Question: what is the difference between mm proposition 1 and 2 with tax ? Il. The Tax Case A. Proposition I with taxes: The value of

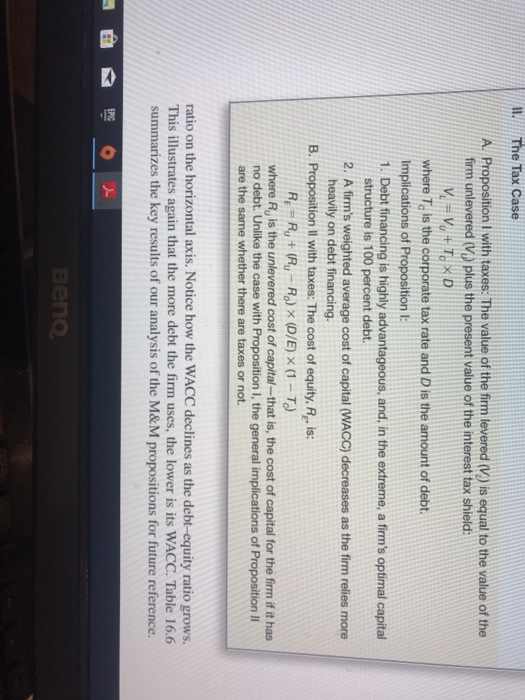

Il. The Tax Case A. Proposition I with taxes: The value of the firm levered (V) is equal to the value of the firm unlevered (V) plus the present value of the interest tax shield: where To is the corporate tax rate and D is the amount of debt. Implications of Proposition 1. Debt financing is highly advantageous, and, in the extreme, a firm's optimal capital structure is 100 percent debt 2. A firm's weighted average cost of capital (WACC) decreases as the firm relies more heavily on debt financing B. Proposition 11 with taxes: The cost of equity, RE" is: RE-Ru + (Ru-Ro) (D/E) (1-Te) where Ry is the unlevered cost of capital-that is, the cost of capital for the firm if it has no debt. Unlike the case with Proposition I, the general implications of Proposition II are the same whether there are taxes or not ratio on the horizontal axis. Notice how the WACC declines as the debt-equity ratio grows This illustrates again that the more debt the firm uses, the lower is its WACC. Table 16.6 summarizes the key results of our analysis of the M&M propositions for future reference. Il. The Tax Case A. Proposition I with taxes: The value of the firm levered (V) is equal to the value of the firm unlevered (V) plus the present value of the interest tax shield: where To is the corporate tax rate and D is the amount of debt. Implications of Proposition 1. Debt financing is highly advantageous, and, in the extreme, a firm's optimal capital structure is 100 percent debt 2. A firm's weighted average cost of capital (WACC) decreases as the firm relies more heavily on debt financing B. Proposition 11 with taxes: The cost of equity, RE" is: RE-Ru + (Ru-Ro) (D/E) (1-Te) where Ry is the unlevered cost of capital-that is, the cost of capital for the firm if it has no debt. Unlike the case with Proposition I, the general implications of Proposition II are the same whether there are taxes or not ratio on the horizontal axis. Notice how the WACC declines as the debt-equity ratio grows This illustrates again that the more debt the firm uses, the lower is its WACC. Table 16.6 summarizes the key results of our analysis of the M&M propositions for future reference.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts