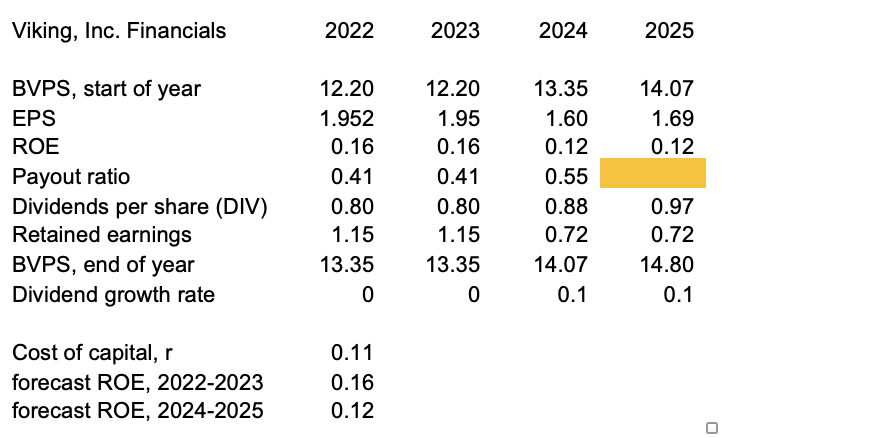

Question: What is Vikings expected Payout ratio for 2025 (see missing value in table)? Assuming these numbers are correct, what would be a fair value for

What is Vikings expected Payout ratio for 2025 (see missing value in table)?

What is Vikings expected Payout ratio for 2025 (see missing value in table)?

Assuming these numbers are correct, what would be a fair value for Viking, Inc. stock price at the beginning of 2022?

Explain what would happen to the value of Viking, Inc. stock if the forecast cost of capital rises from 11% to 13%. No calculations are required, just a clear explanation.

Viking, Inc. Financials 202212.201.9520.160.410.801.1513.350202312.201.950.160.410.801.1513.350202413.351.600.120.550.880.7214.070.1202514.071.690.120.970.7214.800.1 Cost of capital, r 0.11 forecast ROE, 2022-2023 0.16 Viking, Inc. Financials 202212.201.9520.160.410.801.1513.350202312.201.950.160.410.801.1513.350202413.351.600.120.550.880.7214.070.1202514.071.690.120.970.7214.800.1 Cost of capital, r 0.11 forecast ROE, 2022-2023 0.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts