Question: what should be compare to know if should be Call or Put/call or short/ vega, tetha, gama and so on. Explain this exercise in detail.

what should be compare to know if should be Call or Put/call or short/ vega, tetha, gama and so on. Explain this exercise in detail.

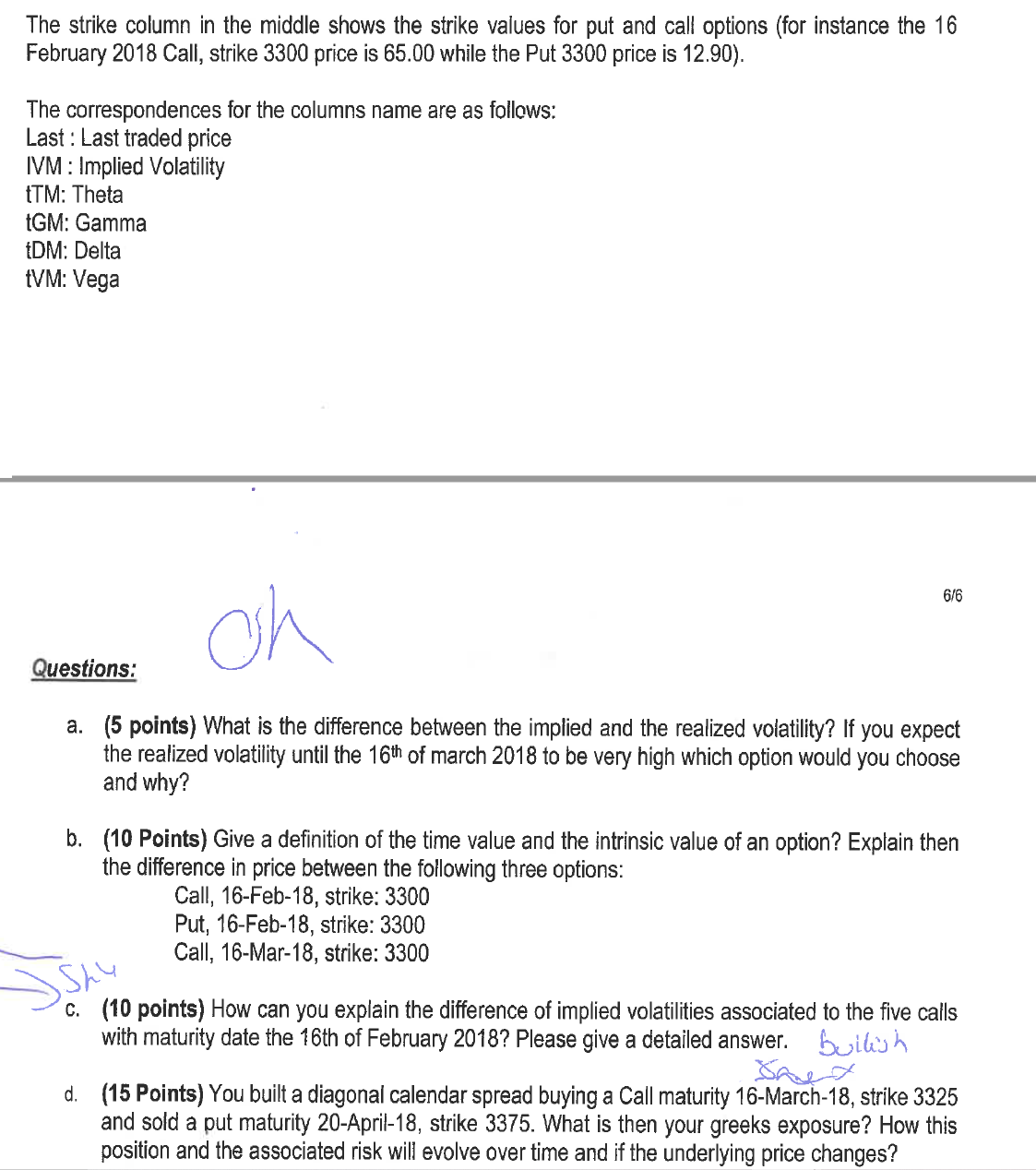

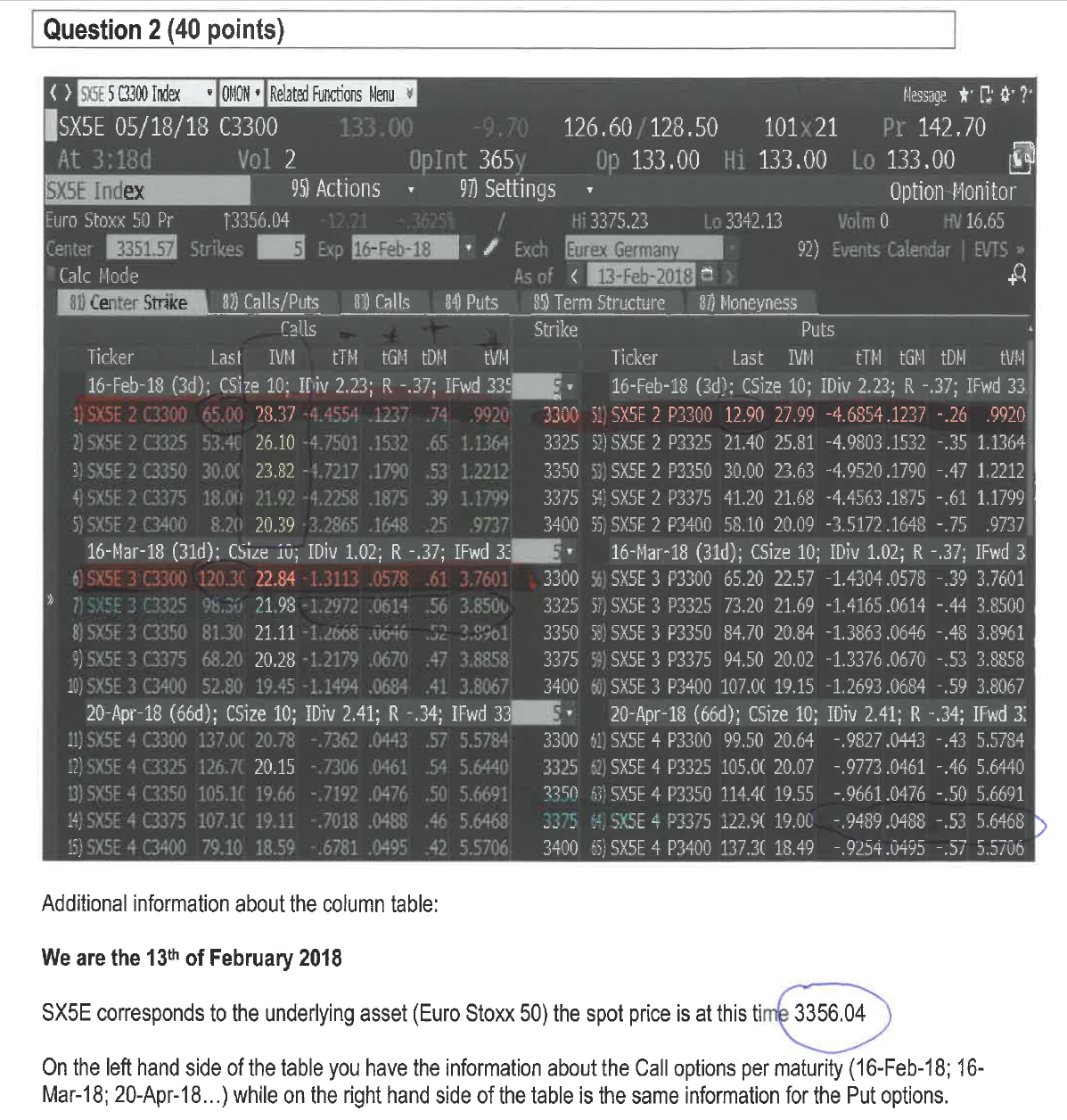

The strike column in the middle shows the strike values for put and call options (for instance the 16 February 2018 Call, strike 3300 price is 65.00 while the Put 3300 price is 12.90). The correspondences for the columns name are as follows: Last: Last traded price IVM: Implied Volatility tTM: Theta tGM: Gamma tDM: Delta tVM: Vega oh Questions: a. (5 points) What is the difference between the implied and the realized volatility? If you expect the realized volatility until the 16th of march 2018 to be very high which option would you choose and why? 6/6 b. (10 Points) Give a definition of the time value and the intrinsic value of an option? Explain then the difference in price between the following three options: Call, 16-Feb-18, strike: 3300 Put, 16-Feb-18, strike: 3300 Call, 16-Mar-18, strike: 3300 c. (10 points) How can you explain the difference of implied volatilities associated to the five calls with maturity date the 16th of February 2018? Please give a detailed answer. bullish SAL d. (15 Points) You built a diagonal calendar spread buying a Call maturity 16-March-18, strike 3325 and sold a put maturity 20-April-18, strike 3375. What is then your greeks exposure? How this position and the associated risk will evolve over time and if the underlying price changes? The strike column in the middle shows the strike values for put and call options (for instance the 16 February 2018 Call, strike 3300 price is 65.00 while the Put 3300 price is 12.90). The correspondences for the columns name are as follows: Last: Last traded price IVM: Implied Volatility tTM: Theta tGM: Gamma tDM: Delta tVM: Vega oh Questions: a. (5 points) What is the difference between the implied and the realized volatility? If you expect the realized volatility until the 16th of march 2018 to be very high which option would you choose and why? 6/6 b. (10 Points) Give a definition of the time value and the intrinsic value of an option? Explain then the difference in price between the following three options: Call, 16-Feb-18, strike: 3300 Put, 16-Feb-18, strike: 3300 Call, 16-Mar-18, strike: 3300 c. (10 points) How can you explain the difference of implied volatilities associated to the five calls with maturity date the 16th of February 2018? Please give a detailed answer. bullish SAL d. (15 Points) You built a diagonal calendar spread buying a Call maturity 16-March-18, strike 3325 and sold a put maturity 20-April-18, strike 3375. What is then your greeks exposure? How this position and the associated risk will evolve over time and if the underlying price changes?

Step by Step Solution

3.35 Rating (136 Votes )

There are 3 Steps involved in it

a Difference between Implied and Realized Volatility Implied Volatility IV is the markets expectation of future price volatility derived from option p... View full answer

Get step-by-step solutions from verified subject matter experts