Question: What is the net present value (NPV) and internal rate of return (IRR) for the investment? How do you interpret these numbers? Free Cash Flow

- What is the net present value (NPV) and internal rate of return (IRR) for the investment? How do you interpret these numbers?

| Free Cash Flow | (16,000,000) | 400,000 | 3,900,000 | 4,500,000 | 4,500,000 | 4,500,000 |

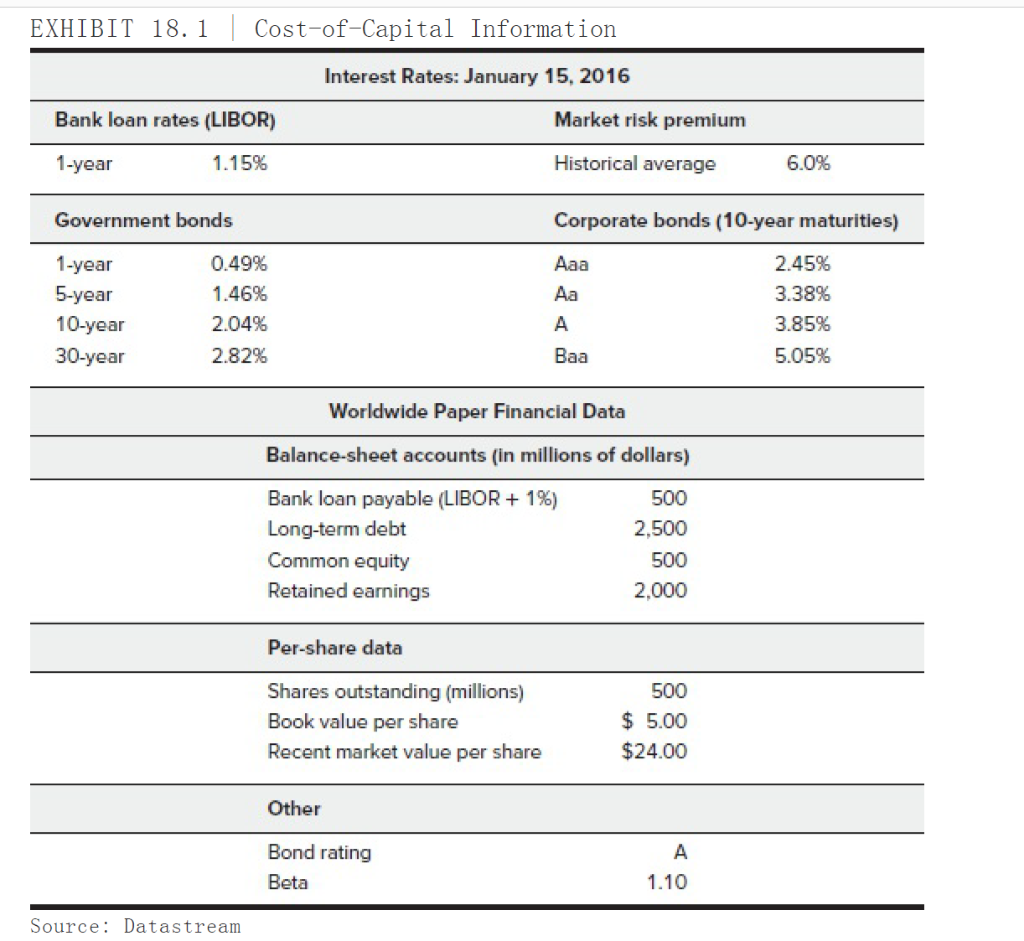

EXHIBIT 18.1 | Cost-of-Capital Information Interest Rates: January 15, 2016 Bank loan rates (LIBOR) Market risk premium 1-year 1.15% Historical average 6.0% Government bonds Corporate bonds (10-year maturities) 1-year 5-year 10-year 30-year 0.49% 1.46% 2.04% 2.82% 2.45% 3.38% 3.85% 5.05% A Baa Worldwide Paper Financial Data Balance-sheet accounts (in millions of dollars) Bank loan payable (LIBOR + 1%) Long-term debt Common equity Retained earnings 500 2,500 500 2.000 Per-share data Shares outstanding (millions) Book value per share Recent market value per share 500 $ 5.00 $24.00 Other Bond rating Beta A 1.10 Source: Datastream

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts