Question: What is the Payroll Payable? That is the only incorrect answer. How do you find the Payroll Payable? Officers' salaries $36,000 Sales salaries 67,000 Federal

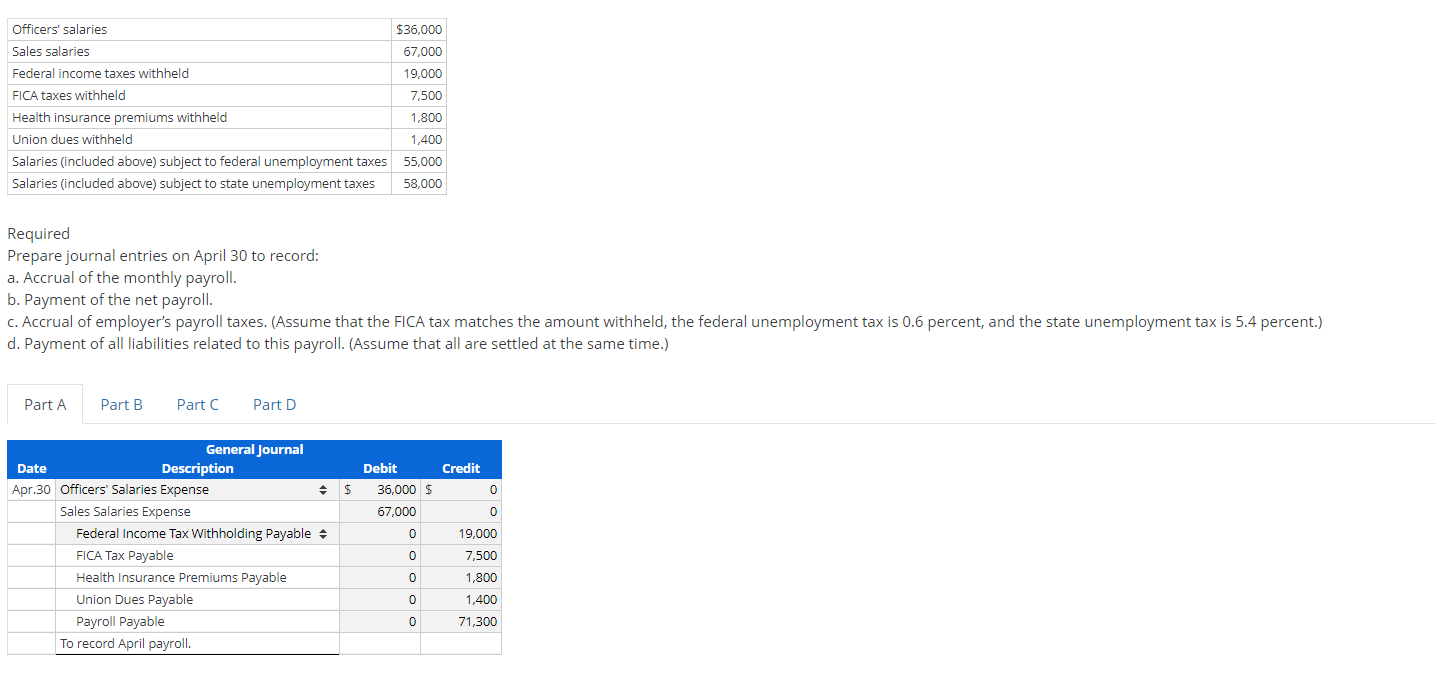

What is the Payroll Payable? That is the only incorrect answer. How do you find the Payroll Payable?

What is the Payroll Payable? That is the only incorrect answer. How do you find the Payroll Payable?

Officers' salaries $36,000 Sales salaries 67,000 Federal income taxes withheld 19,000 FICA taxes withheld 7,500 Health insurance premiums withheld 1,800 Union dues withheld 1,400 Salaries (included above) subject to federal unemployment taxes 55,000 Salaries (included above) subject to state unemployment taxes 58,000 Required Prepare journal entries on April 30 to record: a. Accrual of the monthly payroll. b. Payment of the net payroll. C. Accrual of employer's payroll taxes. (Assume that the FICA tax matches the amount withheld, the federal unemployment tax is 0.6 percent, and the state unemployment tax is 5.4 percent.) d. Payment of all liabilities related to this payroll. (Assume that all are settled at the same time.) Part A Part B Part C Part D Credit $ Debit 36,000 $ 67,000 General Journal Date Description Apr.30 Officers' Salaries Expense Sales Salaries Expense Federal Income Tax Withholding Payable FICA Tax Payable Health Insurance Premiums Payable Union Dues Payable Payroll Payable To record April payroll. 19,000 7,500 1,800 1,400 71,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts