Question: What is the operating cash flow for this project years 1-10? Find the NPV of the project for Miglietti Resturants if the manufacturing equipment can

What is the operating cash flow for this project years 1-10? Find the NPV of the project for Miglietti Resturants if the manufacturing equipment can be sold for $130,000 at the end of the ten-year project and the cost of capital for this project is 7%.

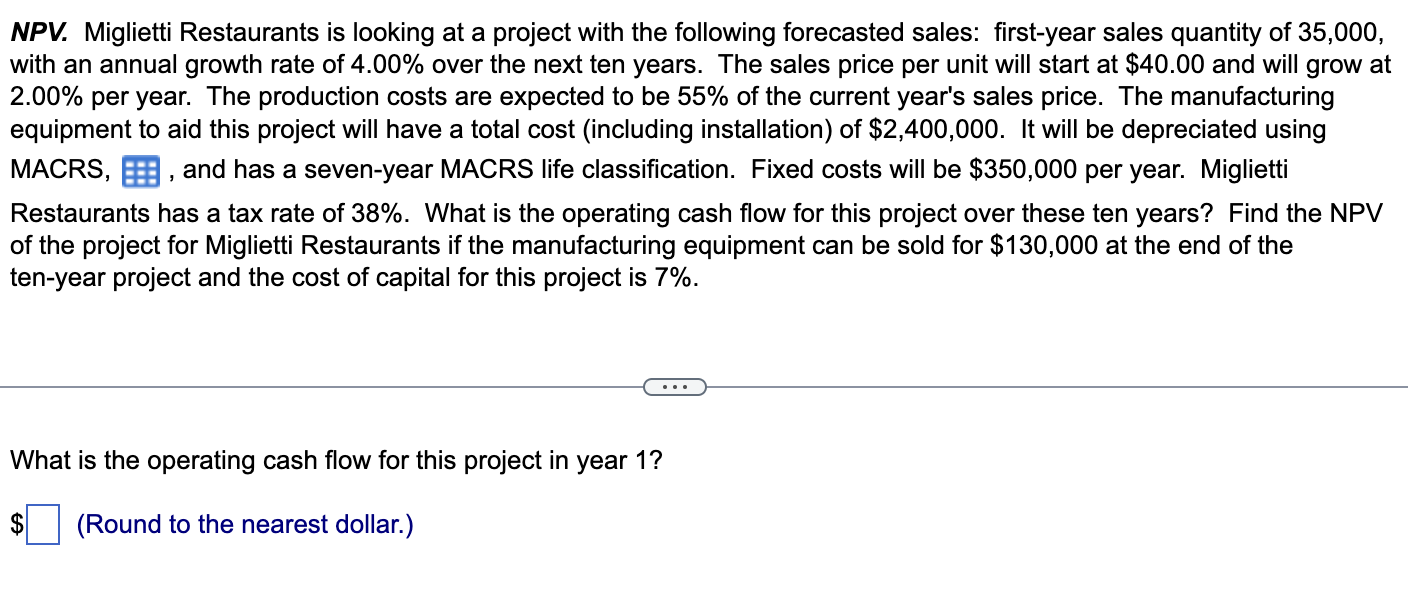

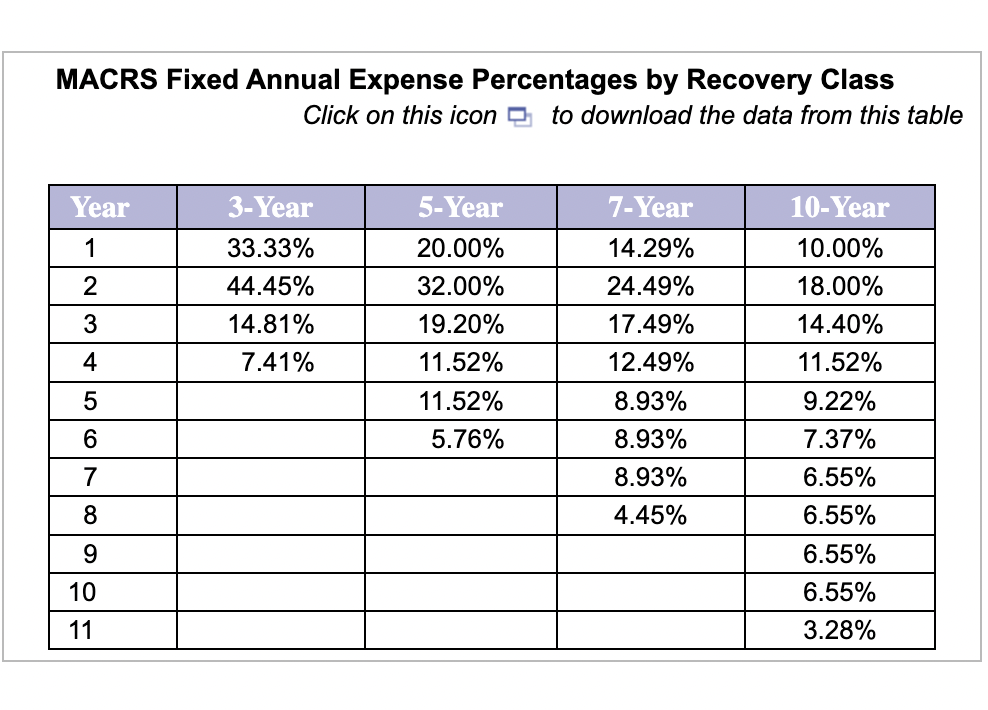

NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000 , with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $40.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, , and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 38%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the ten-year project and the cost of capital for this project is 7%. What is the operating cash flow for this project in year 1? $ (Round to the nearest dollar.) MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts