment Total flight equipment and predelivery deposits, gross Less accumulated depreciation Total flight equipment and predelivery deposits, net Other property and equipment Less accumulated depreciation Total other property and equipment, net Assets constructed for others Less accumulated depreciation Total assets constructed for others, net Total property and equipment, net OTHER ASSETS Investment securities Restricted cash Other Total other assets TOTAL ASSETS 9,525 293 9,818 2,448 7,370 1,074 461 613 561 229 332 8,315 8,980 204 9,184 2.125 7,059 1.041 406 636 561 207 354 8,049 3 59 575 637 10,426 2 56 468 526 $ 9,781 S JetBlue Airways Corporation Consolidated Balance Sheets December 31, 2018 2017 $ $ 437 1,035 313 324 309 2,418 1,361 424 378 966 313 293 196 2,146 1,003 441 in milions, except per share data) LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable Air traffic liability Accrued salaries, wages and benefits Other accrued liabilities Current maturities of long-term debt and capital leases Total current liabilities LONG-TERM DEBT AND CAPITAL LEASE OBLIGATIONS CONSTRUCTION OBLIGATION DEFERRED TAXES AND OTHER LIABILITIES Deferred income taxes Air traffic liability - loyalty non-current Other Total deferred taxes and other liabilities COMMITMENTS AND CONTINGENCIES (Notes 11 & 12) STOCKHOLDERS' EQUITY Preferred stock, S0.01 par value; 25 shares authorized, none issued Common stock, $0.01 par value: 900 shares authorized, 422 and 418 shares issued and 306 and 321 shares outstanding at 2018 and 2017, respectively Treasury stock, at cost; 116 and 97 shares at 2018 and 2017, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1,088 447 77 1,612 999 385 75 1,459 4 (1,272) 2,203 3,679 (3) 4,611 $ 10.426 (890) 2,127 3,491 4.732 $ 9,781 JetBlue Airways Corporation Consolidated Statements of Operations Years Ended December 31, 2018 2017 2016 $ 7,381 277 7,658 $ 6,761 251 7,012 $ 6,380 204 6,584 in millions, except per share amounts) OPERATING REVENUES Passenger Other Total operating revenues OPERATING EXPENSES Aircraft fuel and related taxes Salaries, wages and benefits Landing fees and other rents Depreciation and amortization Aircraft rent Sales and marketing Maintenance, materials and repairs Other operating expenses Special items Total operating expenses OPERATING INCOME OTHER INCOME (EXPENSE) Interest expense Capitalized interest Interest income and other Total other income (expense) INCOME BEFORE INCOME TAXES Income tax expense (benefit) NET INCOME EARNINGS PER COMMON SHARE Basic Diluted 1,899 2,044 420 491 103 294 625 1,059 435 7,370 288 1,363 1,887 397 446 100 271 622 933 1.074 1,698 357 393 110 283 563 866 6,019 993 5,324 1,260 (92) 10 13 (69) 219 31 188 (95) 10 6 (79) 914 (211) $ 1,125 8 7 (96 1,164 437 727 $ s $ $ 0.60 0.60 $ $ 3.42 3.41 $ $ 2.23 2.13 December 31, 2017 As Recast Item 8. Financial Statements and Supplementary Data Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2018 ASSETS Current assets: Cash and cash equivalents 1.854 Short-term investments 1.835 Accounts and other receivables 568 Inventories of parts and supplies, at cost 461 Prepaid expenses and other current assets 310 Total current assets 5,028 $ $ 1,495 1.778 662 420 460 4,815 Property and equipment, at cost: Fight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others Less allowance for depreciation and amortization 21,753 4.960 775 1,768 29,256 9,731 19,525 970 720 26,243 21,368 4,399 919 1,543 28,229 9,690 18,539 970 786 25.110 Goodwill Other assets $ 1,416 1,749 4.134 606 7,905 1,320 1,700 3,495 348 6,863 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Construction obligation Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2018 and 2017 Capital in excess of par value Retained earnings Accumulated other comprehensive income Treasury stock, at cost: 255,008,275 and 219,060,856 shares in 2018 and 2017 respectively Total stockholders' equity 2.771 936 2,427 1,701 650 3,320 1,070 2,119 1,390 707 808 1,510 15,967 20 808 1,451 13,832 12 (8,452) 9.853 16343 (6,462) 9,641 I Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) 2018 Year ended December 31, 2017 As Recast 2016 As Recast OPERATING REVENUES: Passenger Freight Other Total operating revenues 20,455 $ 175 1,335 19,763 $ 173 1,210 21,146 19,068 171 1,050 20,289 21,965 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 7,649 4,616 1,107 1,334 1,201 2,852 18,759 7,305 4,076 1,001 1,292 1,218 2,847 17.739 6,786 3,801 1,045 1,211 1,221 2,703 16,767 OPERATING INCOME 3,206 3,407 3.522 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 131 (38) (69) 18 42 (49) (35) 112 122 (47) (24) 21 142 72 INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME 3,164 699 2,465 $ 3,265 (92) 3,357 3,450 1,267 2.183 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts