Question: what is this case study about? what is the problems that need to be addressed? what are alternative solutions for these problems? what are the

what is this case study about? what is the problems that need to be addressed? what are alternative solutions for these problems? what are the pros and cons for each solution? recommended course of action?

what is this case study about? what is the problems that need to be addressed? what are alternative solutions for these problems? what are the pros and cons for each solution? recommended course of action?

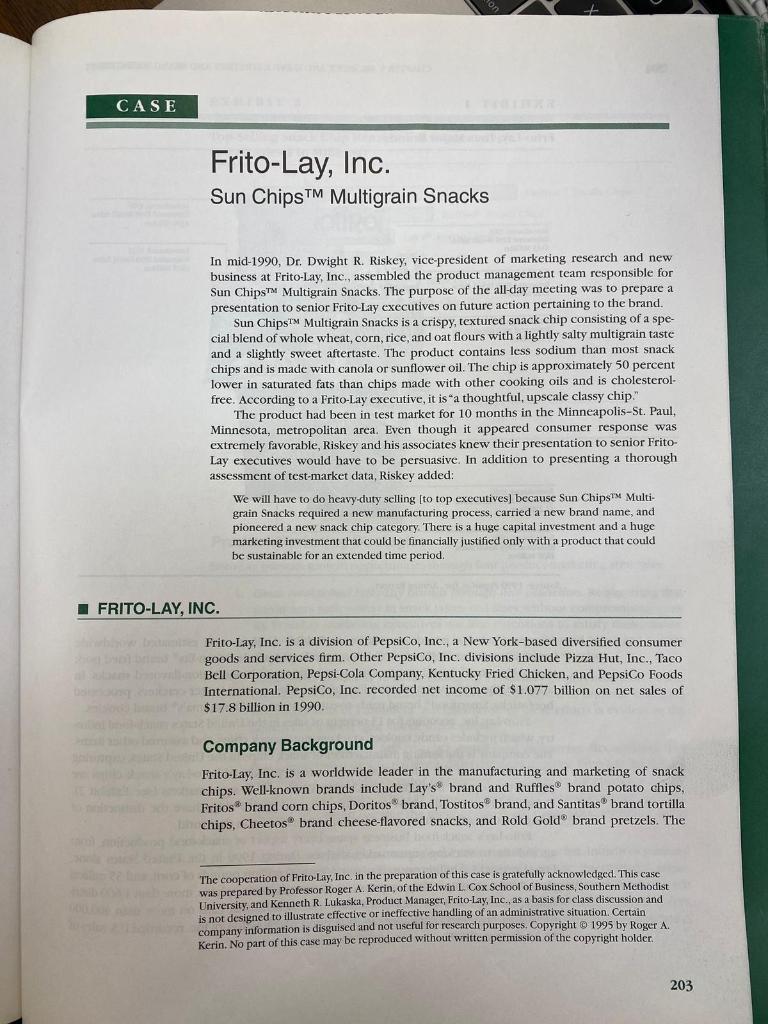

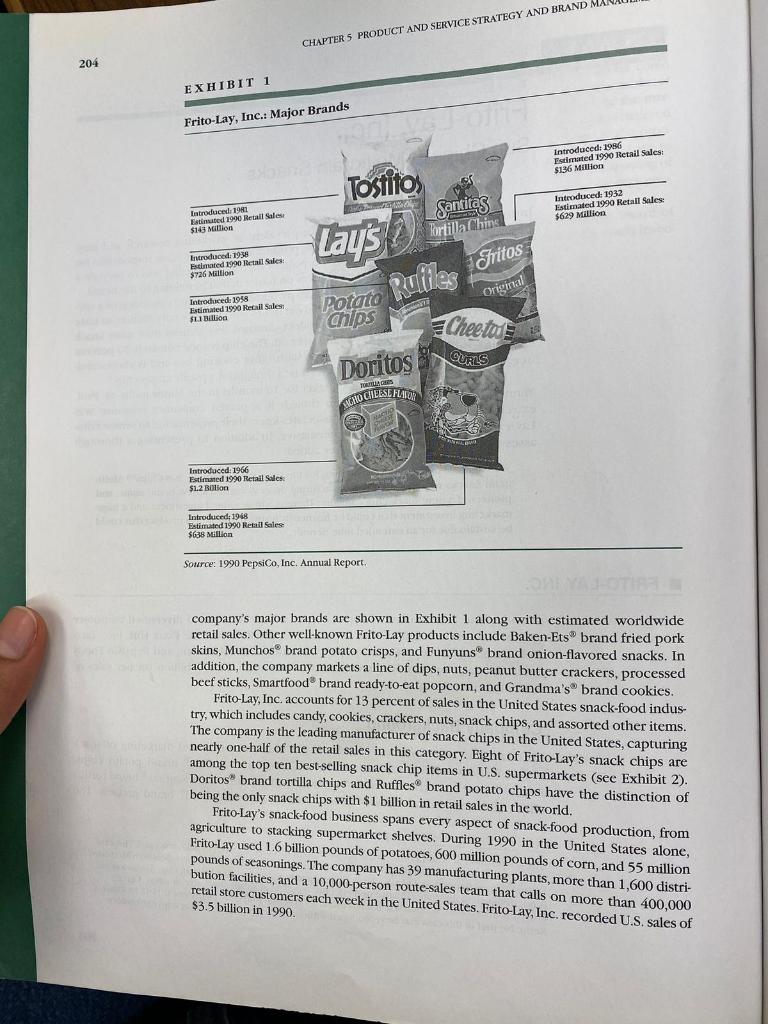

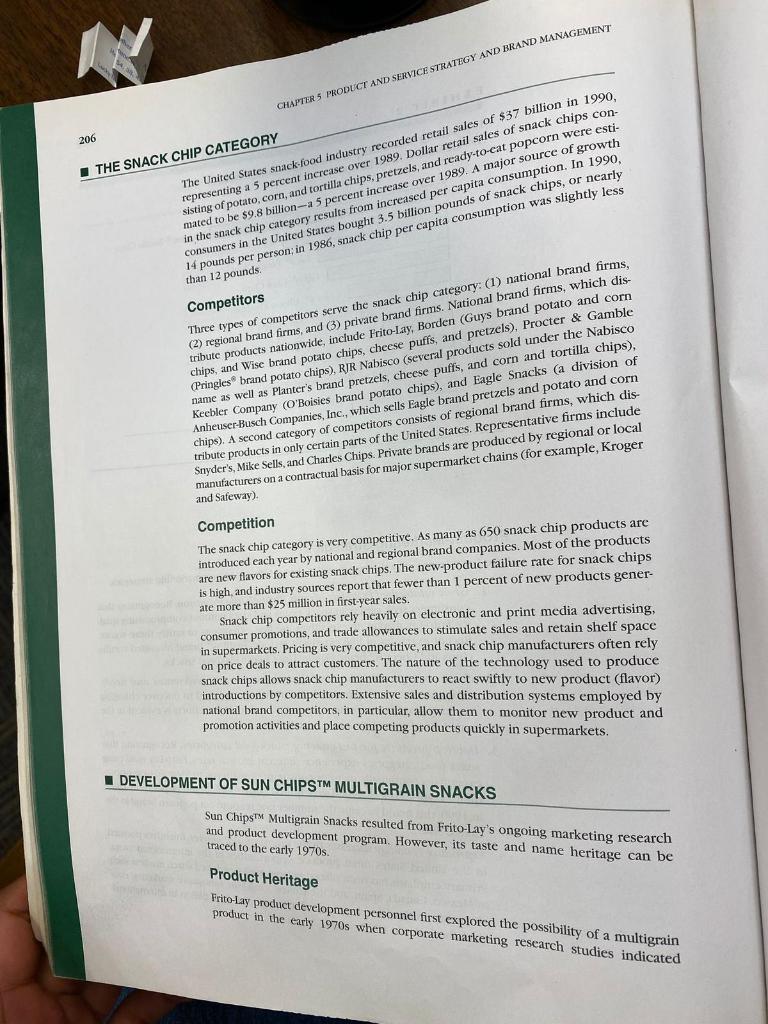

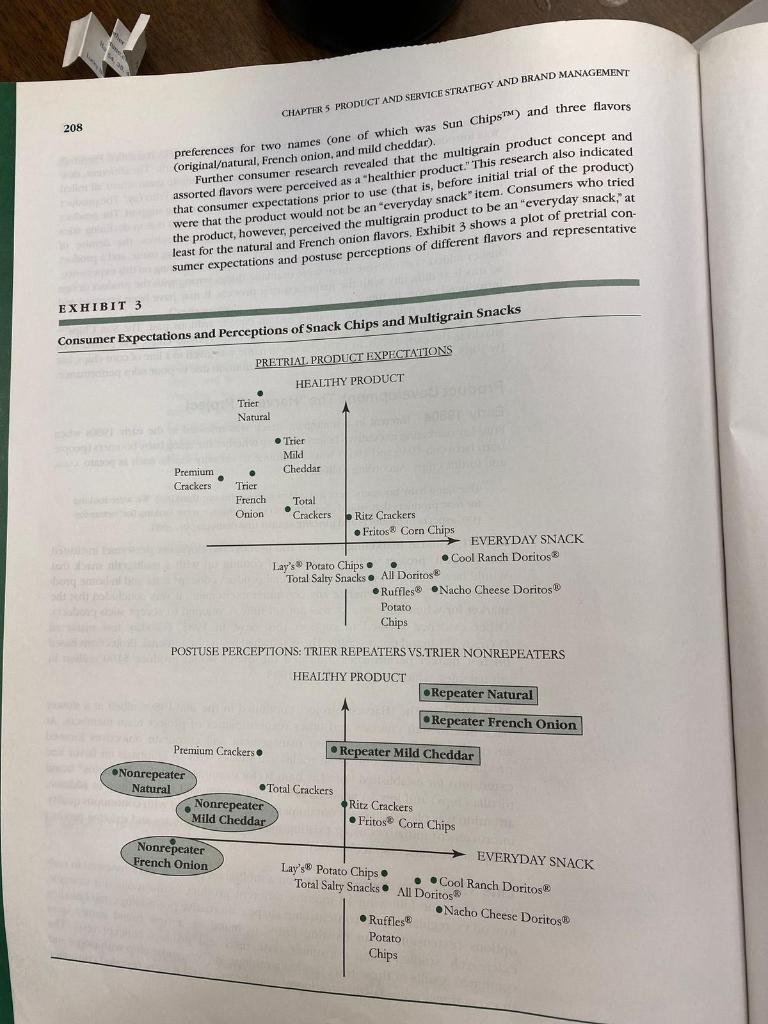

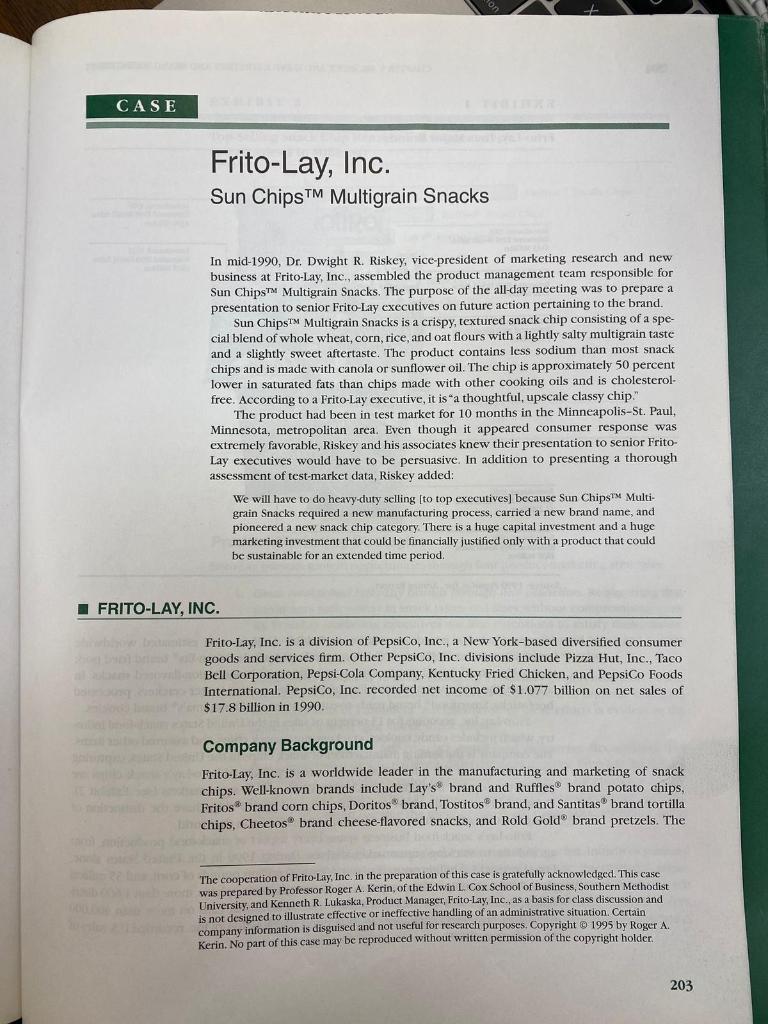

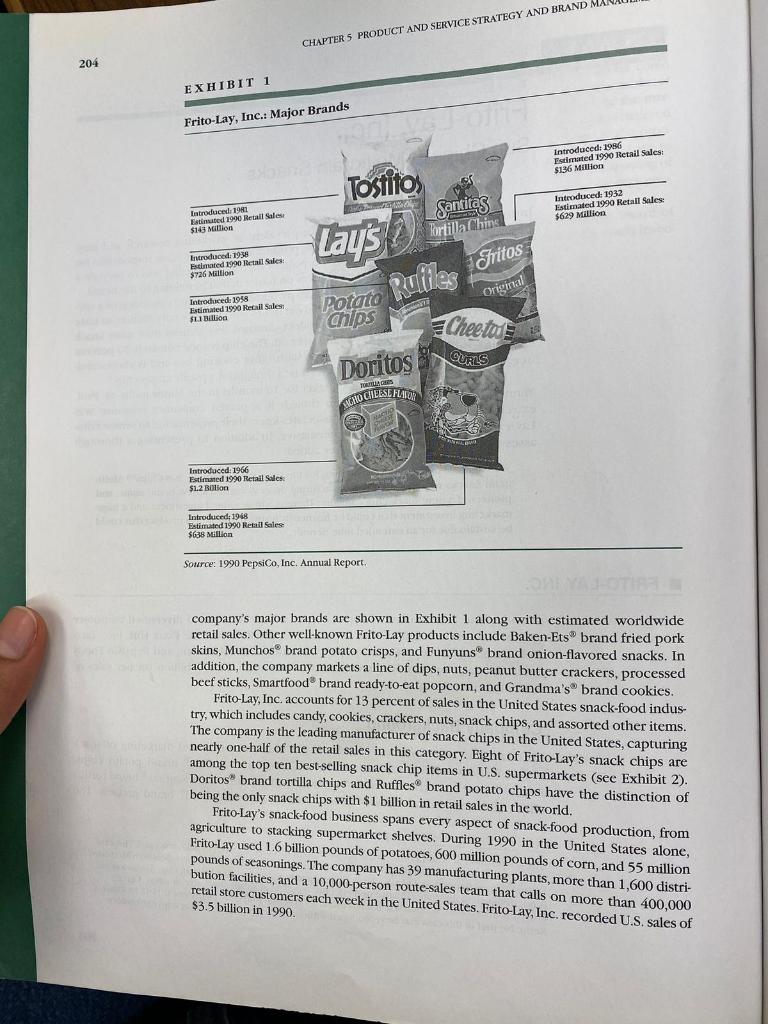

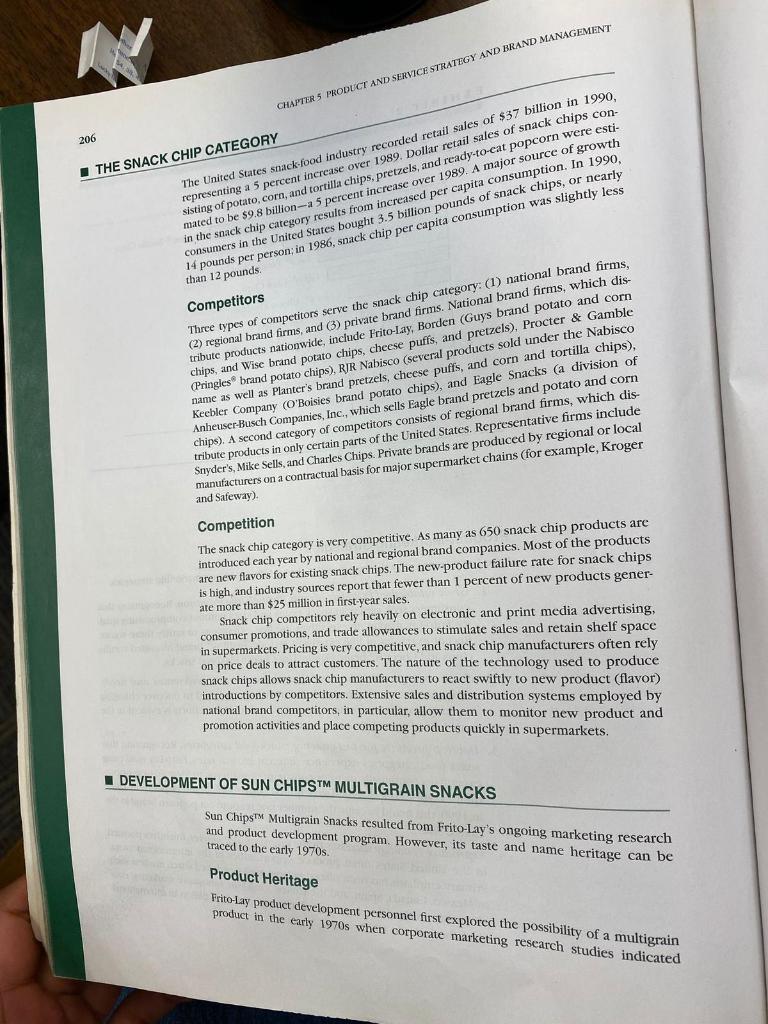

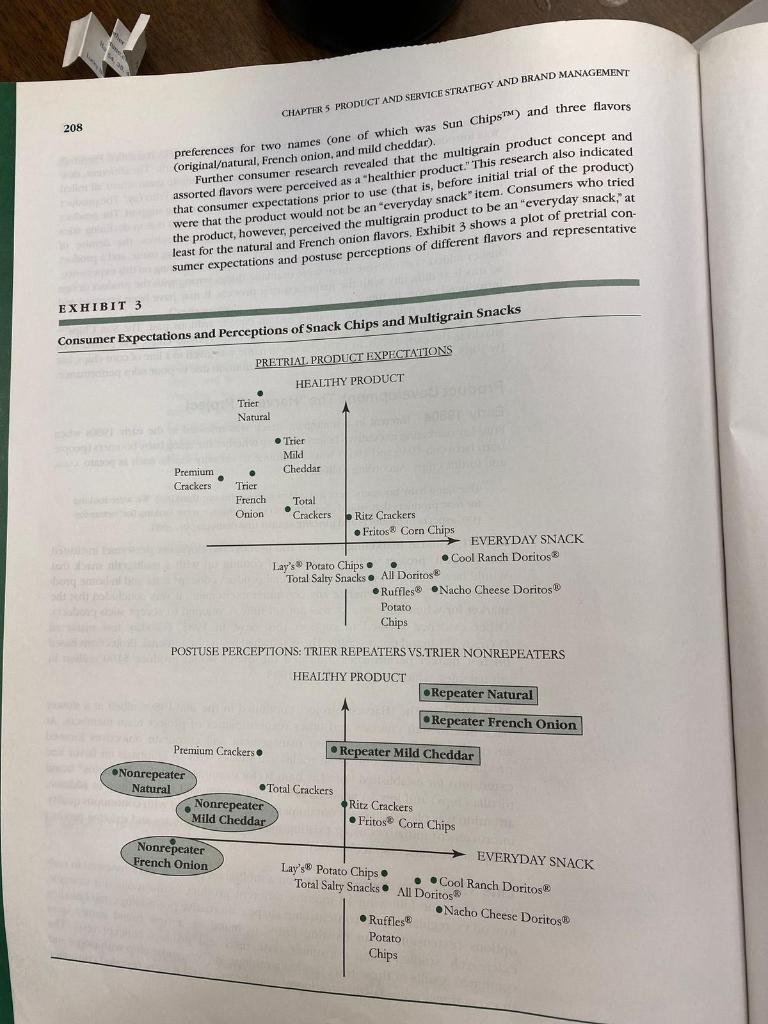

CASE Frito-Lay, Inc. Sun Chips Multigrain Snacks In mid-1990, Dr. Dwight R. Riskey, vice-president of marketing research and new business at Frito-Lay, Inc., assembled the product management team responsible for Sun ChipsTM Multigrain Snacks. The purpose of the all-day meeting was to prepare a presentation to senior Frito-Lay executives on future action pertaining the brand Sun ChipsTM Multigrain Snacks is a crispy, textured snack chip consisting of a spe- cial blend of whole wheat, corn, rice, and oat flours with a lightly salty multigrain taste and a slightly sweet aftertaste. The product contains less sodium than most snack chips and is made with canola or sunflower oil . The chip is approximately 50 percent lower in saturated fats than chips made with other cooking oils and is cholesterol free. According to a Frito-Lay executive, it is a thoughtful, upscale classy chip The product had been in test market for 10 months in the Minneapolis-St. Paul, Minnesota, metropolitan area. Even though it appeared consumer response was extremely favorable, Riskey and his associates knew their presentation to senior Frito- Lay executives would have to be persuasive. In addition to presenting a thorough assessment of test-market data, Riskey added: We will have to do heavy duty selling to top executives) because Sun Chips Multi- grain Snacks required a new manufacturing process, carried a new brand name, and pioneered a new snack chip category. There is a huge capital investment and a huge marketing investment that could be financially justified only with a product that could be sustainable for an extended time period. FRITO-LAY, INC. Frito-Lay, Inc. is a division of PepsiCo, Inc., a New York-based diversified consumer goods and services firm. Other PepsiCo, Inc. divisions include Pizza Hut, Inc., Taco Bell Corporation, Pepsi-Cola Company, Kentucky Fried Chicken, and PepsiCo Foods International. PepsiCo, Inc. recorded net income of $1.077 billion on net sales of $17.8 billion in 1990 Company Background Frito-Lay, Inc. is a worldwide leader in the manufacturing and marketing of snack chips. Well-known brands include Lay's brand and Ruffles brand potato chips, Fritos brand corn chips, Doritos brand, Tostitos brand, and Santitas brand tortilla chips, Cheetos brand cheese-flavored snacks, and Rold Gold brand pretzels. The The cooperation of Frito-Lay, Inc. in the preparation of this case is gratefully acknowledged. s case was prepared by Professor Roger A. Kerin, of the Edwin L. Cox School of Business, Southern Methodist University, and Kenneth R. Lukaska, Product Manager, Frito-Lay, Inc., as a basis for class discussion and is not designed to illustrate effective or ineffective handling of an administrative situation. Certain company information is disguised and not useful for research purposes. Copyright 1995 by Roger A. Kerin. No part of this case may be reproduced without written permission of the copyright holder 203 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND 204 EXHIBIT 1 Frito Lay, Inc.: Major Brands Introduced: 1986 Estimated 1990 Retail Sales $36 Million Tostitos Santitas Entroduced: 1981 Estimated 1990 Retail Sales $143 Million Introduced: 1932 Listimated 1990 Retail Sales: $629 Million Tortilla (thins Introduced: 1938 d 1990 Retail Sales $726 Million Estimac Laus?) Railles Fritos Original Introduced1958 Estimated 1990 Recall Sales $1 Billion Potato Chips Cheetos QURLS Doritos TROCIHEESE FENOM Introduced: 1966 Estimated 1990 Retail Sales $1.2 Bilion Introduced: 1948 Estimated 1990 Retail Sales $638 Million Source: 1990 PepsiCo, Inc. Annual Report company's major brands are shown in Exhibit 1 along with estimated worldwide retail sales. Other well-known Frito-Lay products include Baken-Ets brand fried pork skins, Munchos brand potato crisps, and Funyuns brand onion-flavored snacks. In addition, the company markets a line of dips, nuts, peanut butter crackers, processed beef sticks, Smartfood brand ready-to-eat popcorn, and Grandma's brand cookies. Frito-Lay, Inc. accounts for 13 percent of sales in the United States snack-food indus- try, which includes candy, cookies, crackers, nuts, snack chips, and assorted other items. The company is the leading manufacturer of snack chips in the United States, capturing nearly one-half of the retail sales in this category. Eight of Frito-Lay's snack chips are among the top ten best-selling snack chip items in U.S. supermarkets (see Exhibit 2). Doritos brand tortilla chips and Ruffles brand potato chips have the distinction of being the only snack chips with $1 billion in retail sales in the world. Frito-Lay's snack-food business spans every aspect of snack-food production, from agriculture to stacking supermarket shelves. During 1990 in the United States alone, Frito-Lay used 1.6 billion pounds of potatoes, 600 million pounds of corn, and 55 million pounds of seasonings. The company has 39 manufacturing plants, more than 1,600 distri- bution facilities, and a 10,000-person route-sales team that calls on more than 400,000 retail store customers each week in the United States. Frito-Lay, Inc. recorded U.S. sales of $3.5 billion in 1990 FRITO-LAY, INC 205 EXHIBIT 2 Top-Selling Snack Chip Items in U.S. Supermarkets (Retail Sales $ in Millions) Doritos Tortilla Chips Ruffles Potato Chips Lay's Potato Chips Fritos Corn Chips Cheetos Cheese Flavored Pringle's Potato Chips Tostitos Crispy Round Tortilla Chips Frito-Lay Variety Pack Santitas Restaurant Style Tortilla Chips Eagle Thins Potato Chips 0 100 200 300 400 500 600 Source: 1990 PepsiCo, Inc. Annual Report. Product Marketing Strategies Frito-Lay pursues growth opportunities through four product-marketing strategies. 1. Grow establisbed Frito-Lay brands through line extension. Recognizing that consumers seek variety in snack tastes and sizes without compromising qual- ity, Frito Lay marketing executives use line extensions to satisfy these wants. Recent examples of line extension include Tostitos brand bite-sized tortilla chips and Cheetos brand Flamin' Hot Cheese Flavored Snacks. 2. Create new products to meet changing consumer preferences and needs. Continuous marketing research at Frito-Lay is designed to uncover changing snacking needs of customers. A recent result of these efforts is evident in the launch of a low-oil light line of snack chips. 3. Develop products for fast-growing snack-food categories. Recognizing that snack-food categories experience different growth rates, Frito-Lay marketing executives continually monitor consumption patterns to identify new oppor- tunities. For example, Frito-Lay acquired Smartfood brand popcorn in 1989. In 1990, this brand became the number one ready-to-eat popcorn brand in the United States 4. Reproduce Frito-Lay successes in the international market. Initiatives pursued in the United States often produce opportunities in the international arena. Primary emphasis has been placed in large, well-developed snack markets such as Mexico, Canada, Spain, and the United Kingdom. Innovative marketing cou- pled with product development efforts produced $1.6 billion in international snack-food sales in 1990. N CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT 206 THE SNACK CHIP CATEGORY The United States stack-food industry recorded retail sales of $37 billion in 1990, representing a 5 percent increase over 1989. Dollar retail sales of snack chips con- sisting of potato, corn, and tortilla chips, pretzels, and ready-to-eat popcorn were esti- mated to be $9.8 billion--a 5 percent increase over 1989. A major source of growth in the snack chip category results from increased per capita consumption. In 1990, consumers in the United States bought 3.5 billion pounds of snack chips, or nearly 14 pounds per person; in 1986, snack chip per capita consumption was slightly less than 12 pounds Competitors Three types of competitors serve the snack chip category: (1) national brand firms, 2) regional brand firms, and () private brand firms. National brand firms, which dis- Tributc products nationwide, include Frito-Lay, Borden (Guys brand potato and com chips, and Wise brand potato chips, cheese puffs, and pretzels), Procter & Gamble Pringles brand potato chips), Rir Nabisco (several products sold under the Nabisco name as well as Planter's brand pretzels, cheese puffs, and corn and tortilla chips), Keebler Company O'Boisies brand potato chips), and Eagle Snacks (a division of Anheuser-Busch Companies, Inc., which selts Eagle brand pretzels and potato and corn chips). A second category of competitors consists of regional brand firms, which dis- tribute products in only certain parts of the United States. Representative firms include Snyder's, Mike Sells, and Charles Chips. Private brands are produced by regional or local manufacturers on a contractual basis for major supermarket chains (for example, Kroger Competition and Safeway) The snack chip category is very competitive. As many as 650 snack chip products are introduced each year by national and regional brand companies. Most of the products are new flavors for existing snack chips. The new product failure rate for snack chips is high and industry sources report that fewer than 1 percent of new products gener- ate more than $25 million in first-year sales. Snack chip competitors rely heavily on electronic and print media advertising, consumer promotions, and trade allowances to stimulate sales and retain shelf space in supermarkets. Pricing is very competitive, and snack chip manufacturers often rely on price deals to attract customers. The nature of the technology used to produce snack chips allows snack chip manufacturers to react swiftly to new product (flavor) introductions by competitors. Extensive sales and distribution systems employed by national brand competitors, in particular, allow them to monitor new product and promotion activities and place competing products quickly in supermarkets. DEVELOPMENT OF SUN CHIPSTM MULTIGRAIN SNACKS Sun Chips Multigrain Snacks resulted from Frito-Lay's ongoing marketing research and product development program. However, its taste and name heritage can be traced to the early 1970s. Product Heritage Frito Lay product development personnel first explored the possibility of a multigrain product in the early 1970s when corporate marketing research studies indicated y control FRITO-LAY, INC. 207 consumers were looking for nutritious snacks. A multigrain snack chip called Prontos was introduced in 1974 with the following positioning statement: "The different, deli- cious new snack made from nature's own corn, oats, and whole grain wheat all rolled into one special recipe, together in a snack for the first time from Frito-Lay" The product was only mildly successful despite advertising and merchandising support. The product was subsequently withdrawn from national distribution in 1978 due to declining sales and manufacturing difficulties. According to Frito-Lay executives, the demise of Prontos in 1978 was driven by "noncommittal" copy, a confusing name, and a product that generated appeal among too narrow a target market. Reflecting on this experience, Riskey added, "I'm not sure there were dramatic things wrong with the product design so much as difficulty with the manufacturing process. It may have been invented and introduced before its time." The brand name for the product had an equally arduous past. The Sun Chips name was originally assigned to a line of corn chips, potato chips, and puffed corn snacks in the early 1970s. In 1976, the brand name was given to a line of corn chips, but by 1985, this line was also withdrawn from distribution due to poor sales performance, Product Development: The "Harvest" Project Early 1980s Interest in a multigrain snack was revisited in the early 1980s when Frito-Lay marketing executives began to worry whether the aging baby boomers (people born between 1946 and 1964) would continue to eat salty snacks such as potato, corn, and tortilla chips. According to Riskey: The aging baby boomers were a significant factor in our thinking). We were looking for new products that would allow them to snack. But we were looking for better-for- you aspects in products and pushing against that demographic sluift. In 1981, Frito-Lay marketing research and product development personnel instituted the "Harvest" project with an objective of coming up with a multigrain snack that would have consumer appeal. After several product concept tests and in-home prod. uct use tests failed to generate any consumer excitement, it was concluded that the market for wholesome snacks was not yet fully developed to accept such products, Other evidence seemed to support this view. In 1983, Frito Lay test marketed O'Grady'sTM brand potato chips. The results had been phenomenal. Projections based on test market performance indicated the brand would produce $100 million in annual sales, which it did in 1984 and 1985. Mid-1980s The "Harvest" project continued in the mid-1980s, albeit at a slower pace due to staff changes and other responsibilities of project team members. At about this time, a change in top management and corporate objectives focused product development efforts on traditional snacks with an emphasis on flavor line extensions for established Frito-Lay brands (for example, Cool Ranch Doritos brand tortilla chips) and low-fat versions of its potato, corn, and tortilla chips. In addition, attention was placed on cost-containment measures coupled with continuous quality- improvement initiatives using existing manufacturing facilities and existing product and process snack chip technology. Late 1980s Development efforts on a multigrain product were renewed in early 1988. Over the following 13 months, different product formulations (for example, low oil vs. regular oil; salt content; chip shape), alternative positionings, and branding options (extension of an existing Frito-Lay brand vs. a new brand name) were extensively studied using consumer taste tests and product concept tests. The combined results of these tests yielded a multigrain rectangular chip with ridges and an exceptional taste. Further testing of brand names and flavors revealed consumer FRITO-LAY, INC. 209 snack chip brands and crackers, Concurrent research on brand names indicated a decided preference for the Sun Chips name. The name evoked positive consumer imagery and attributes of wholesomeness, great taste, light and distinctive, and fun. according to a Frito-Lay executive. Premarket Test Positive consumer response to the product concept and brand name prompted an ini- tial assessment of the commercial potential of Sun Chips Multigrain Snacks. A simu- lated test market or premarket test (PMT) was commissioned in April 1989 and conducted by an independent marketing research firm. A PMT involves interviewing consumers about attitudes and usage behavior concerning a product category (for example, snack chips). Consumers would be exposed to a product concept using product descriptions or mock-ups of advertise- ments, and their responses would be assessed (sce Exhibit 4 on page 210). These consumers would then be given an opportunity to receive the product if interested. After an in-home usage period of several weeks, they would be contacted by tele- phone and asked about their attitude toward the product, use of the product, and intention to repurchase. These data would be incorporated into computer models that would include elements of the product's marketing plan (price, advertising, dis- tribution coverage). The output provided by the PMT would include estimates of household trial rates, repeat rates, average number of units purchased on the initial trial and subsequent repeats in the first year, product cannibalism, and first-year sales volume. The product concept tested in the PMT was priced at parity with Doritos brand tortilla chips. Planned distribution coverage was set at levels comparable for Frito-Lay potato, corn, and tortilla chips. Two-flavor combinations (natural and French onion and natural and mild cheddar) and three advertising and merchandising expenditure levels ($11 million, $17 million, and $22 million) were tested.2 Results from the PMT indicated that Sun Chips Multigrain Snacks would pro- duce a most likely first-year sales volume of $113 million at manufacturer's prices given the marketing plan set for the product, including a $22 million advertising and merchandising expenditure. The estimated first-year sales volume exceeded the $100 million Frito Lay sales goal for new products. The natural and French onion flavor combination produced the lowest cannibalization (42 percent of other Frito-Lay brands. Summary statistics for the simulated test market are shown in Exhibit 5 on page 211 TEST MARKET Positive results from consumer research and the simulated test market led to a recom- mendation to proceed with Sun ChipsTM Multigrain Snacks and implement a test market under Dwight Riskey's direction. The Minneapolis-St. Paul, Minnesota metropolitan area was chosen as the test site because Frito-Lay executives were confident it had a social and economic profile representative of the United States. Furthermore, Minneapolis-St. Paul, Published validation data on premarket test models indicate that 75 percent of the time they are plus or minus 10 percent of actual performance when a product was introduced (see, for example, A. Shocker and W. Hall, Pretest Market Models: A Critical Evaluation, Journal of Product Innovation Management 3. (1986), pp. 86-107 Advertising and merchandising expenditures included electronic and print media advertising, consumer promotions, and trade allowances A proposition to be voted upon: 3 papers of 2-3 pages w/ presentation + discussion grade + weekly factual Midterm and Final + discussion grade assessments 3 short papers: 1) on a contribution of a woman to American Civilization"; 2) one on an object or technology or service which changed America; 3) one on the arts, media, literature, music, theatre, or a political figure of interest related to the student's major Instructor "surprises class at midterm and final. Class feverishly pours out their hearts, not knowing if they will meet the instructor's expectations. Name: Due Due Topic 1: Topic 2: Topic 3: Due: Three Source minimum; footnotes using Chicago Style, written and oral presentation anticipated. CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT 208 preferences for two names (one of which was Sun Chips") and three flavors (originalatural, French onion, and mild cheddar). Further consumer research revealed that the multigrain product concept and assorted flavors were perceived as a "healthier product." This research also indicated that consumer expectations prior to use (that is, before initial trial of the product) were that the product would not be an everyday snack"item. Consumers who tried the product, however, perceived the multigrain product to be an "everyday snack, at least for the natural and French onion flavors. Exhibit 3 shows a plot of pretrial con sumer expectations and postuse perceptions of different flavors and representative EXHIBIT 3 Consumer Expectations and Perceptions of Snack Chips and Multigrain Snacks PRETRIAL PRODUCT EXPECTATIONS HEALTHY PRODUCT Trier Natural Trier Mild Cheddar Premium Crackers Trier French Onion Crackers Total Ritz Crackers Fritos Corn Chips EVERYDAY SNACK Lay's Potato Chips . Cool Ranch Doritos . Total Salty Snacks All Doritos Ruffles Nacho Cheese Doritos Potato Chips POSTUSE PERCEPTIONS: TRIER REPEATERS VS. TRIER NONREPEATERS HEALTHY PRODUCT Repeater Natural Repeater French Onion Premium Crackers Repeater Mild Cheddar Nonrepeater Total Crackers Natural Ritz Crackers Nonrepeater Fritos Corn Chips Mild Cheddar EVERYDAY SNACK Nonrepeater French Onion Lay's Potato Chips Cool Ranch Doritos Total Salty Snacks All Doritos Nacho Cheese Doritos Ruffles Potato Chips

what is this case study about? what is the problems that need to be addressed? what are alternative solutions for these problems? what are the pros and cons for each solution? recommended course of action?

what is this case study about? what is the problems that need to be addressed? what are alternative solutions for these problems? what are the pros and cons for each solution? recommended course of action?