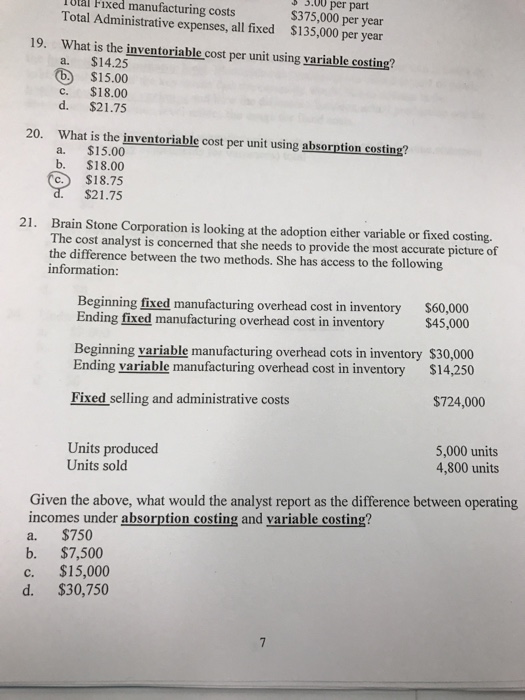

Question: What is the inventoriable cost per unit using variable costing? a. $14.25 b. $15.00 c. $18.00 d. $21.75 What is the inventoriable cost per unit

What is the inventoriable cost per unit using variable costing? a. $14.25 b. $15.00 c. $18.00 d. $21.75 What is the inventoriable cost per unit using absorption costing? a. $15.00 b. $18.00 c. $18.75 d. $21.75 Brain Stone Corporation is looking at the adoption either variable or fixed costing. The cost analyst is concerned that she needs to provide the most accurate picture of the difference between the two methods. She has access to the following information: Beginning fixed manufacturing overhead cost in inventory $60,000 Ending fixed manufacturing overhead cost in inventory $45,000 Beginning variable manufacturing overhead costs inventory $30,000 Ending variable manufacturing overhead cost in inventory $14, 250 Fixed selling and administrative costs $724,000 Units produced 5,000 units Units sold 4, 800 units Given the above, what would the analyst report as the difference between operating incomes under absorption costing and variable costing? a. $750 b. $7, 500 c. $15,000 d. $30, 750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts