Question: What problem do you see if overhead is allocated using direct labor hours as a cost driver for all departments? How much overhead would

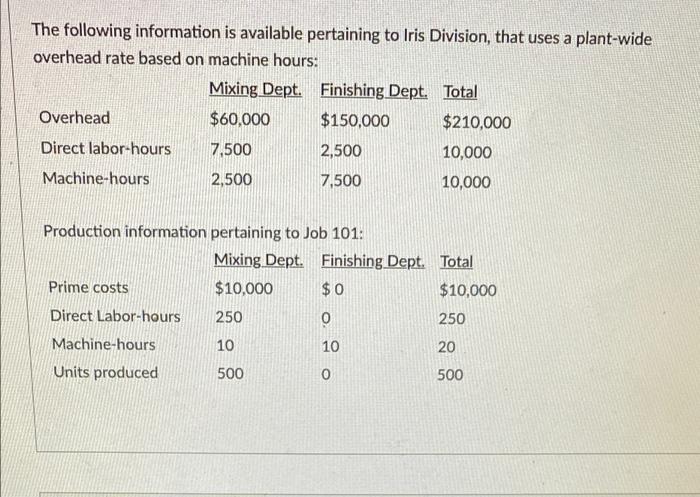

What problem do you see if overhead is allocated using direct labor hours as a cost driver for all departments? How much overhead would be charged to Job 101? The following information is available pertaining to Iris Division, that uses a plant-wide overhead rate based on machine hours: Mixing Dept. Finishing Dept. Total Overhead $60,000 $150,000 $210,000 Direct labor-hours 7,500 2,500 10,000 Machine-hours 2,500 7,500 10,000 Production information pertaining to Job 101: Mixing Dept. Finishing Dept. Total Prime costs $10,000 $0 $10,000 Direct Labor-hours 250 250 Machine-hours 10 10 20 Units produced 500 500

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Estimated annual overhead Plantwide overhe... View full answer

Get step-by-step solutions from verified subject matter experts