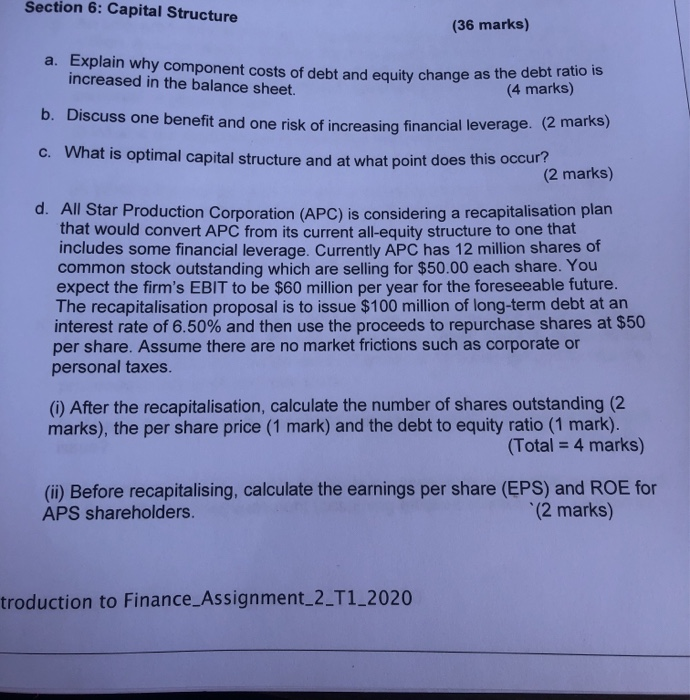

Question: Section 6: Capital Structure (36 marks) a. Explain why component costs of debt and equity change as increased in the balance sheet. and equity change

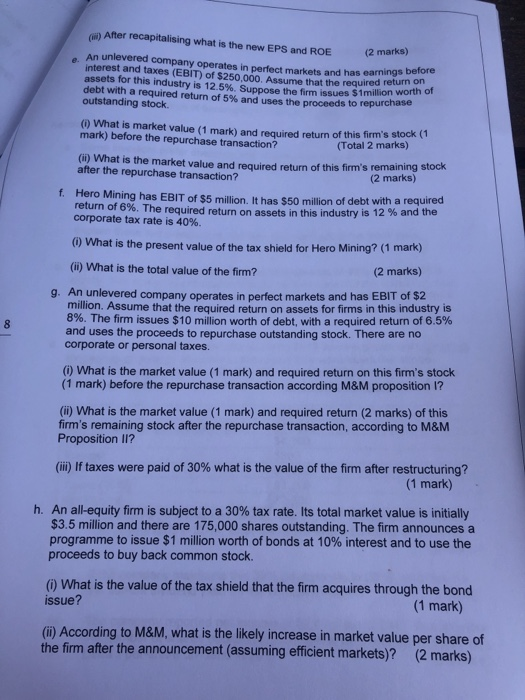

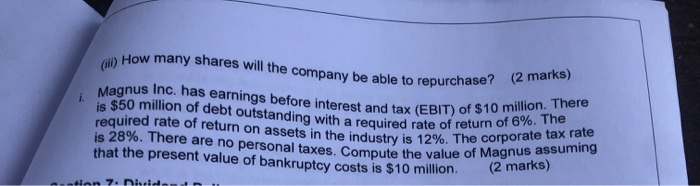

Section 6: Capital Structure (36 marks) a. Explain why component costs of debt and equity change as increased in the balance sheet. and equity change as the debt ratio is (4 marks) b. Discuss one benefit and one risk of increasing financial leverage. c. What is optimal capital structure and at what point does this occur (2 marks) d. All Star Production Corporation (APC) is considering a recapitalisation Plan that would convert APC from its current all-equity structure to one that includes some financial leverage. Currently APC has 12 million shares of common stock outstanding which are selling for $50.00 each share. You expect the firm's EBIT to be $60 million per year for the foreseeable future. The recapitalisation proposal is to issue $100 million of long-term debt at an interest rate of 6.50% and then use the proceeds to repurchase shares at $50 per share. Assume there are no market frictions such as corporate or personal taxes. (0) After the recapitalisation, calculate the number of shares outstanding (2 marks), the per share price (1 mark) and the debt to equity ratio (1 mark). (Total = 4 marks) (ii) Before recapitalising, calculate the earnings per share (EPS) and ROE for APS shareholders. (2 marks) troduction to Finance Assignment_2_T1_2020 Alter recapitalising what is the new EPS and ROE (2 manns An unlevered company operates in perfect markets and has earning Interest and taxes (EBIT) of $250.000. Assume that the required retum assets for this industry is 12 5%. Suppose the firm issues $imillion won debt with a required return of 5% and uses the proceeds to repurcha outstanding stock markets and has earnings before 0 What is market value (1 mark) and required return of this firm's stock (1 mark) before the repurchase transaction? (Total 2 marks) (m) What is the market value and required return of this firm's remaining stock after the repurchase transaction? (2 marks) Hero Mining has EBIT of $5 million. It has $50 million of debt with a required return of 6%. The required return on assets in this industry is 12 % and the corporate tax rate is 40%. o What is the present value of the tax shield for Hero Mining? (1 mark) (m) What is the total value of the firm? (2 marks) 9. An unlevered company operates in perfect markets and has EBIT of $2 million. Assume that the required return on assets for firms in this industry is 8%. The firm issues $10 million worth of debt, with a required return of 6.5% and uses the proceeds to repurchase outstanding stock. There are no corporate or personal taxes. 0 What is the market value (1 mark) and required return on this firm's stock (1 mark) before the repurchase transaction according M&M proposition 1? (ii) What is the market value (1 mark) and required return (2 marks) of this firm's remaining stock after the repurchase transaction, according to M&M Proposition ll? (m) if taxes were paid of 30% what is the value of the firm after restructuring? (1 mark) h. An all-equity firm is subject to a 30% tax rate. Its total market value is initially $3.5 million and there are 175,000 shares outstanding. The firm announces a programme to issue $1 million worth of bonds at 10% interest and to use the proceeds to buy back common stock. (0) What is the value of the tax shield that the firm acquires through the bond issue? (1 mark) (ii) According to M&M, what is the likely increase in market value per share of the firm after the announcement (assuming efficient markets)? (2 marks) How many shares will the company be any be able to repurchase? (2 marks) Magnus Inc. has earnings before interest and tax (EBIT) OT is $50 million of debt outstanding with a required rate of retum required rate of return on assets in the industry is 12%. The co is 28%. There are no personal taxes. Compute the value of that the present value of bankruptcy costs is $10 million nd tax (EBIT) of $10 million. There sets in the industry is 12%. The corporate tax rate ed rate of return of 6%. The "taxes. Compute the value of Magnus assuming in 7. Disida

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts