Question: what is the Value implied by precedent transaction Here by using the table of the precedent transaction in the picture? which number should I use?

what is the Value implied by precedent transaction Here by using the table of the precedent transaction in the picture? which number should I use?

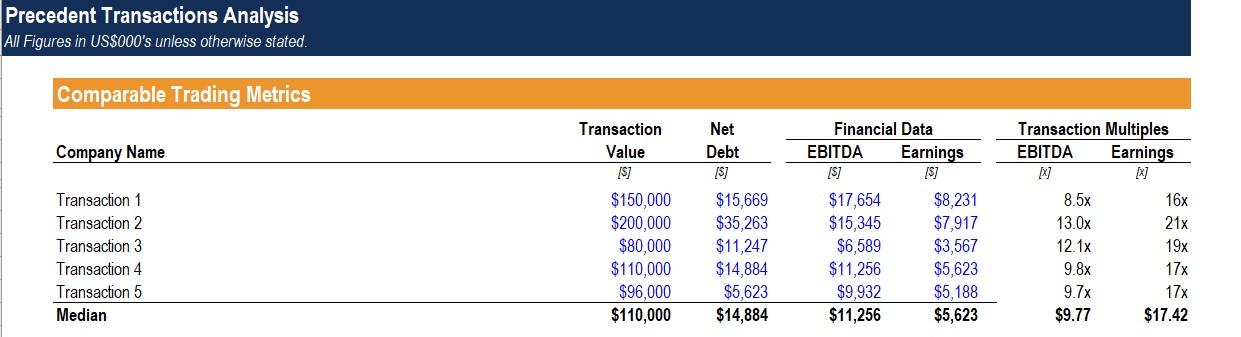

Download Case Study B, complete the financial model for Company XYZ, and answer the following 7 questions. 13 Under the Base Case, what is the average implied enterprise value based using: 1. NPV 2. Value implied by comparable company analysis 3. Value implied by precedent transactions If the NPV value is given a weighting of 60%, the value implied by comparable company analysis is given a weighting of 25% and the value implied by precedent transactions a weighting of 15%. For comparable company analysis and precedent transactions, use 2021E amounts and the median EV/EBITDA. For NPV, assume the terminal value is based on the perpetual growth rate assumption outlined on the "Control Panel" tab. Review Later $90,468 $91,268 $91,071 $91,871 Precedent Transactions Analysis All Figures in US$000's unless otherwise stated. Comparable Trading Metrics Company Name Transaction 1 Transaction 2 Transaction 3 Transaction 4 Transaction 5 Median Transaction Value [S] $150,000 $200,000 $80,000 $110,000 $96,000 $110,000 Net Debt [S] $15,669 $35,263 $11,247 $14,884 $5,623 $14,884 Financial Data EBITDA Earnings IS] [S] $17,654 $8,231 $15,345 $7,917 $6,589 $3,567 $11,256 $5,623 $9,932 $5,188 $11,256 $5,623 Transaction Multiples EBITDA Earnings [x] 8.5x 16x 13.0x 21x 12.1x 19x 9.8x 17x 9.7x 17x $9.77 $17.42 Download Case Study B, complete the financial model for Company XYZ, and answer the following 7 questions. 13 Under the Base Case, what is the average implied enterprise value based using: 1. NPV 2. Value implied by comparable company analysis 3. Value implied by precedent transactions If the NPV value is given a weighting of 60%, the value implied by comparable company analysis is given a weighting of 25% and the value implied by precedent transactions a weighting of 15%. For comparable company analysis and precedent transactions, use 2021E amounts and the median EV/EBITDA. For NPV, assume the terminal value is based on the perpetual growth rate assumption outlined on the "Control Panel" tab. Review Later $90,468 $91,268 $91,071 $91,871 Precedent Transactions Analysis All Figures in US$000's unless otherwise stated. Comparable Trading Metrics Company Name Transaction 1 Transaction 2 Transaction 3 Transaction 4 Transaction 5 Median Transaction Value [S] $150,000 $200,000 $80,000 $110,000 $96,000 $110,000 Net Debt [S] $15,669 $35,263 $11,247 $14,884 $5,623 $14,884 Financial Data EBITDA Earnings IS] [S] $17,654 $8,231 $15,345 $7,917 $6,589 $3,567 $11,256 $5,623 $9,932 $5,188 $11,256 $5,623 Transaction Multiples EBITDA Earnings [x] 8.5x 16x 13.0x 21x 12.1x 19x 9.8x 17x 9.7x 17x $9.77 $17.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts