- What recommendations would you make to Amazon To address some of the challenges outlined in the case?

-

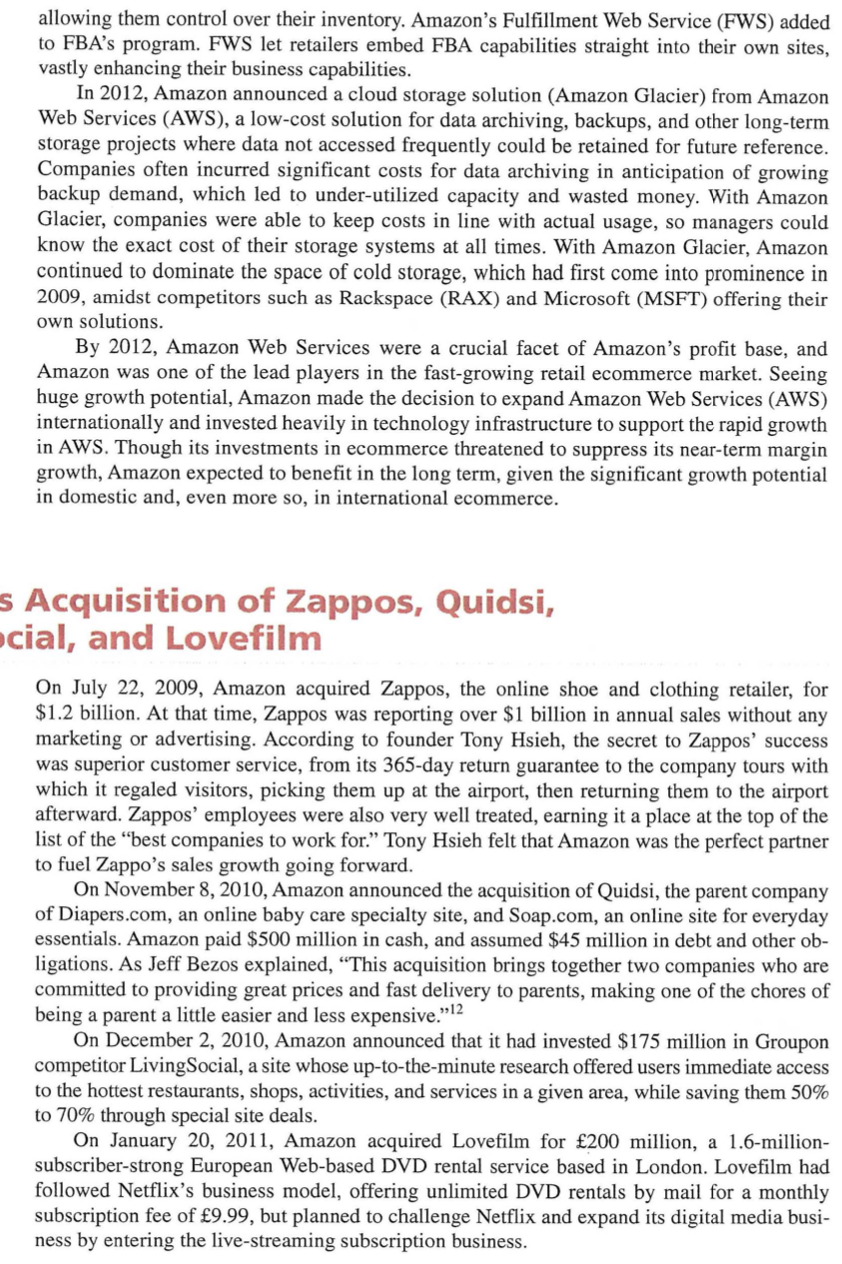

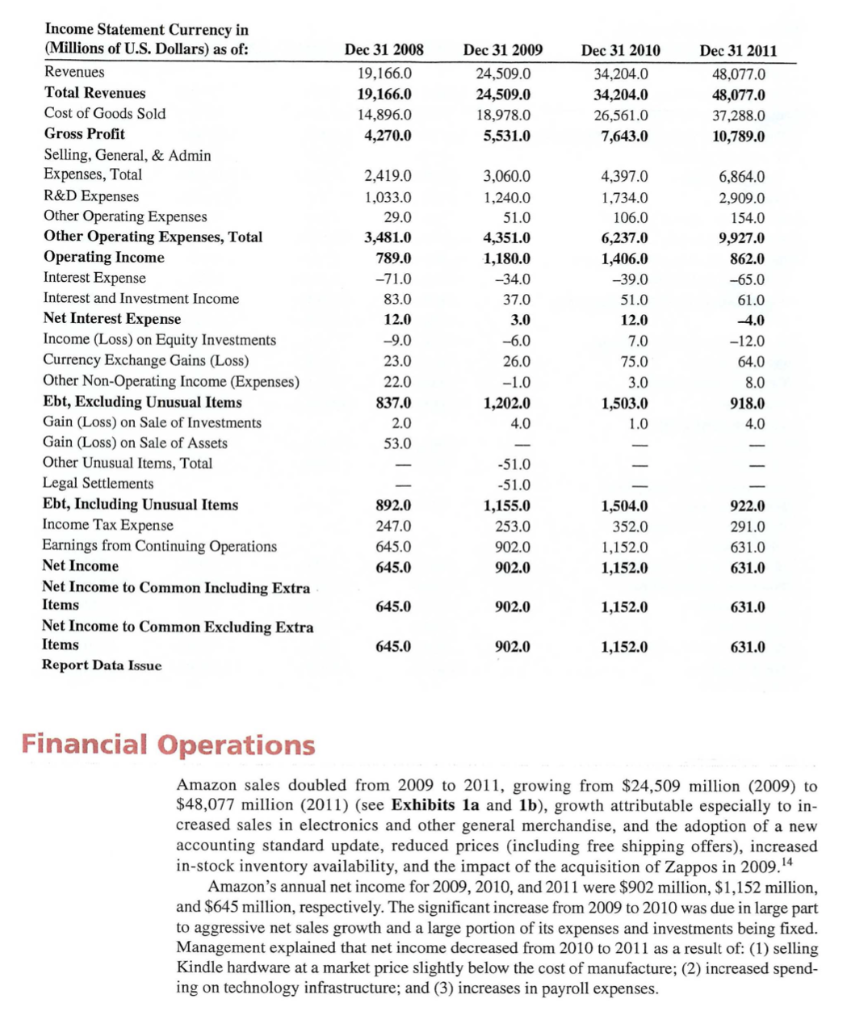

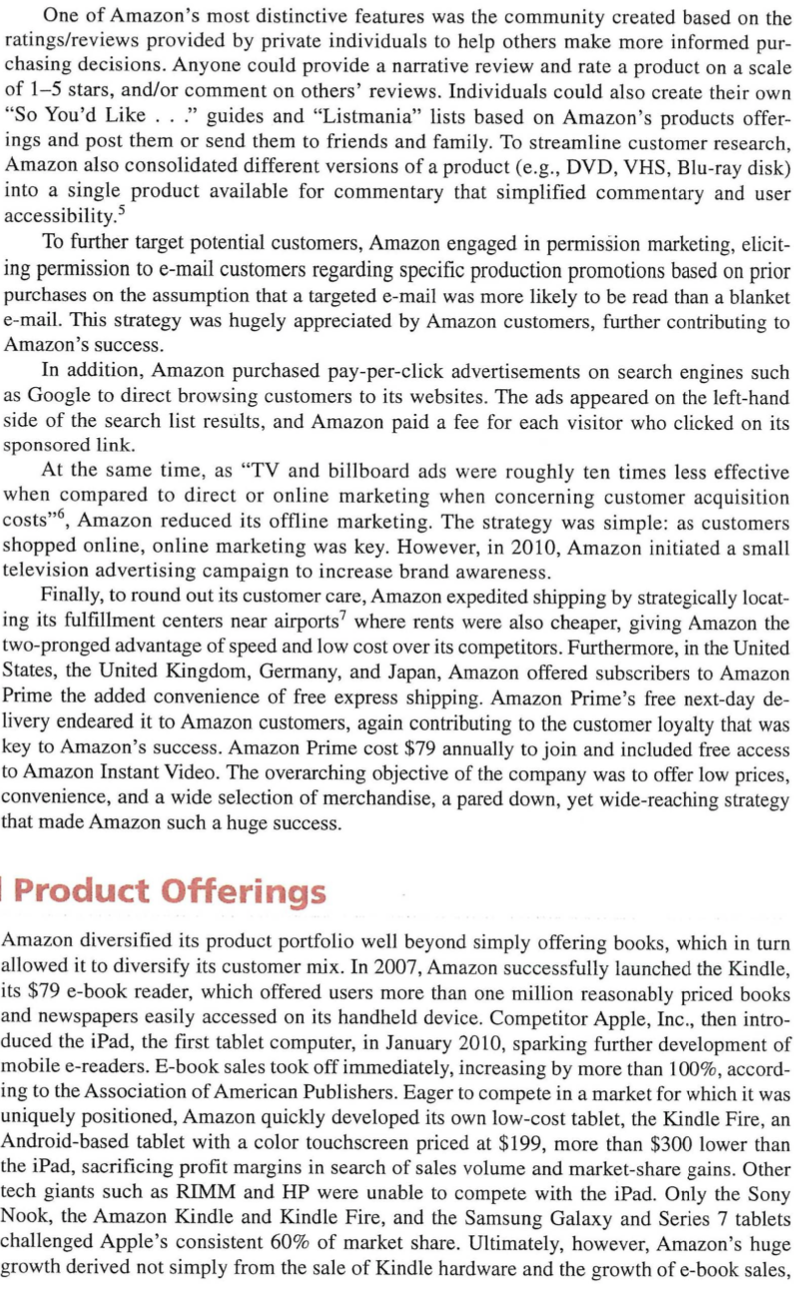

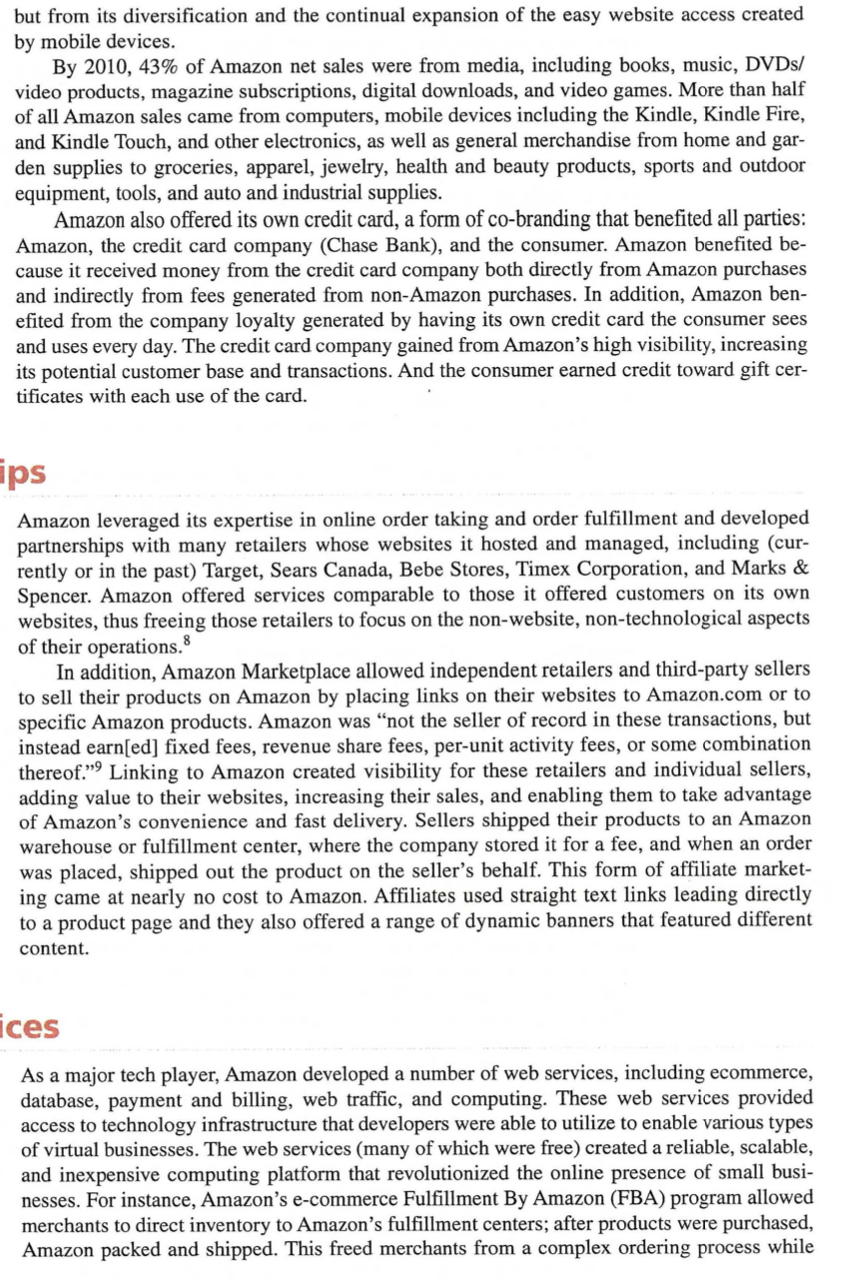

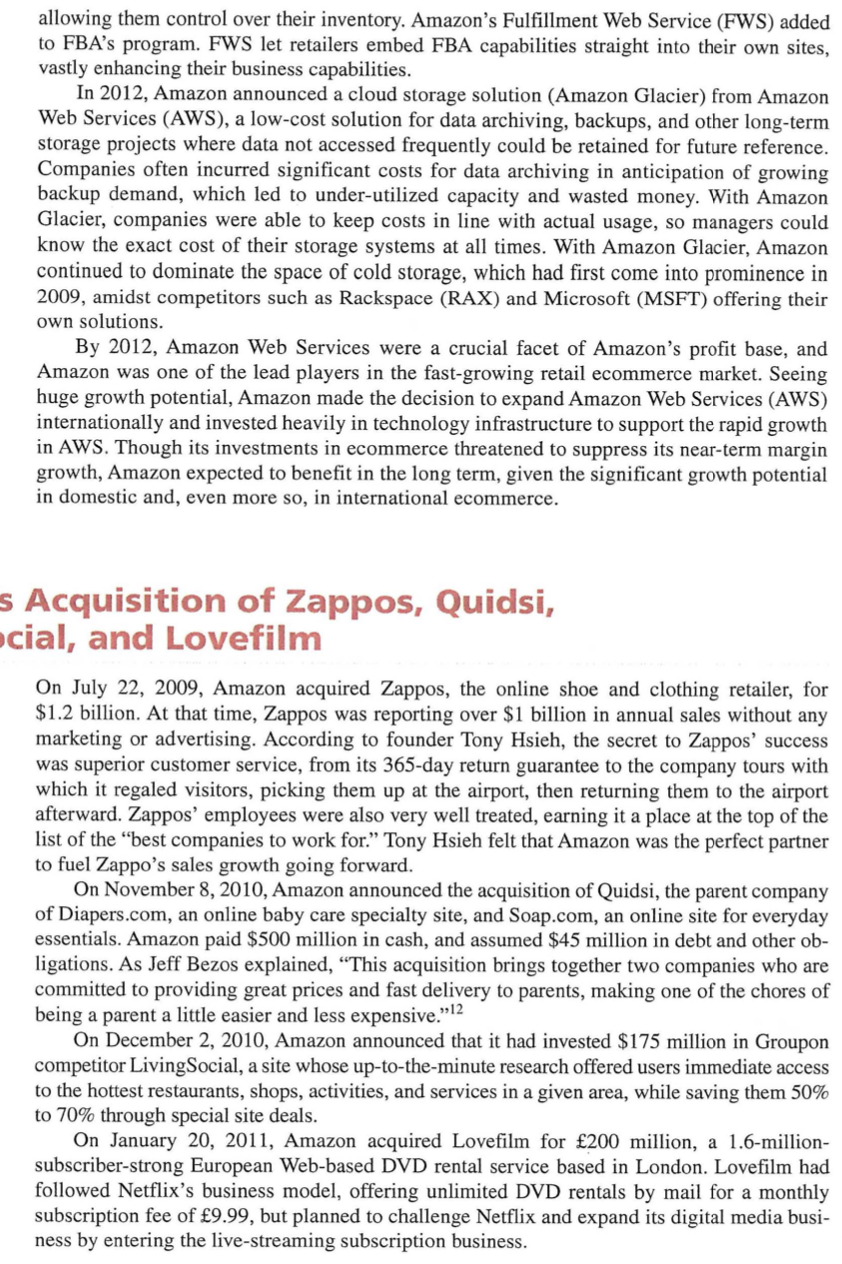

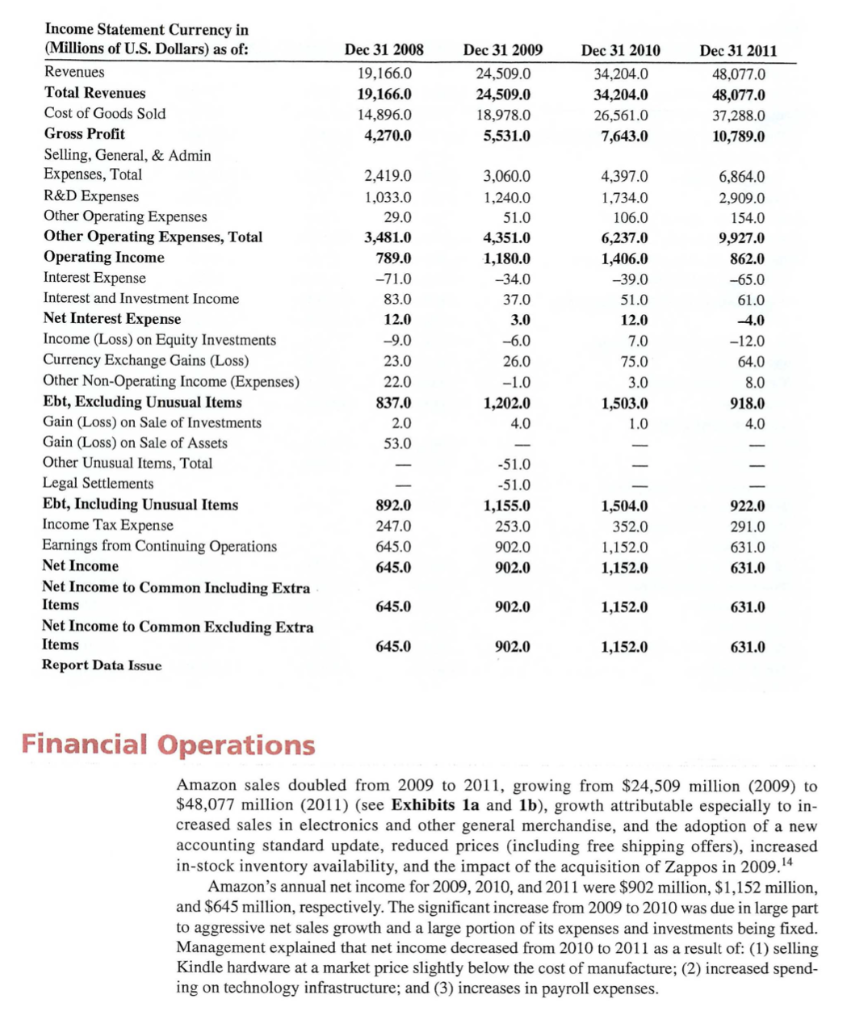

Founded by Jeff Bezos, online giant Amazon.com, Inc. (Amazon), was incorporated in the state of Washington in July, 1994, and sold its first book in July, 1995. In May 1997, Amazon (AMZN) completed its initial public offering and its common stock was listed on the NASDAQ Global Select Market. Amazon quickly grew from an on- line bookstore to the world's largest online retailer, greatly expanding its product and service offerings through a series of acquisitions, alliances, partnerships, and exclusivity agreements. Amazon's financial objective was to achieve long-term sustainable growth and profitability. To attain this objective, Amazon maintained a lean culture focused on increas- ing its operating income through continually increasing revenue and efficiently managing its working capital and capital expenditures, while tightly managing operating costs. The name Amazon was evocative for founder Jeff Bezos of his vision of Amazon as a huge natural phenomenon, like the longest river in the world. He envisioned the company to be the largest online marketplace on earth someday. By 2008, Amazon had become a global brand, with websites in Canada, the United Kingdom, Germany, France, China, and Japan, with order fulfillment in more than 200 countries. Its opera- tions were organized into two principal segments: North America and International Operations, which grew to include Italy in 2010 and Spain in 2011. By 2012, Amazon employed more than 56,200 people around the world working in the corporate office in Seattle, and in software devel- opment, order fulfillment, and customer service centers in North America, Latin America, Europe, and Asia. Amazon Corporate Governance Jeff Bezos is the Chairman of the Board and CEO of Amazon and owns 19.4% of the company. Amazon has three board committees of which two are standard: the audit commit- tee and the governance committee. The third committee, the Leadership Development and Compensation Committee, is uncommon. Most publicly traded companies have a compensation committee; however, it is unusual for the compensation committee to have leadership development as part of its mandate. The Leadership Development and Com- pensation Committee monitors and periodically assesses the continuity of capable man- agement, including succession plans for executive officers. Amazon's board is not populated by CEOs or retired CEOs. It includes several venture capitalists, a number of senior-level executives from varied industries, an eminent scientist, and a representative from the non-profit sector. Amazon's board has served together for a long time. This implies a deeper understanding of the company and increasing familiarity and even friendship amongst the group. This tends to discourage independent thinking and objectivity. All of it is further proof that Jeff Bezos is a strong CEO and runs the company. Retail Operations/Amazon's Superior Website As people became more comfortable shopping on line, Amazon developed its website to take advantage of increased Internet traffic and to serve its customers most effectively? The hall- marks of Amazon's appeal were ease of use; speedy, accurate search results; selection, price, and convenience; a trustworthy transaction environment; timely customer service; and fast, reliable fulfillmentall of it enabled by the sophisticated technology the company encouraged its employees to develop to better serve its customers. The site, which offered a huge array of products sold both by itself and by third parties, was particularly designed to create a person- alized shopping experience that helped customers discover new products and make efficient, informed buying decisions. Key to Amazon's success was continual website improvement. A huge part of the technological work done for Amazon was dedicated to identifying problems, developing solutions, and enhancing customers' online experience. Jacob Lepley, in his Amazon Marketing Strategy: Report One, notes that, when you visit Amazon ... you can use [it] to find just about any item on the market at an extremely low price. Amazon has made it very simple for customers to purchase items with a simple click of the mouse. . . . When you have everything you need, you make just one payment and your orders are processed."4 This simple system is the same whether a customer purchases directly from Amazon or from one of its associates. Pursuing perfection, Amazon was aggressive in analyzing its website's traffic and modi- fying the website accordingly. Amazon particularly excelled at customer tracking, collecting data from every visit to its website. Utilizing the information, Amazon then directed users to products that it surmised they might be interested in because the item was either related to a product that they had previously searched for or purchased by another Amazon customer looking for a similar product. Recommendations were also customized based on the information customers provided about themselves and their interests, and their ratings prior purchased. Amazon also collected data on those who had never visited any of its websites, but who had received gifts from those who had used the site. One of Amazon's most distinctive features was the community created based on the ratings/reviews provided by private individuals to help others make more informed pur- chasing decisions. Anyone could provide a narrative review and rate a product on a scale of 1-5 stars, and/or comment on others' reviews. Individuals could also create their own "So You'd Like ..." guides and "Listmania lists based on Amazon's products offer- ings and post them or send them to friends and family. To streamline customer research, Amazon also consolidated different versions of a product(e.g., DVD, VHS, Blu-ray disk) into a single product available for commentary that simplified commentary and user accessibility. To further target potential customers, Amazon engaged in permission marketing, elicit- ing permission to e-mail customers regarding specific production promotions based on prior purchases on the assumption that a targeted e-mail was more likely to be read than a blanket e-mail. This strategy was hugely appreciated by Amazon customers, further contributing to Amazon's success. In addition, Amazon purchased pay-per-click advertisements on search engines such as Google to direct browsing customers to its websites. The ads appeared on the left-hand side of the search list results, and Amazon paid a fee for each visitor who clicked on its sponsored link. At the same time, as "TV and billboard ads were roughly ten times less effective when compared to direct or online marketing when concerning customer acquisition costs6, Amazon reduced its offline marketing. The strategy was simple: as customers shopped online, online marketing was key. However, in 2010, Amazon initiated a small television advertising campaign to increase brand awareness. Finally, to round out its customer care, Amazon expedited shipping by strategically locat- ing its fulfillment centers near airports? where rents were also cheaper, giving Amazon the two-pronged advantage of speed and low cost over its competitors. Furthermore, in the United States, the United Kingdom, Germany, and Japan, Amazon offered subscribers to Amazon Prime the added convenience of free express shipping. Amazon Prime's free next-day de- livery endeared it to Amazon customers, again contributing to the customer loyalty that was key to Amazon's success. Amazon Prime cost $79 annually to join and included free access to Amazon Instant Video. The overarching objective of the company was to offer low prices, convenience, and a wide selection of merchandise, a pared down, yet wide-reaching strategy that made Amazon such a huge success. Product Offerings Amazon diversified its product portfolio well beyond simply offering books, which in turn allowed it to diversify its customer mix. In 2007, Amazon successfully launched the Kindle, its $79 e-book reader, which offered users more than one million reasonably priced books and newspapers easily accessed on its handheld device. Competitor Apple, Inc., then intro- duced the iPad, the first tablet computer, in January 2010, sparking further development of mobile e-readers. E-book sales took off immediately, increasing by more than 100%, accord- ing to the Association of American Publishers. Eager to compete in a market for which it was uniquely positioned, Amazon quickly developed its own low-cost tablet, the Kindle Fire, an Android-based tablet with a color touchscreen priced at $199, more than $300 lower than the iPad, sacrificing profit margins in search of sales volume and market-share gains. Other tech giants such as RIMM and HP were unable to compete with the iPad. Only the Sony Nook, the Amazon Kindle and Kindle Fire, and the Samsung Galaxy and Series 7 tablets challenged Apple's consistent 60% of market share. Ultimately, however, Amazon's huge growth derived not simply from the sale of Kindle hardware and the growth of e-book sales, but from its diversification and the continual expansion of the easy website access created by mobile devices. By 2010, 43% of Amazon net sales were from media, including books, music, DVDs/ video products, magazine subscriptions, digital downloads, and video games. More than half of all Amazon sales came from computers, mobile devices including the Kindle, Kindle Fire, and Kindle Touch, and other electronics, as well as general merchandise from home and gar- den supplies to groceries, apparel, jewelry, health and beauty products, sports and outdoor equipment, tools, and auto and industrial supplies. Amazon also offered its own credit card, a form of co-branding that benefited all parties: Amazon, the credit card company (Chase Bank), and the consumer. Amazon benefited be- cause it received money from the credit card company both directly from Amazon purchases and indirectly from fees generated from non-Amazon purchases. In addition, Amazon ben- efited from the company loyalty generated by having its own credit card the consumer sees and uses every day. The credit card company gained from Amazon's high visibility, increasing its potential customer base and transactions. And the consumer earned credit toward gift cer- tificates with each use of the card. ips Amazon leveraged its expertise in online order taking and order fulfillment and developed partnerships with many retailers whose websites it hosted and managed, including (cur- rently or in the past) Target, Sears Canada, Bebe Stores, Timex Corporation, and Marks & Spencer. Amazon offered services comparable to those it offered customers on its own websites, thus freeing those retailers to focus on the non-website, non-technological aspects of their operations. In addition, Amazon Marketplace allowed independent retailers and third-party sellers to sell their products on Amazon by placing links on their websites to Amazon.com or to specific Amazon products. Amazon was not the seller of record in these transactions, but instead earn[ed] fixed fees, revenue share fees, per-unit activity fees, or some combination thereof."! Linking to Amazon created visibility for these retailers and individual sellers, adding value to their websites, increasing their sales, and enabling them to take advantage of Amazon's convenience and fast delivery. Sellers shipped their products to an Amazon warehouse or fulfillment center, where the company stored it for a fee, and when an order was placed, shipped out the product on the seller's behalf. This form of affiliate market- ing came at nearly no cost to Amazon. Affiliates used straight text links leading directly to a product page and they also offered a range of dynamic banners that featured different content. ices As a major tech player, Amazon developed a number of web services, including ecommerce, database, payment and billing, web traffic, and computing. These web services provided access to technology infrastructure that developers were able to utilize to enable various types of virtual businesses. The web services (many of which were free) created a reliable, scalable, and inexpensive computing platform that revolutionized the online presence of small busi- nesses. For instance, Amazon's e-commerce Fulfillment By Amazon (FBA) program allowed merchants to direct inventory to Amazon's fulfillment centers; after products were purchased, Amazon packed and shipped. This freed merchants from a complex ordering process while allowing them control over their inventory. Amazon's Fulfillment Web Service (FWS) added to FBA's program. FWS let retailers embed FBA capabilities straight into their own sites, vastly enhancing their business capabilities. In 2012, Amazon announced a cloud storage solution (Amazon Glacier) from Amazon Web Services (AWS), a low-cost solution for data archiving, backups, and other long-term storage projects where data not accessed frequently could be retained for future reference. Companies often incurred significant costs for data archiving in anticipation of growing backup demand, which led to under-utilized capacity and wasted money. With Amazon Glacier, companies were able to keep costs in line with actual usage, so managers could know the exact cost of their storage systems at all times. With Amazon Glacier, Amazon continued to dominate the space of cold storage, which had first come into prominence in 2009, amidst competitors such as Rackspace (RAX) and Microsoft (MSFT) offering their own solutions. By 2012, Amazon Web Services were a crucial facet of Amazon's profit base, and Amazon was one of the lead players in the fast-growing retail ecommerce market. Seeing huge growth potential, Amazon made the decision to expand Amazon Web Services (AWS) internationally and invested heavily in technology infrastructure to support the rapid growth in AWS. Though its investments in ecommerce threatened to suppress its near-term margin growth, Amazon expected to benefit in the long term, given the significant growth potential in domestic and, even more so, in international ecommerce. s Acquisition of Zappos, Quidsi, cial, and Lovefilm On July 22, 2009, Amazon acquired Zappos, the online shoe and clothing retailer, for $1.2 billion. At that time, Zappos was reporting over $1 billion in annual sales without any marketing or advertising. According to founder Tony Hsieh, the secret to Zappos' success was superior customer service, from its 365-day return guarantee to the company tours with which it regaled visitors, picking them up at the airport, then returning them to the airport afterward. Zappos' employees were also very well treated, earning it a place at the top of the list of the best companies to work for. Tony Hsieh felt that Amazon was the perfect partner to fuel Zappo's sales growth going forward. On November 8, 2010, Amazon announced the acquisition of Quidsi, the parent company of Diapers.com, an online baby care specialty site, and Soap.com, an online site for everyday essentials. Amazon paid $500 million in cash, and assumed $45 million in debt and other ob- ligations. As Jeff Bezos explained, This acquisition brings together two companies who are committed to providing great prices and fast delivery to parents, making one of the chores of being a parent a little easier and less expensive.:12 On December 2, 2010, Amazon announced that it had invested $175 million in Groupon competitor LivingSocial, a site whose up-to-the-minute research offered users immediate access to the hottest restaurants, shops, activities, and services in a given area, while saving them 50% to 70% through special site deals. On January 20, 2011, Amazon acquired Lovefilm for 200 million, a 1.6-million- subscriber-strong European Web-based DVD rental service based in London. Lovefilm had followed Netflix's business model, offering unlimited DVD rentals by mail for a monthly subscription fee of 9.99, but planned to challenge Netflix and expand its digital media busi- ness by entering the live-streaming subscription business. Dec 31 2008 19,166.0 19,166.0 14,896.0 4,270.0 Dec 31 2009 24,509.0 24,509.0 18,978.0 5,531.0 Dec 31 2010 34,204.0 34,204.0 26,561.0 7,643.0 Dec 31 2011 48,077.0 48,077.0 37,288.0 10,789.0 2,419.0 1,033.0 29.0 4,397.0 1,734.0 106.0 6,237.0 1,406.0 -39.0 51.0 3,060.0 1,240.0 51.0 4,351.0 1,180.0 -34.0 37.0 3.0 -6.0 26.0 -1.0 1,202.0 4.0 6,864.0 2,909.0 154.0 9,927.0 862.0 -65.0 61.0 12.0 Income Statement Currency in (Millions of U.S. Dollars) as of: Revenues Total Revenues Cost of Goods Sold Gross Profit Selling, General, & Admin Expenses, Total R&D Expenses Other Operating Expenses Other Operating Expenses, Total Operating Income Interest Expense Interest and Investment Income Net Interest Expense Income (Loss) on Equity Investments Currency Exchange Gains (Loss) Other Non-Operating Income (Expenses) Ebt, Excluding Unusual Items Gain (Loss) on Sale of Investments Gain (Loss) on Sale of Assets ther Unusual Items, Tot Legal Settlements Ebt, Including Unusual Items Income Tax Expense Earnings from Continuing Operations Net Income Net Income to Common Including Extra Items Net Income to Common Excluding Extra Items Report Data Issue -4.0 3,481.0 789.0 -71.0 83.0 12.0 -9.0 23.0 22.0 837.0 2.0 53.0 7.0 75.0 3.0 1,503.0 1.0 -12.0 64.0 8.0 918.0 4.0 892.0 247.0 645.0 645.0 -51.0 -51.0 1,155.0 253.0 902.0 902.0 1,504.0 352.0 1,152.0 1,152.0 922.0 291.0 631.0 631.0 645.0 902.0 1,152.0 631.0 645.0 902.0 1,152.0 631.0 Financial Operations Amazon sales doubled from 2009 to 2011, growing from $24,509 million (2009) to $48,077 million (2011) (see Exhibits la and 1b), growth attributable especially to in- creased sales in electronics and other general merchandise, and the adoption of a new accounting standard update, reduced prices (including free shipping offers), increased in-stock inventory availability, and the impact of the acquisition of Zappos in 2009.14 Amazon's annual net income for 2009, 2010, and 2011 were $902 million, $1,152 million, and $645 million, respectively. The significant increase from 2009 to 2010 was due in large part to aggressive net sales growth and a large portion of its expenses and investments being fixed. Management explained that net income decreased from 2010 to 2011 as a result of: (1) selling Kindle hardware at a market price slightly below the cost of manufacture; (2) increased spend- ing on technology infrastructure; and (3) increases in payroll expenses