Question: What is the total cost per unit produced for each product? How much of the overhead will be assigned to each product if direct labor

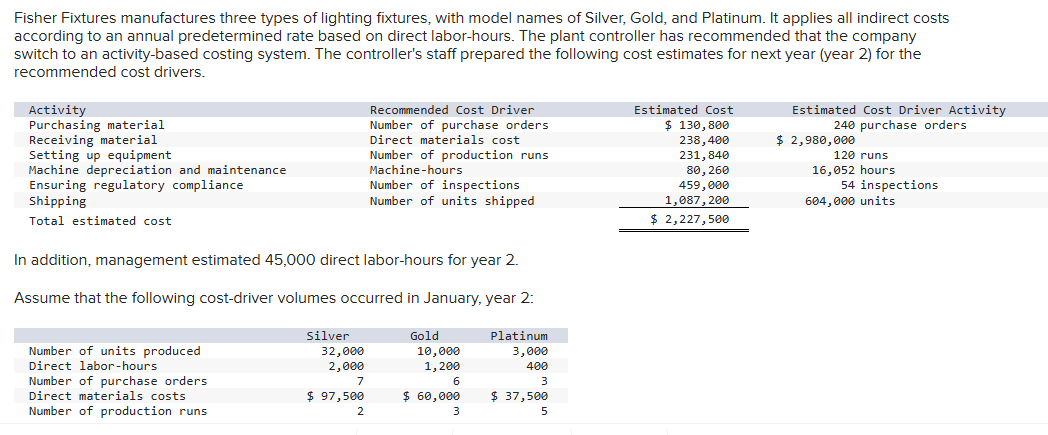

What is the total cost per unit produced for each product? How much of the overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product? Fisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct laborhours. The plant controller has recommended that the company switch to an activitybased costing system. The controller's staff prepared the following cost estimates for next year year for the recommended cost drivers.

In addition, management estimated direct laborhours for year

Assume that the following costdriver volumes occurred in January, year : Assume that the following costdriver volumes occurred in January, year :

Labor costs are based on the contractual rate of $ per hour.

Required:

a Compute the predetermined rate for year for use in the current productcosting system using direct laborhours as the allocation base.

b Compute the perunit production costs for each model for January using direct laborhours as the allocation base and the predetermined rate computed in requirement a

c Compute the predetermined overhead rate for year for each cost driver using the estimated costs and estimated cost driver units prepared by the controller's staff to be used in an ABC system.

d Compute the per unit production costs for each product for January using the cost drivers recommended by the consultant and the predetermined rates computed in requirement cNote: Do not assume that total overhead applied to products in January will be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock