Question: What is the difference between book value and market value of an investment? Why do we have two measures for the same thing? You are

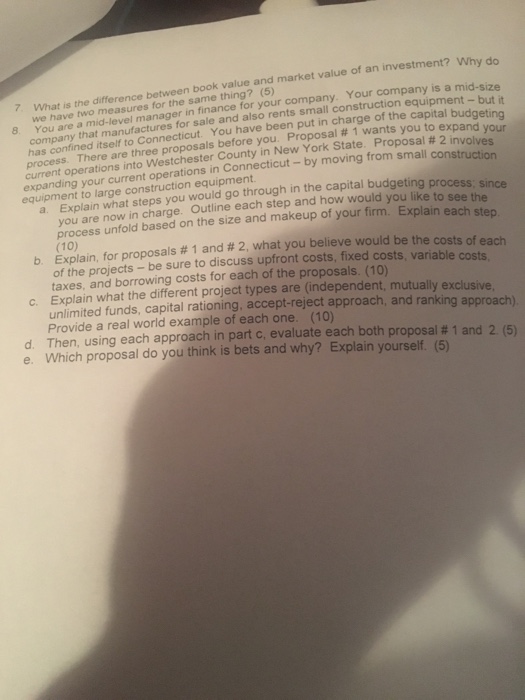

What is the difference between book value and market value of an investment? Why do we have two measures for the same thing? You are a mid-level manager in finance for your company. Your company is a mid-size company that manufactures for sale and also rents small construction equipment-but it has confined itself to Connecticut. You have been put in charge of the capital budgeting process. There are three proposals before you. Proposal#1 wants you to expand g current operations into Westchester County in New York State. Proposal # 2 involves expanding your current operations in Connecticut-by moving from small construction equipment to large construction equipment Explain what steps you would go through in the capital budgeting process, since you are now in charge. Outline each step and how would you like to see the process unfold based on the size and makeup of your firm. Explain each step. Explain, for proposals # 1 and # 2, what you believe would be the costs of each of the projects-be sure to discuss upfront costs, fixed costs, variable costs, taxes, and borrowing costs for each of the proposals. Explain what the different project types are (independent, mutually exclusive unlimited funds capital rationing accept reject approach, and ranking approach). Provide a real world example of each one. Then, using each approach in part c, evaluate each both proposal # 1 and 2 (5) Which proposal do you think is bets and why? Explain yourself

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts