Question: What key challenges is Metro C&C facing from competition in the Indian market? What is the companys approach to handling these challenges? Rakhi Thakur wrote

What key challenges is Metro C&C facing from competition in the Indian market? What is the companys approach to handling these challenges?

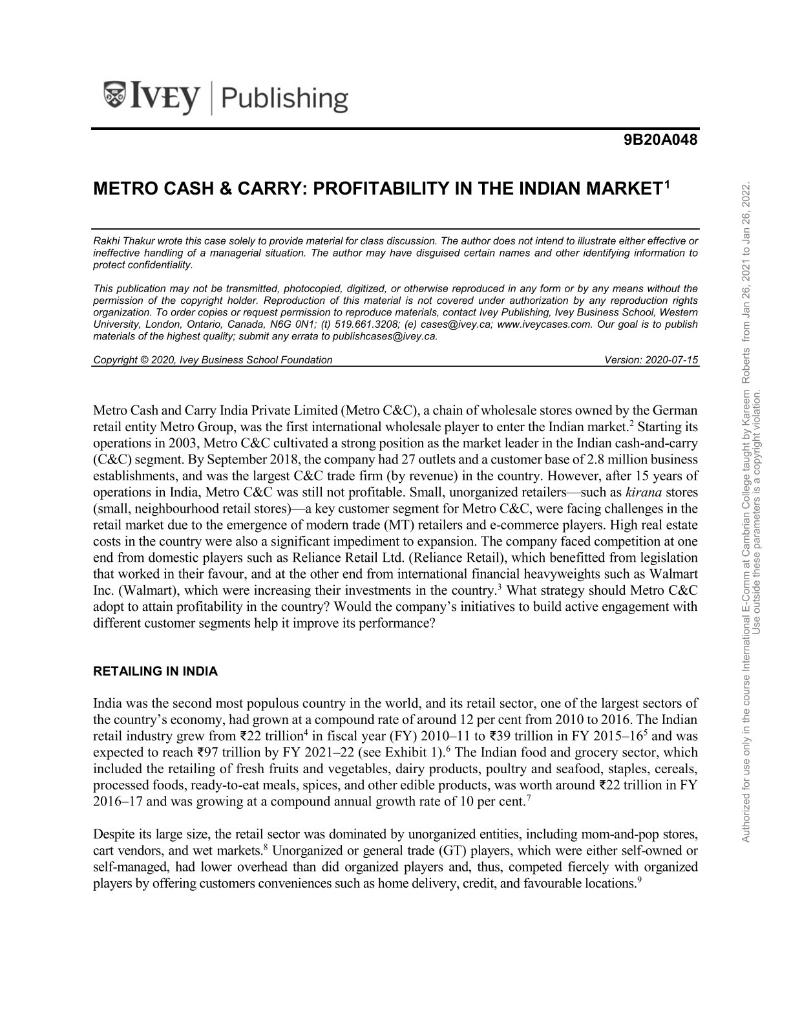

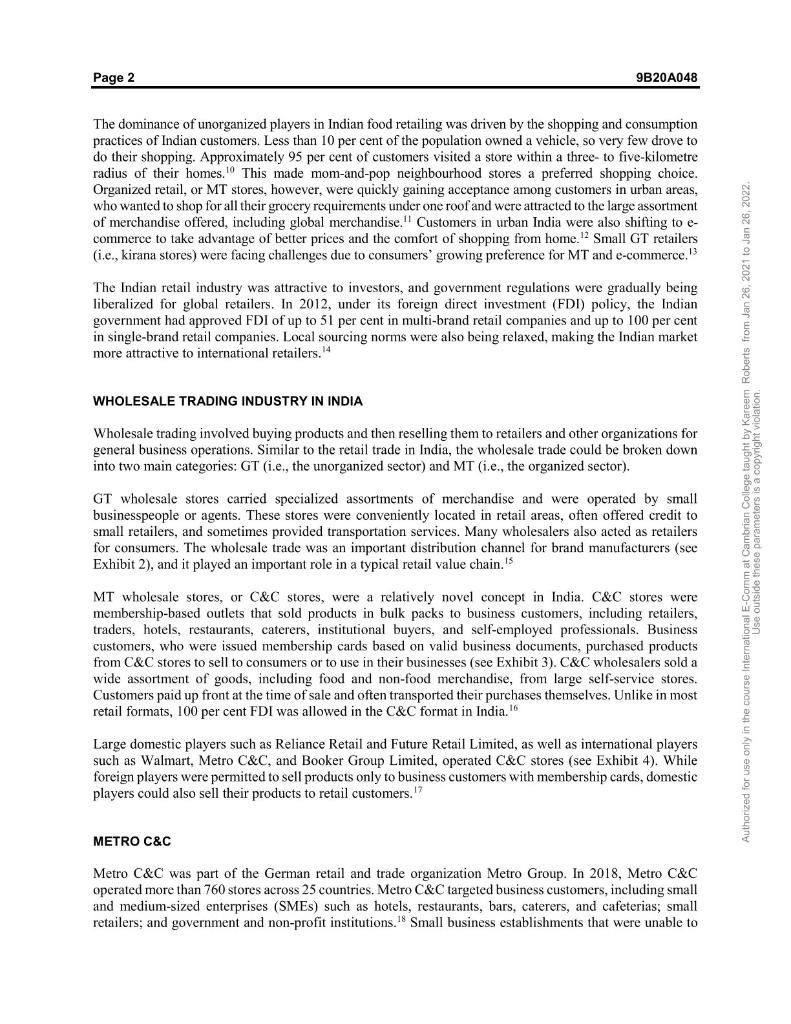

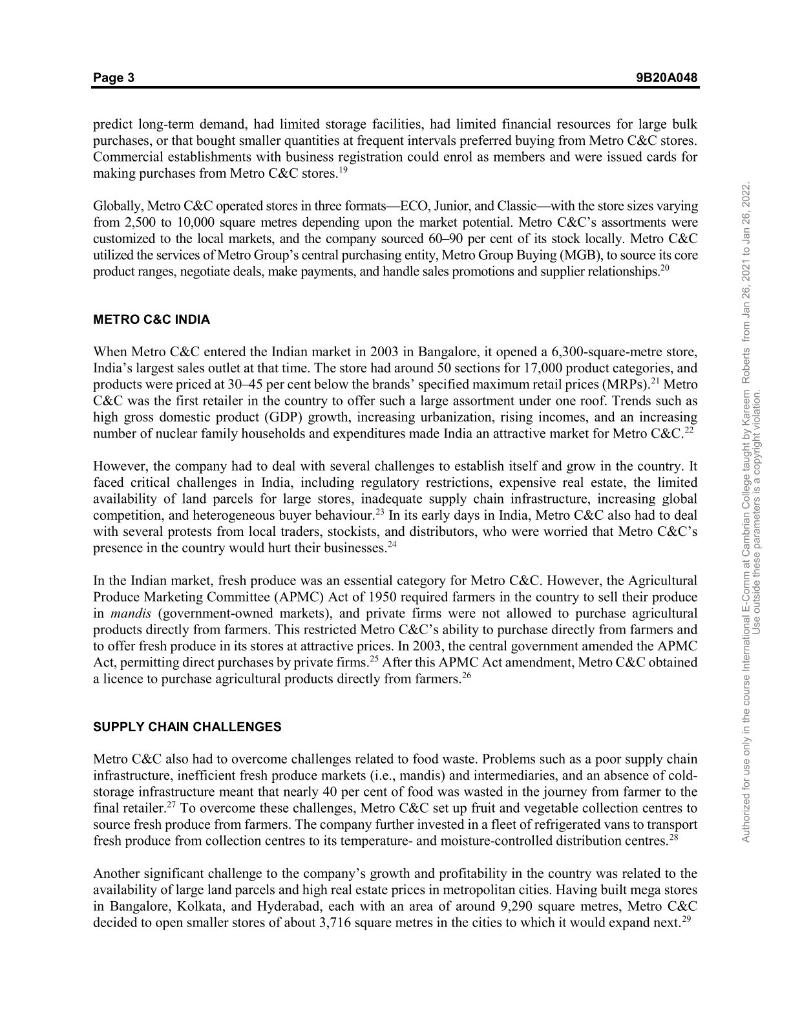

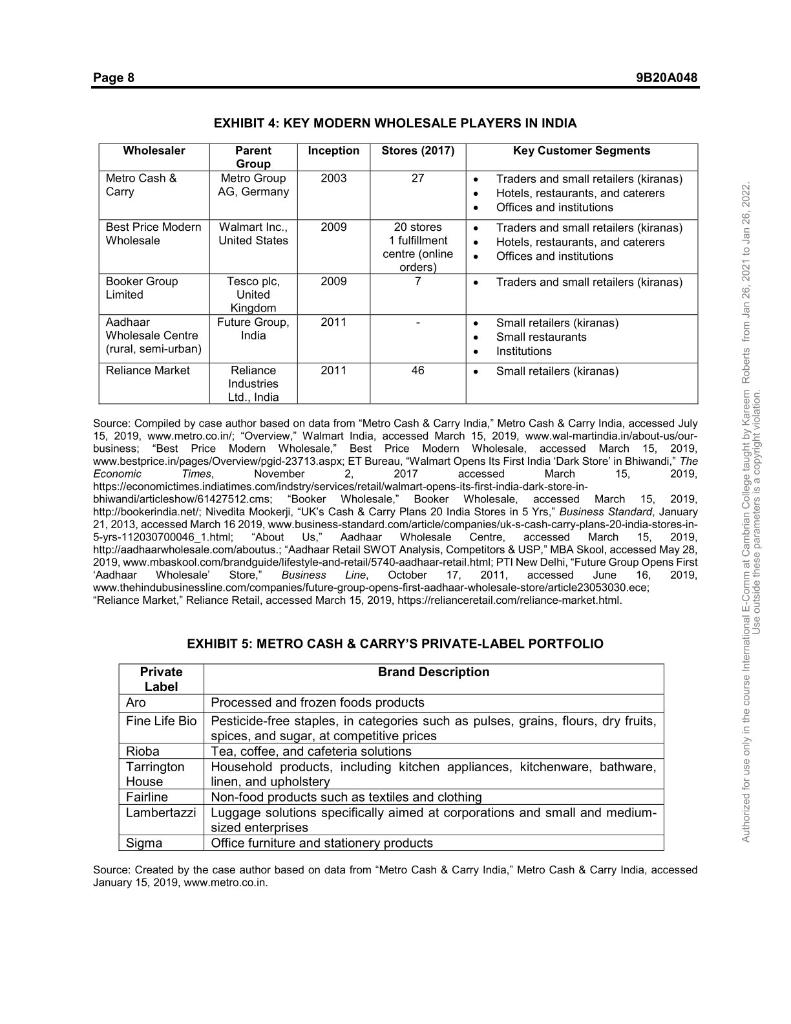

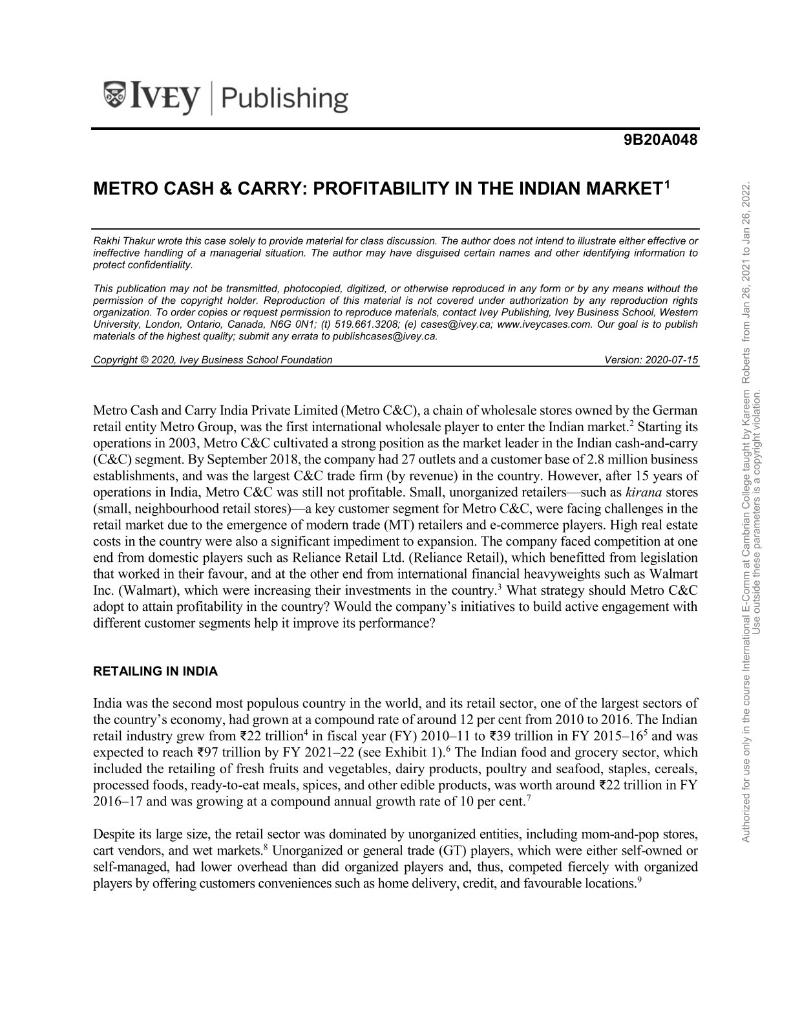

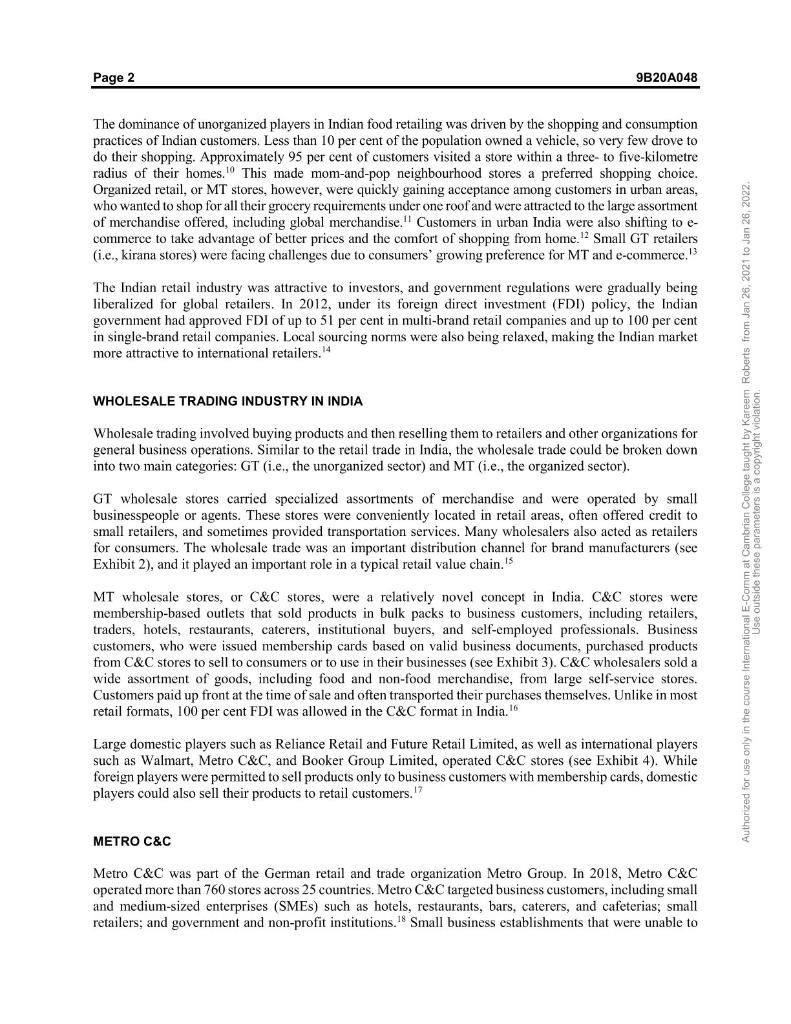

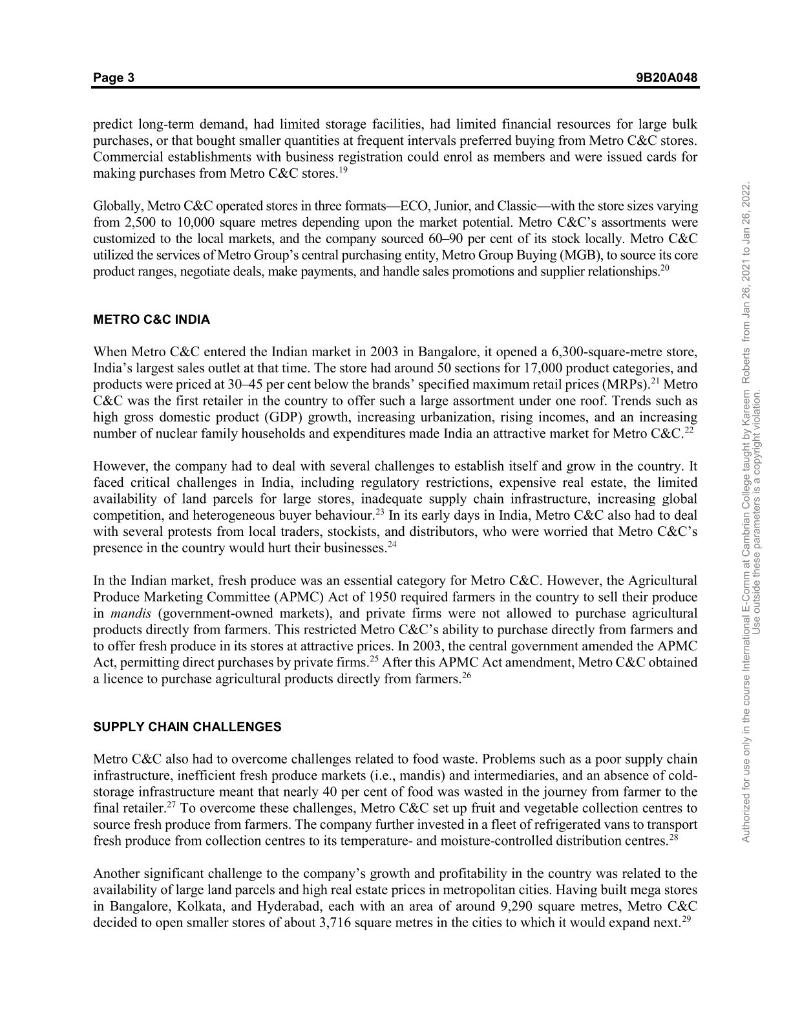

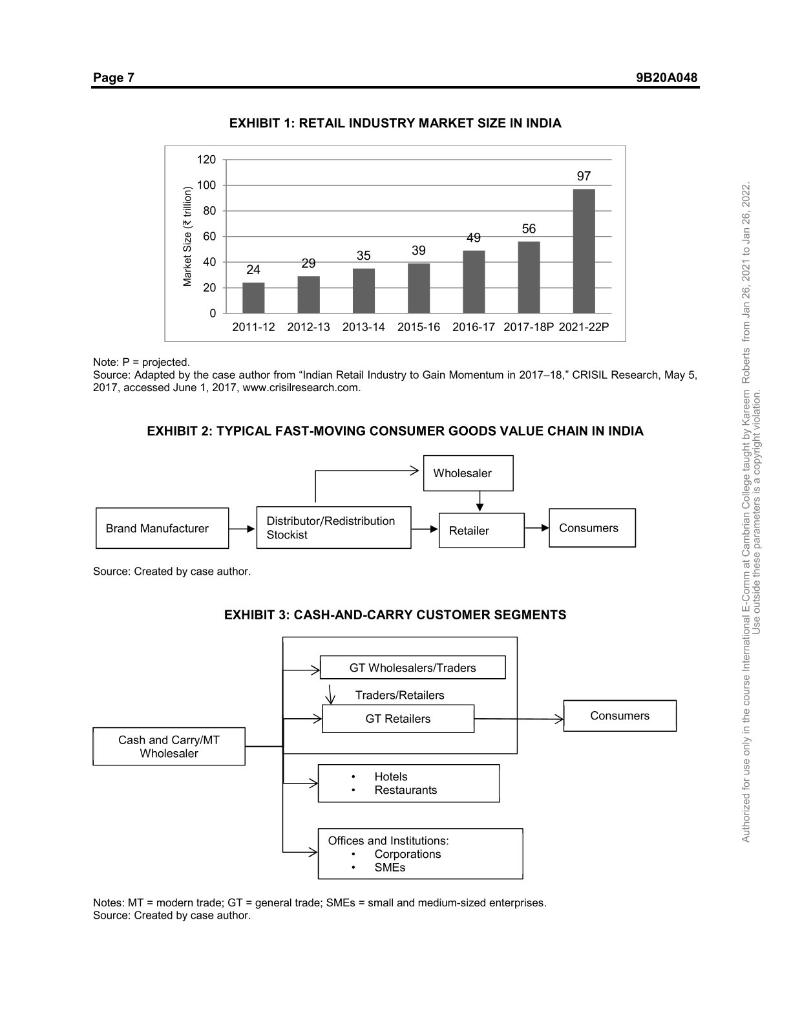

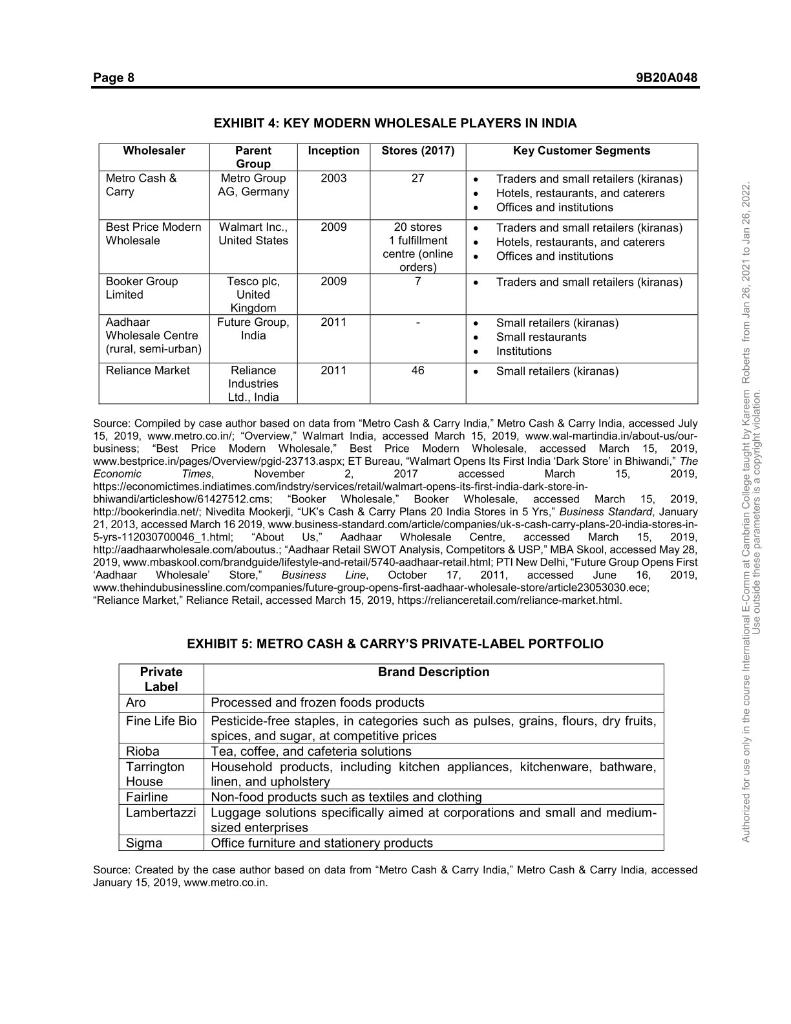

Rakhi Thakur wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation. The author may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduclion rights organization. To arder copies or request permission to reproduce materials, contact lvey Publishing. Ivey Business School, Westem University, London, Ontario, Canada, N6G ON1: (t) 519.661.3208; (e) cases@ivey.ca, wwwiveycases.com. Our goal is to publish materials of the highest quality; submit any errata to publishcases@ivey.ca. Copyright @ 2020, Ivey Business School Foundation Version: 2020-07-15 Metro Cash and Carry India Private Limited (Metro C\&C), a chain of wholesale stores owned by the German retail entity Metro Group, was the first international wholesale player to enter the Indian market. 2 Starting its operations in 2003, Metro C\&C cultivated a strong position as the market leader in the Indian cash-and-carry (C\&C) segment. By September 2018 , the company had 27 outlets and a customer base of 2.8 million business establishments, and was the largest C\&C trade firm (by revenue) in the country. However, after 15 years of operations in India, Metro C\&C was still not profitable. Small, unorganized retailers such as kirana stores (small, neighbourhood retail stores)-a key customer segment for Metro C&C, were facing challenges in the retail market due to the emergence of modern trade (MT) retailers and e-commerce players. High real estate costs in the country were also a significant impediment to expansion. The company faced competition at one end from domestic players such as Reliance Retail Ltd. (Reliance Retail), which benefitted from legislation that worked in their favour, and at the other end from international financial heavyweights such as Walmart Inc. (Walmart), which were increasing their investments in the country. 3 What strategy should Metro C\&C adopt to attain profitability in the country? Would the company's initiatives to build active engagement with different customer segments help it improve its performance? RETAILING IN INDIA India was the second most populous country in the world, and its retail sector, one of the largest sectors of the country's economy, had grown at a compound rate of around 12 per cent from 2010 to 2016. The Indian retail industry grew from 22 trillion 4 in fiscal year (FY) 2010-11 to 39 trillion in FY 2015-16 5 and was expected to reach 97 trillion by FY 2021-22 (see Exhibit 1). 6 The Indian food and grocery sector, which included the retailing of fresh fruits and vegetables, dairy products, poultry and seafood, staples, cereals, processed foods, ready-to-eat meals, spices, and other edible products, was worth around 22 trillion in FY 2016-17 and was growing at a compound annual growth rate of 10 per cent. Page 2 9B20A048 The dominance of unorganized players in Indian food retailing was driven by the shopping and consumption practices of Indian customers. Less than 10 per cent of the population owned a vehicle, so very few drove to do their shopping. Approximately 95 per cent of customers visited a store within a three- to five-kilometre radius of their homes. 10 This made mom-and-pop neighbourhood stores a preferred shopping choice. Organized retail, or MT stores, however, were quickly gaining acceptance among customers in urban areas, who wanted to shop for all their grocery requirements under one roof and were attracted to the large assortment of merchandise offered, including global merchandise. 11 Customers in urban India were also shifting to ecommerce to take advantage of better prices and the comfort of shopping from home. 12 Small GT retailers (i.e., kirana stores) were facing challenges due to consumers' growing preference for MT and e-commerce. 13 The Indian retail industry was attractive to investors, and government regulations were gradually being liberalized for global retailers. In 2012, under its foreign direct investment (FDI) policy, the Indian government had approved FDI of up to 51 per cent in multi-brand retail companies and up to 100 per cent in single-brand retail companies. Local sourcing norms were also being relaxed, making the Indian market more attractive to international retailers. 14 WHOLESALE TRADING INDUSTRY IN INDIA Wholesale trading involved buying products and then reselling them to retailers and other organizations for general business operations. Similar to the retail trade in India, the wholesale trade could be broken down into two main categories: GT (i.e., the unorganized sector) and MT (i.e., the organized sector). GT wholesale stores carried specialized assortments of merchandise and were operated by small businesspeople or agents. These stores were conveniently located in retail areas, often offered credit to small retailers, and sometimes provided transportation services. Many wholesalers also acted as retailers for consumers. The wholesale trade was an important distribution channel for brand manufacturers (see Exhibit 2), and it played an important role in a typical retail value chain. 15 MT wholesale stores, or C&C stores, were a relatively novel concept in India. C\&C stores were membership-based outlets that sold products in bulk packs to business customers, including retailers, traders, hotels, restaurants, caterers, institutional buyers, and self-employed professionals. Business customers, who were issued membership cards based on valid business documents, purchased products from C\&C stores to sell to consumers or to use in their businesses (see Exhibit 3). C\&C wholesalers sold a wide assortment of goods, including food and non-food merchandise, from large self-service stores. Customers paid up front at the time of sale and often transported their purchases themselves. Unlike in most retail formats, 100 per cent FDI was allowed in the C\&C format in India. 16 Large domestic players such as Reliance Retail and Future Retail Limited, as well as international players such as Walmart, Metro C\&C, and Booker Group Limited, operated C\&C stores (see Exhibit 4). While foreign players were permitted to sell products only to business customers with membership cards, domestic players could also sell their products to retail customers. 17 METRO C\&C Metro C&C was part of the German retail and trade organization Metro Group. In 2018, Metro C\&C operated more than 760 stores across 25 countries. Metro C\&C targeted business customers, including small and medium-sized enterprises (SMEs) such as hotels, restaurants, bars, caterers, and cafeterias; small retailers; and government and non-profit institutions. 18 Small business establishments that were unable to predict long-term demand, had limited storage facilities, had limited financial resources for large bulk purchases, or that bought smaller quantities at frequent intervals preferred buying from Metro C\&C stores. Commercial establishments with business registration could enrol as members and were issued cards for making purchases from Metro C&C stores. 19 Globally, Metro C\&C operated stores in three formats-ECO, Junior, and Classic - with the store sizes varying from 2,500 to 10,000 square metres depending upon the market potential. Metro C\&C's assortments were customized to the local markets, and the company sourced 6090 per cent of its stock locally. Metro C\&C utilized the services of Metro Group's central purchasing entity, Metro Group Buying (MGB), to source its core product ranges, negotiate deals, make payments, and handle sales promotions and supplier relationships. 20 METRO C\&C INDIA When Metro C\&C entered the Indian market in 2003 in Bangalore, it opened a 6,300-square-metre store, India's largest sales outlet at that time. The store had around 50 sections for 17,000 product categories, and products were priced at 3045 per cent below the brands' specified maximum retail prices (MRPs). 21 Metro C&C was the first retailer in the country to offer such a large assortment under one roof. Trends such as high gross domestic product (GDP) growth, increasing urbanization, rising incomes, and an increasing number of nuclear family households and expenditures made India an attractive market for Metro C&C22 However, the company had to deal with several challenges to establish itself and grow in the country. It faced critical challenges in India, including regulatory restrictions, expensive real estate, the limited availability of land parcels for large stores, inadequate supply chain infrastructure, increasing global competition, and heterogeneous buyer behaviour. 23In its early days in India, Metro C&C also had to deal with several protests from local traders, stockists, and distributors, who were worried that Metro C\&C's presence in the country would hurt their businesses. 24 In the Indian market, fresh produce was an essential category for Metro C&C. However, the Agricultural Produce Marketing Committee (APMC) Act of 1950 required farmers in the country to sell their produce in mandis (government-owned markets), and private firms were not allowed to purchase agricultural products directly from farmers. This restricted Metro C&C 's ability to purchase directly from farmers and to offer fresh produce in its stores at attractive prices. In 2003, the central government amended the APMC Act, permitting direct purchases by private firms. 25 After this APMC Act amendment, Metro C\&C obtained a licence to purchase agricultural products directly from farmers. 26 SUPPLY CHAIN CHALLENGES Metro C&C also had to overcome challenges related to food waste. Problems such as a poor supply chain infrastructure, inefficient fresh produce markets (i.e., mandis) and intermediaries, and an absence of coldstorage infrastructure meant that nearly 40 per cent of food was wasted in the journey from farmer to the final retailer. 27 To overcome these challenges, Metro C&C set up fruit and vegetable collection centres to source fresh produce from farmers. The company further invested in a fleet of refrigerated vans to transport fresh produce from collection centres to its temperature- and moisture-controlled distribution centres. 28 Another significant challenge to the company's growth and profitability in the country was related to the availability of large land parcels and high real estate prices in metropolitan cities. Having built mega stores in Bangalore, Kolkata, and Hyderabad, each with an area of around 9,290 square metres, Metro C\&C decided to open smaller stores of about 3,716 square metres in the cities to which it would expand next. 29 ADAPT ABILITY TO CULTURAL VARIATIONS As Winston Churchill pointed out, India was diverse; his comment that the country was "merely a geographical expression. It is no more a single country than the Equator" reflected its various heterogeneous aspects: diverse languages, climates, religions, cultural practices, and levels of economic development. 30 This diversity had huge implications for the consumption patterns of people in different parts of the country. In the food and grocery categories, people consumed different oils and spices and had strong inclinations toward regional brands. For example, in the southern part of the country, people consumed higher quantities of rice than did those in the northern states, where wheat was a staple. Metro C\&C understood these differences and modified its offerings in different parts of the country to suit regional preferences. To satisfy the purchasing patterns of customers, the company offered more international brands in metropolitan cities, compared to other locations, where it focused on regional brands. Furthermore, its stores in northern states such as Punjab sold larger sizes in its apparel lines compared to the stores in southern cities such as Bangalore and Hyderabad, where it sold smaller sizes, based on the needs of the local populations. 31 Although Metro C\&C was the first entrant in the C\&C segment, this lucrative segment had attracted other national and international players. Indian C\&C players Reliance Market, part of the leading retail chain Reliance Retail, and Best Price Modern Wholesale (Best Price), operated by global retail giant Walmart, were key competitors for Metro C&C. As an Indian company, Reliance Market had the advantage of softer regulatory policies working in its favour. Reliance Retail also had a large footprint across several retail formats, so it could capitalize on operational efficiencies. Furthermore, Reliance Market could also sell products to end-consumers from its stores. 32 The other competitor, Best Price (Walmart), had extensive international expertise in running retail stores and was financially strong. Walmart was aggressively expanding in the country and had planned to invest 32 billion in the Indian market over the 2018-2021 period. 33 Best Price and Metro C&C catered to the same customer segments; therefore, Best Price's expansion in the country was a direct threat to Metro C&CC34 Customers Metro C&C catered to three key customer segments in India: (1) traders and small retailers (i.e., kirana stores); (2) hotels, restaurants, and caterers; and (3) offices and institutions. 35 Traders and small retailers dominated the food and grocery segment in the country. These stores got products either through brand distributors or through wholesalers. Some of these retailers shopped at Metro C\&C for better prices and promotions. These retailers had loyal customer bases in their respective catchment areas. While large in number, many of these retailers lacked modern infrastructure and professional management skills. These stores were losing business to sophisticated MT stores and e-commerce platforms. 36 Metro C\&C identified this segment as a significant opportunity for its business. To attract and build loyalty within this customer segment, the company launched several customized initiatives to help kirana owners run their businesses better and increase profitability. 37 To help kirana stores become more competitive and profitable, Metro C&C launched its Super Trader program, which was designed to help kiranas enhance their offerings with more appropriate assortments, more efficient inventory management, greater hygiene, improved ambience, and better services for their shoppers. 38 The company also held Super Trader conventions, where industry experts shared best practices with traders. Metro C&C organized periodic workshops for small retailers on topics such as managing stocks, merchandising, improving customer service, and selecting assortments of goods. Metro C\&C's Kirana Success Centre provided small retailers with modern fixtures, to increase shelf space and to better display merchandise, and with expertise to help them better manage their stores. 39 Metro C \&C understood that it could improve its business by helping small retailers grow their businesses. Toward that objective, the company launched a focused digitization initiative in 2017 . The company partnered with third-party service providers, including Easy Pay Private Limited and SnapBizz Cloudtech Private Limited, to provide business enhancement hardware and software to around 100 retailers to digitize their businesses. 40 These tools were aimed at helping kirana stores improve their customer service; track daily purchases, sales, and inventory; and track customer details, similar to MT retailers. Metro C\&C also partnered with finance companies such as CapFloat Financial Services Private Limited (Capital Float), Neo Growth Credit Private Limited, and Kotak Mahindra Bank to provide small-ticket loans to support small businesses in managing their working capital requirements. 41 Metro C\&C planned to launch an e-commerce portal to reach the customers who were not able to visit the stores frequently. 42 It also launched an order processing, payment collection, and delivery initiative to increase its outreach to kirana stores. The initial results were encouraging, and the pilot stores reported an increase of 40 per cent in their sales following the introduction of the digitization program. 43 Hospitality (i.e., hotels, restaurants, and caterers) was another important customer segment for Metro C\&C. These customers bought large packages of different food products from Metro C&C to use as raw material in their businesses. While large, this segment was also dominated by small, unorganized players. The needs of the hospitality segment were quite different from those of kirana stores; accordingly, Metro C\&C offered a different set of services to this customer segment. For small and mid-sized restaurants, it offered hygiene audits and quality training initiatives to help them raise hygiene standards and food quality. For restaurants, the company started offering flexible payment facilities and hazard analysis and critical control points (HACCP)-certified quality assurance. (HACCP certification was an international standard defining the requirements for the effective control of food safety). 44 To build engagement in the restaurant segment, Metro C\&C launched an interactive, professional knowledge-sharing platform for cooking, called Chef-ology. Chef-o-logy was an interactive platform where well-known chefs and food consultants provided value-added services to small hotels and restaurants. These services were focused on areas such as thematic cuisine creation, food festivals, menu merchandising, and knowledge-sharing. 45 Metro C\&C also launched its Young Chefs' Culinary Challenge to nurture culinary talent and foster popularity among the young generation. For caterers and canteens, the company provided bulk packing and doorstep delivery service. For hotels, it appointed key account managers who could understand and service their business needs. 46 Offices and institutions were another important customer segment for Metro C\&C. Institutional buyers purchased office supplies, commercial products, and electronic goods for business usage. Unlike kirana stores, many of these customers had to be managed individually. The company appointed dedicated key account managers, who had knowledge about specific industries and could inform specific institutions about relevant product portfolios, promotions, and technological advances. Other initiatives for institutional buyers included specific product ranges, doorstep delivery, and logistics assistance. 47 Product Portfolio Metro C\&C sold a wide range of food and non-food products from its stores. The company had a complex merchandise mix to accommodate its different customer segments. For traders and retailers, the company had products and stock-keeping units (SKUs) suitable for GT customers. These included fresh produce, meat, seafood, dry groceries, fast-moving consumer goods (FMCG) products, apparel, and footwear. These customers bought small package sizes in bulk to sell from their stores. 48 To cater to hospitality customers, Metro C\&C sold a wide range of fresh produce, perishable products (e.g., bread), large packages of food (e.g., noodles, biscuits, and sauces), non-food products (e.g., paper napkins and aluminum foil), and a range of cleaning and housekeeping products. To cater to the needs of institutional buyers, Metro C\&C had a wide assortment of stationery, electronics, and home improvement products. Based on the diverse needs of its customers, the company sold a broad range of international, national, and regional brands. 49 Page 6 9B20A048 Like its global parent company, Metro C\&C sold a wide range of private-label products in almost all categories (see Exhibit 5). The private-label portfolio helped the company earn better margins, differentiate itself from competitors, and develop a loyal customer base 50 Metro C&C acquired HACCP certification, which assured its customers of the quality of its food products. 51 Suppliers By 2017, Metro C\&C was sourcing nearly 10,000 products directly from more than 2,000 suppliers of food and non-food products. These suppliers included large multinational firms, SMEs, and agricultural producers. The company worked closely with large international, national, and regional brands primarily to get the right products at excellent prices. Procuring products directly and in large quantities allowed Metro C\&C to offer its customers attractive prices that were better than those of other distributors and wholesalers. 52 Metro Group's central purchasing entity, MGB, played a critical role in this. While the close association with large manufacturers ensured better margins and trade terms, the more significant challenge for Metro C\&C was working with SMEs and agricultural producers to obtain a supply of fresh produce. Metro C\&C had come up with an intensive training initiative for farmers and small suppliers to enhance their methods and help them produce high-quality products, and the company sourced a lot of local merchandise and private-label products from SMEs. 53 Metro C\&C invested in these companies by providing them with guidelines and training that enabled them to produce products according to Metro C&C 's standards. The company offered knowledge about certification systems and customer requirements for food quality and safety. Fresh produce-including fruits and vegetables, and dairy, meat, and poultry products - was challenging to procure and manage. Though these categories provided the potential for higher margins, they came with significant challenges in terms of quality, storage, and logistics. 54 Metro C\&C worked closely with farmers, imparting knowledge to improve the quality of their produce. It opened fruit and vegetable collection centres, where it could source fresh produce from farmers and manage storage and transportation. 55 Metro C&C conducted special engagement activities for meat suppliers, providing them with training on meat handling and processing techniques in alignment with the company's international best practices and experience. 56 Metro C&C introduced immediate payment to its suppliers in an industry where long credit periods were the norm. This helped the company get access to fresh produce at a better cost, and it helped suppliers realize better financial value for their products. 57 THE WAY AHEAD Although Metro C\&C continued its growth in the Indian market - engaging with regulators, customers, and suppliers profitability was still a concern for the company. While French heavyweight Carrefour SA had not been able to sustain its business in India and had quit the Indian market after running C&C operations in the country for less than four years, 58 Walmart, Metro C\&C's closest competitor in the country, was strengthening its base and had started e-commerce operations to expand its wholesale business. Ecommerce heavyweight Amazon.com Inc. had launched its wholesale Amazon Business platform in the country in 2017. 59 Amazon Business would offer convenience and efficiency to small retailers and other business customers through an online channel. How could Metro C \&C maintain its leadership position when challenged by other C \&C players as well as players in the large, unorganized GT wholesale business? How could it achieve profitability after 15 years of operation in the country? EXHIBIT 1: RETAIL INDUSTRY MARKET SIZE IN INDIA Note: P= projected. Source: Adapted by the case author from "Indian Retail Industry to Gain Momentum in 2017-18, "CRISIL Research, May 5 , 2017, accessed June 1, 2017, www.crisilresearch.com. EXHIBIT 2: TYPICAL FAST-MOVING CONSUMER GOODS VALUE CHAIN IN INDIA Source: Created by case author. EXHIBIT 3: CASH-AND-CARRY CUSTOMER SEGMENTS Notes: MT = modern trade; GT= general trade; SMEs = small and medium-sized enterprises. Source: Created by case author. EXHIBIT 4: KEY MODERN WHOLESALE PLAYERS IN INDIA Source: Compiled by case author based on data from "Metro Cash \& Carry India," Metro Cash \& Carry India, accessed July 15, 2019, www.metro.co.in/; "Overview," Walmart India, accessed March 15, 2019, ww. wal-martindia.in/about-us/ourbusiness; "Best Price Modern Wholesale," Best Price Modern Wholesale, accessed March 15, 2019, www.bestprice.in/pages/Overview/pgid-23713.aspx; ET Bureau, "Walmart Opens Its First India 'Dark Store' in Bhiwandi," The Economic Times, November 2, 2017 accessed 2019 , March https://economictimes.indiatimes.com/indstry/services/retail/walmart-opens-its-first-india-dark-store-inbhiwandilarticleshow/61427512.cms; "Booker Wholesale," Booker Wholesale, accessed March 15, 2019, http:Jlbookerindia.net/; Nivedita Mookerji, "UK's Cash \& Carry Plans 20 India Stores in 5 Yrs, "Business Standard, January 21, 2013, accessed March 16 2019, www.business-standard.com/article/companies/uk-s-cash-carry-plans-20-india-stores-in5-yrs-112030700046_1.html; "About Us," Aadhaar Wholesale Centre, accessed March 15, 2019, http:Ilaadhaarwholesale.com/aboutus.; "Aadhaar Retail SWOT Analysis, Competitors \& USP," MBA Skool, accessed May 28, 2019, www.mbaskool.com/brandguide/lifestyle-and-retail/5740-aadhaar-retail.html; PTI New Delhi, "Future Group Opens First 'Aadhaar Wholesale' Store," Business Line, October 17, 2011, accessed June 16, 2019, Www.thehindubusinessline.com/companies/future-group-opens-first-aadhaar-wholesale-store/article23053030.ece; "Reliance Market," Reliance Retail, accessed March 15, 2019, https://relianceretail.com/reliance-market.html. EXHIBIT 5: METRO CASH \& CARRY'S PRIVATE-LABEL PORTFOLIO Source: Created by the case author based on data from "Metro Cash \& Carry India," Metro Cash \& Carry India, accessed January 15, 2019, www.metro.co.in