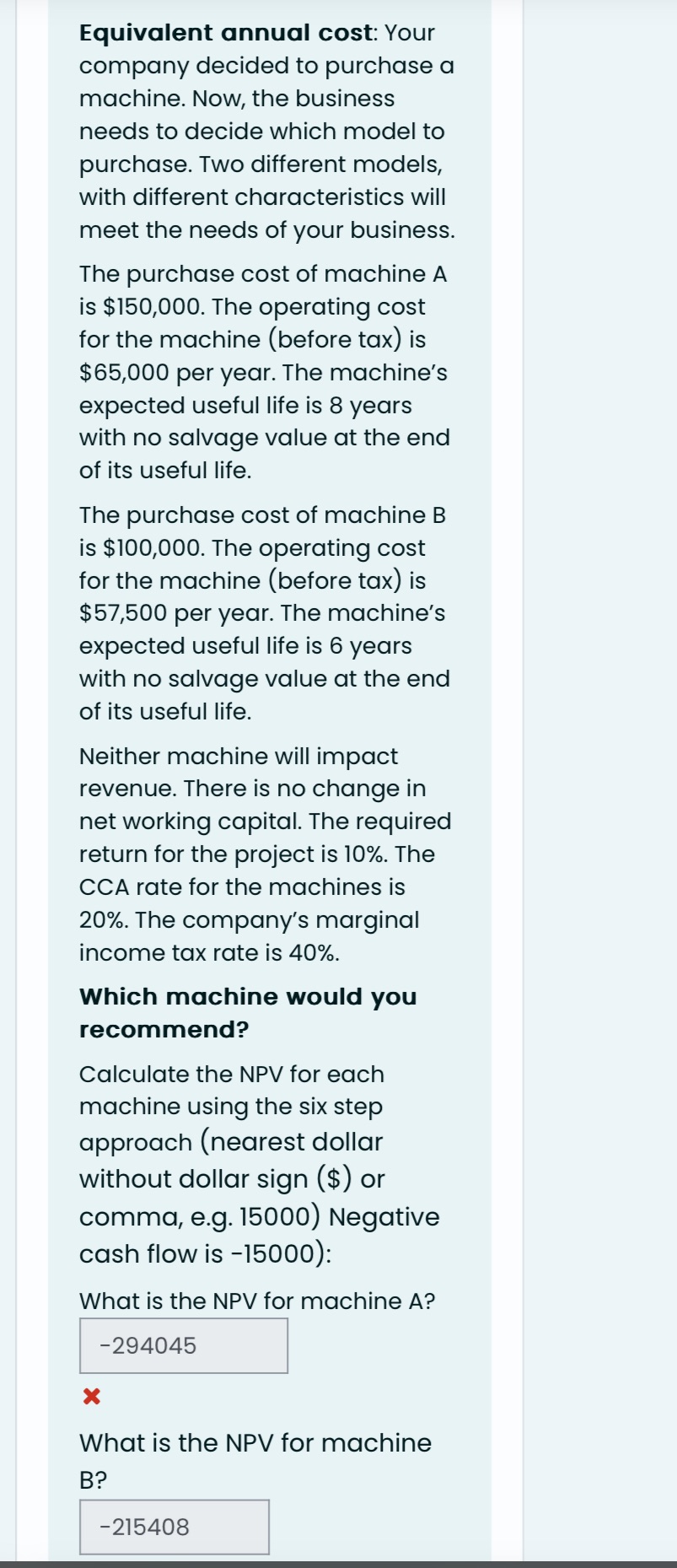

Question: What is the EAC for machine A?What is the EAC for machine B? Based on your analysis, which machine would you recommend to management? Equivalent

What is the EAC for machine A?What is the EAC for machine B? Based on your analysis, which machine would you recommend to management?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts