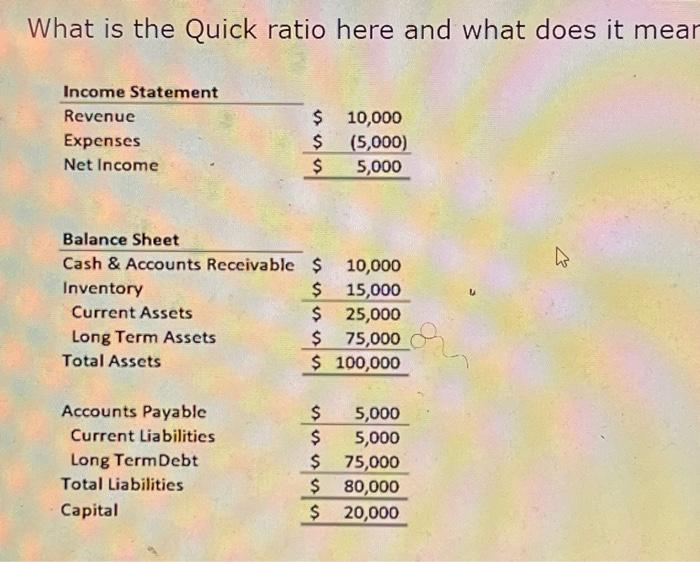

Question: What is the Quick ratio here and what does it mear Current Assets - Current Liabilities / Capital =($25,000$5,000)/$20,000=1,0, how many times can 'quickly cashed

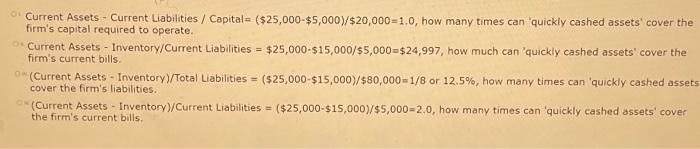

What is the Quick ratio here and what does it mear Current Assets - Current Liabilities / Capital =($25,000$5,000)/$20,000=1,0, how many times can 'quickly cashed assets' cover the firm's capital required to operate. Current Assets - Inventory/Current Liabilities =$25,000$15,000/$5,000=$24,997, how much can 'quickly cashed assets' cover the firm's current bills. (Current Assets - Inventory)/Total Liabilities =($25,000$15,000)/$80,000=1/8 or 12.5%, how many times can 'quickly cashed assets cover the firm's liabilities. (Current Assets - Inventory)/Current Liabilities =($25,000$15,000)/$5,000=2.0, how many times can 'quickly cashed assets' cover the firm's current bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts