Question: what is this case study about? what are the problems that need to be addressed? what are alternative solutions for these problems? what are the

what is this case study about? what are the problems that need to be addressed? what are alternative solutions for these problems? what are the pros and cons for each solution? recommended course of action?

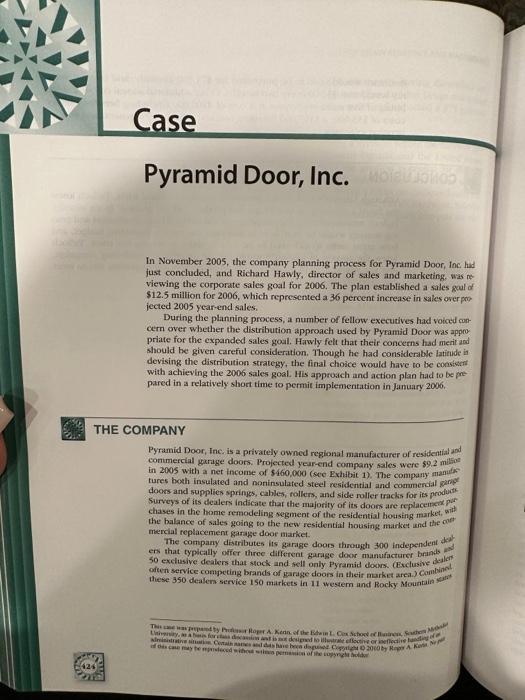

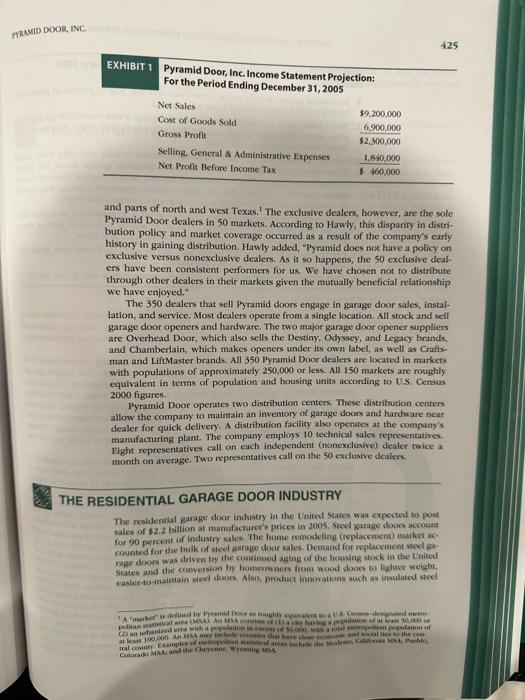

and parts of north and west Texas. 1 The exclusive dealers, however, are the sole Pyramid Door dealers in 50 markets. According to Hawly, this disparity in distribution policy and market coverage occurred as a result of the company's early history in gaining distribution. Hawly added, "Pyramid does not have a policy on exclusive versus nonexclusive dealers. As it so happens, the 50 exclusive dealers have been consistent performers for us. We have chosen not to distribute through other dealers in their markets given the mutually beneficial relationship we have enjoyed." The 350 dealers that sell Pyramid doors engage in garage door sales, installation, and service. Most dealers operate from a single location. All stock and sell garage door openers and hardware, The two major garage door openet suppliers are Overhead Door, which also sells the Destiny, Odyssey, and Legacy brinds, and Chamberlain, which makes openers under its own label, as well as Criftsman and LiftMaster brands. All 350 Pyramid Door dealers are located in markets with populations of approximately 250,000 or less. All 150 markets are roughly equivalent in terms of population and lousing units according to U.S, Census 2000 figures: Pyramid Door operates two distribution centers. These distribution centers allow the company to maintain an inventory of garage doors and hardware near dealer for quick delivery. A distribution ficility also operates at the company's manufacturing plant. The company employs 10 tectuical sales representatives. Eight representatives eall on each independent (nonexclusive) dealer twice a month on average. Two representatives call on the 50 exclusive dealers. THE RESIDENTIAL GARAGE DOOR INDUSTRY The residential garige door industry in the Enited states was expected to post bales of $2.2 billion at manufictuer prices in 2005 . Steel garage doos account for 90 percent of industry sales. The home remodeling (replacement) market aecounted for the bulk of steel garago door sales. Dentand for replacemeet seel garage doors was driven by the continued aging of the housing stock in the United fiates and die comventan by bomeconners from wood doon to lighter weight, casies-to anjintain seel doom. Also, product limovations such as insulated steel twly saw his charge as determining the characteristics, the number, a tives. One viewpoint favired increasing the ning the company. The reasoning behind this position was the currently served by the cumperifing deaters to attain the sales goal specified in the cor would be difo plan. Executives expressing this view noted that even with a 2.4 peroen increase in sales following the industry trend, it would be necessiry to asd ? least another 100 dealers. They said these dealers would likely be independen (nonexclusive) dealers located in the 100 markets not served by excluslie dedit? ships. Hawly believed that adding another 100 dealers in its present markes one the next year would not be easy and would require increasing the sales force the serviced nonexclusive dealers. Executives acknowledged that this plan had mon merit in the long run of, say, three to four years. However, their idea had meti a long-term distribution policy, they thought. The incremental direct cont of ids ing a sales representative was $80,000 per year. A second viewpoint favored the development of a formal exclusive franditr program, since 27 nonexclusive dealers had posed such a possibility in the hat yox Fach of these dealers represented a different market, and each of these madess wir considered to have high potential and be a candidate for the new adrentising al promotion program, These dealers were prepared to sell off competing lines mor of which were supplied by regional and local garage door manufactures thy would sell Pyramid doors exclusively in their narket for a specified franchise fit. In exchange for the dealer's contractual obligation to stock, install, and servie the company's products in a specified manner consivent with Pyramid Doors policis the company would drop present dealers in their markets and nok add new deles Furthermore, these executives noted, the company's current contractial andrments with its independent dealers allowed for cancellation by either pary, wins cause, with 90 days advance notification. Thus, the program coula be inplemsied during the traditionally slow first quarter of the upcoming year. If adopoct of pany executives believed the franchise prognam in these 27 markets could be sond by the advertising and promotion program. The other 50 murkets sened ly ofsive dealers would be unaffected, since the advertising and promotion propene w already budgeted for these dealers. The reraining 73 markets woold alsi fe wo fected, except for increased advertising in 2.5 high-potential markets. A third viewpoint called for a general reduction in the nuinter of dexships without granting any formal exclusive franchises. Executives supposes this approach cited a number of factors fovering if. First, analyais of sove 70 peroent of company sales, This success was acticved without a chise program. Second, these execuives belisved that comaniting t: third, an improvenent in sles-force effor and possibly lincroused dealers in the 150 markess served by the company from 350 to 250 efit from the additional marketing spending the distribution stratesy or the dealers. Matser, they believed that should do a better job with the current distribution policy and network EXHIBIT 2 Residential Garage Door Survey Results Summary: 2005 1. Residential garage door name awareness was very low, Just 10 percent of prospectiy buyers could provide a brand nume wben asked. PYRUMID DOOR. 2. When asked what criteria they would use in buying a new residkential garape boer price, quality, reliability of the installer, and aesthetic appeal of the door nore firs tioned most frequently in that oeder. 3. Friends, Felatives, and neighbors were the principal sources: identified when abant where they would look for information abour resideratial garage doors. The rolow Pages and newspaper advertisements were the next most frequently mentioned infor mation sources, A company that may have installed or serviced a garage doer opener or repaired an existing door also was considered an information source. 4. Thirty pereent of prospextive buyers expected to get at least two bids on a reslifntid garage door instaltation. Virtually all expected to receive and review prodoct farm ture, including warany information, prior to inctilting a new door: 5. Fiffeca percent of prospestive buyers sald they would install their own revidest garage door when a replicement was needed. doors, new springing systems, and residential garage doors with improved suif fearures have made steel doors popular. Propected 2006 siles of reviletal garage doors to the home remodeling market were $2.25 billion, represcatigh) 2.4 percent increase. There pre several large national manufacturers and many repional and bol manufacturers in the U.S. residential garage door indestry, The lapest guap door manufacturer in the Enited States is the Clopay Corporation. Copay of poration markets its garage doors through a netwotk of some 2,000 isterpo dent dealers and large home center chains, incloding Home Depo, Merunk and Lowe's Companies. Other large, well-known garage door manufidurs in Onerhead Door Corporation, Wayne-Dalton Corporation, Amarr Garage Doxs and Raynor Garage Doors, I'ynamid Doce, Inc, is contidered to be ooe of ithe smaller regional getage door manufecturers in the indusery. share is about 2.6 percent, I know we can do better than that. In fact, the ambitious sales goal of $12.5 million in 2006 is achievable given the potential existing in our present markets." HE DISTRIBUTION STRATEGY ISSUE The strategic planning process had affirmed the overall direction and performance of Pyramid Door's sales and marketing initiatives with good reason. The company recorded sales gains in each of the past 10 years that exceeded the industry growth rate and had added 50 dealers in the past decade. The $12,5 million sales goal for 2006 was driven principally by supply considerations. Senior executives were of the firm belief that the company had to attain a larger critical mass of sales volume to preserve its buying position with suppliers, particularly with respect to raw materials for its garage doors, namely, galvanized steel and insulated foam. During the planning process, company executives agreed that additional investment in advertising and promotion dollars was necessary to achicve the ambitious sales goal. Aocordingly, Hawly was able to increase his marketing budget by 20 percent for 2006 . It was decided that this incremental expenditure should be directed at the 100 highest-potential markets currently served by Pyramid Door. These included the 50 markets served by exclusive dealers and 50 markets served by independent dealers, which had yet to be finalized. The remaining 50 markets and independent dealers would continue to receive the level of ad. vertising and promotion support prowided in 2005. This support was typically in the form of cooperative advertising allowances for Yellow Pages advertising. with additional incentives for featuring the Pyramid Door name, and product literature (see Exhibit 3). Pyramid Door, Inc. In November 2005, the company planning process for Pyramid Door, Inc had just concluded, and Richard Hawly, director of sales and marketing, was of viewing the corporate sales goal for 2006 . The plan established a sales goal of $12.5 million for 2006 , which represented a 36 percent increase in sales orerpos jected 2005 year-end sales. During the planning process, a number of fellow exectitives had voiced concern over whether the distribution approach used by Pyzamid Door was appor priate for the expanded sales goal. Hawly felt that their concerns had merit and should be given careful consideration. Though he had considerable latitude in devising the distribution strategy, the final choice would have to be consistert with achieving the 2006 sales goal. His approach and action plan had to be pre pared in a relatively short time to permit implementation in January 2006. COMPANY Pyramid Door, Inc. is a privately owned regional manufacturer of residential and commercial gorage doors. Projected yeur-end company sales were $9.2 milfol in 2005 with a net income of $460,000 (see Exhibit 1). The company mandes tures both insulated and norinsulated steel residential and commercial ganp? doors and supplies springs, cables, rollers, and side roller tracks for iss produds. Surveys of its dealers indicate thar the majority of its doors are replacentex por chases in the home remodeling segment of the residential housing market, with the balance of sales going to the new residential housing maiket and the ofer mercial replacement ganage door market. The company distributes its garage doors through 300 independent doy en that typically offer three different garage door manufacturer brinds is 50 exclusive dealers that stock and sell only Pyramid doors. (Exclusive dalent often service competing brands of garage doors in their market area.) Combinet. these 350 . dealen service 150 markets in 11 westem and Rocky Mountain sop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts