what should prada do, borrow money or do an IPO?and why prada chooses hong kong?

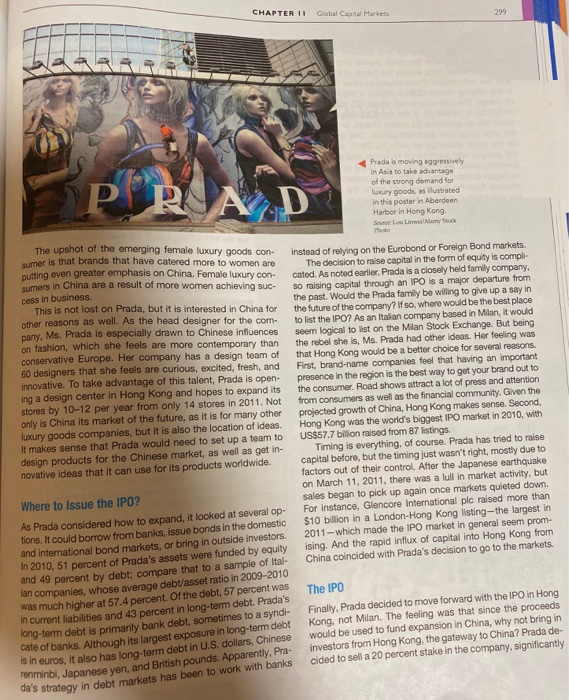

CASE Does the Devil Really Wear Prada? Probably not, but the Italian Prada Group, clearly one of the top luxury businesses in the world, is designing, pro- ducing, and distributing luxury handbags, leather goods footwear, ready-to-wear apparel accessories, evewear and fragrances all over the world 56 It operates in 70 countries through 618 directly operated stores and se lected, high-end multi-brand stores and luxury depart- ment stores. Prada is a closely held firm in which the Prada family-led by Miuccia Prada, president and head designer, and her hus band, CEO Patrizio Borteli-holds 80 percent of the shares with Italian bank Intesa Sanpaolo holding the rest. When Ber- tell and Prada realized that the future of luxury consumption would be in Asia, they had to decide how they were going to fund their expansion. Due to a string of debt-financed acou sitions in the early 2000s, Prada ran into liquidity problems and had to tum to Intesa for funding. Intesa purchased the 5 percent interest in the company in 2006 for 100 million which put a valuation on Prada of 62 billion at the time. They had considered an IPO in 2001 and 2008, but the collapse in global stock markets both times forced them to pull back However, 2011 seemed like a good time. Issuing stock to out. Side investors would bring in new money, but it would also force Prada to deal with nonfamily shareholders and the finan- cial discipline of the market. Also, they had to figure out where to issue the IPO and how much of the company they should soll. Should they list on the Milan Stock Exchange, as they were being advised by nearly everyone in Italy? Or should they become the first Italian company to list in Hong Kong, where they could be closer to the future growth markets in China? businesses such as Church's Group and Car Shodland bering into consing and joint venture agreements with it an eyewear manufacturer Luxottica and Spanish cosmetic manufacturer PUIG Beauty & Fashion Group. With these quisitions, Prada expanded its product lines and openede stores, it even launched a new phone by LG of South Korea In 2010, Prada was basically a European company rating nearly half of its revenues from Europe, including 195 percent from Italy. However, percent from Italy. However, the importance of Asia was panding. By 2012. European revenues were 22.7 percent cluding 16.2 percent from Italy, but Asia-Pacific exclude Japan rose to 35.6 of total revenues. In spite of its accu tions, the Prada brand still counted for nearly 80 percent the company's global revenues. The Asia-Pacific area had the highest growth rate of all geographic areas in which Praca was operating, benefitting from organic growth rather than acquisitions. Prada opened 17 new stores in the region and did a lot of work upgrading existing stores. Who Is Prada? Prada began in 1913 when Mario Prada opened a luxury store in the Galleria Vittorio Emanuele II in Milan Prada quickly built a strong reputation in luxury goods due to its exclusive designs, superior manufacturing techniques, and high-quality materials. By 1919, Prada had become an off cial supplier to the Italian Royal Family and a benchmark for fashion throughout Europe. At the end of the 1970s, Mario's great-granddaughter, Miuccia Prada, entered into a partnership with Patrizio Bertelli, a Tuscan businessman who was involved in high- quality leather goods. Initially. Bertelli's company, L.P. I SpA, had an exclusive license to produce and distribute leather goods using the Prada name, but in 2003 L.P.I. SpA and Prada merged into Prada SpA. (SpA-Societ per An- zioni -- is the same as "corporation in the United States or plc in the U.K.) In the 1990s and early 2000s, Prada began to expand by launching new brands (such as Miu Miu), acquiring new Why China? The lucury goods market, of which Prada is a members hard to define. It is typically composed of goods that are high-priced, high-quality, and high-status. Some of the oth- er largest lucury goods firms in the world are French-based LVMH, Christian Dior (which holds 42 percent of LVMH. PPR (which includes Gucci and Yves Saint Laurent), and Richemont (which includes Cartier, Chloe, and Alfred Dunhil, and has a JV with Polo Ralph Lauren). Of course, there are also lucury goods firms in many industries, such as fashion, automobiles, watches and jewelry, and drinks. It is clear, however, that Asia, especially China, is rapidly becoming the future of the luxury goods industry. In addition to having the largest population in the world, China is now the world's second-largest economy and grow- ing at a faster rate than any of the advanced countries and the rest of the BRICs. There are several reasons why China is becoming the target of the luxury goods markets. The country is expected to be the largest luxury market in the world by 2020, catering to both men and women. Until recently, the market in China was driven by men, but women are becoming increasingly important. Maserati SpA and Bulgari SpA have been successful in China because they have positioned ther- s elves as the ultimate male status symbols. Much of the luxury goods purchases were by men for women, but now women are starting to assert themselves as consumers. In 2009, for example, 30 percent of Maserati's sales were to women, up from 7 percent in 2005. In the broader luxury market sales, women accounted for over half of the $15 billion in sales compared with 45 percent in 2008. Also, the average female luxury consumer spent 22 percent more in 2010 than in 2006 CHAPTER II Global Capital Markets Prada is moving aggressively in Asia to take advantage of the strong demand for luxury goods, as ilustrated In this poster in Aberdeen Harbor in Hong Kong Sur Loire Alarmy Stock The upshot of the emerging female luxury code con sumer is that brands that have catered more to women are putting even greater emphasis on China. Female luxury con- Gumers in China are a result of more women achieving suc- cess in business. This is not lost on Prada, but it is interested in China for other reasons as well. As the head designer for the come pany, Ms. Prada is especially drawn to Chinese influences on fashion, which she feels are more contemporary than conservative Europe. Her company has a design team of 60 designers that she feels are curious, excited, fresh, and Innovative. To take advantage of this talent, Prada is open ing a design center in Hong Kong and hopes to expand its stores by 10-12 per year from only 14 stores in 2011. Not only is China its market of the future, as it is for many other luxury goods companies, but it is also the location of ideas. It makes sense that Prada would need to set up a team to design products for the Chinese market, as well as get in- novative ideas that it can use for its products worldwide. intend of min on the Eurobond or Foreign Bond markets. The decision to raise capital in the form of equity is compli- cated. As noted earlier, Prada is a closely held family company, so raising capital through an IPO is a major departure from the past. Would the Prada family be willing to give up a say in the future of the company? If so, where would be the best place to list the IPO2 As an Italian company based in Milan, it would seem logical to list on the Milan Stock Exchange. But being the rebel she is, Ms. Prada had other ideas. Her feeling was that Hong Kong would be a better choice for several reasons. First, brand-name companies feel that having an important presence in the region is the best way to get your brand out to the consumer. Road shows attract a lot of press and attention from consumers as well as the financial community. Given the projected growth of China, Hong Kong makes sense. Second, Hong Kong was the world's biggest IPO market in 2010, with US$57.7 bilion raised from 87 listings. Timing is everything, of course. Prada has tried to raise capital before, but the timing just wasn't right, mostly due to factors out of their control. After the Japanese earthquake on March 11, 2011, there was a lull in market activity, but sales began to pick up again once markets quieted down. For instance, Glencore International plc raised more than $10 billion in a London-Hong Kong listing--the largest in 2011-which made the IPO market in general seem prom- ising. And the rapid influx of capital into Hong Kong from China coincided with Prada's decision to go to the markets. Where to issue the IPO? As Prada considered how to expand, it looked at several op tions. It could borrow from banks, issue bonds in the domestic and international bond markets, or bring in outside investors. In 2010, 51 percent of Prada's assets were funded by equity and 49 percent by debt: compare that to a sample of Ital lan companies, whose average debt/asset ratio in 2009-2010 was much higher at 57.4 percent. Of the debt, 57 percent was In current liabilities and 43 percent in long-term debt. Prada's long-term debt is primarily bank debt, sometimes to a syndi- cate of banks. Although its largest exposure in long-term debt is in euros, it also has long-term debt in U.S. dollars, Chinese renminbi, Japanese yen, and British pounds. Apparently, Pra- da's strategy in debt markets has been to work with banks ational bond peda's ass what to a sa 2009-2010 pe by debt: com dept/asset 57 percent meanies, W 7 A percento long-term sto a syno sales and bank debt. in long Chinese The IPO Finally, Pradaian. The teelmansion in C Finally, Prada decided to move forward with the IPO in Hong Kong, not Milan. The feeling was that since the proceeds would be used to fund expansion in China, why not bring in investors from Hong Kong, the gateway to China? Prada de- cided to sell a 20 percent stake in the company, significantly 300 PART 4 World Financial Environment A s we moved into 2016, Prada has suffered for a var of reasons. Persistent weakness in Hong Kong has really Prada sales. Tighter visa restrictions on Chinese shop who looked to Hong Kong as the place to shop pushed an of Chinese shoppers to Europe. However, the terrorist attack in Paris dramatically reduced the flow of Chinese tourists to Europe. The economic slowdown in China coupled with a rin in the Hong Kong dollar which is pegged to the United States also hurt the sales of Prada and other luxury brands. Wii China ever come back to the point that Prada will be as su cessful as it anticipated when it offered its IPO in Hong Kong changing its ownership structure. But Ms. Prada knew it was the right move. Friends and advisors convinced her that in some respects the stock market and the discipline it imposes would help ensure the future of Prada and help with the succession Prada hoped to raise 20 billion HK$ in the offering (about US$2.6 billion), a significant amount of money. The goal was to sell about 423 million shares at HK$36.50 to HK$48.00. If the demand were strong, Prada could sell an additional 63 million shares, or 15 percent of the offer on an over-allotment option. That goal was to list on the stock exchange on June 24, 2011, after beginning the process with institutional investors and then the wider investing public. As Prada got closer to the listing date, prica es began to move down a little due to uncertainty in global markets from the European debt crisis, the U.S. debt cri- sis, and inflation in China, Prada adjusted its target price to consumers to a range of HK$39.50 to HK$42.25 per share (US$5.07 to US$5.42). This would put its value at 22.8 to 24.4 times 2011 expected earnings, which is still higher than LVMH, which trades at 20.1 times earnings. Pricing is clearly better in Hong Kong than elsewhere. When the stock finally hit the exchange, retail inves- tors didn't come into the market as much as anticipated, and Prada wasn't able to sell all of the shares allotted to investors. In addition, prices didn't really jump all that much initially. Within about two weeks, however, prices were up 13 percent over their HK$39.50 IPO price, or HK$44.64. QUESTIONS 11-3. Do you agree with the decision to list an IPO, or should Prada have borrowed more money, possibly floating a dim sum bond or a Eurobond in London or elsewhere? 11-4. What do you feel are the best justifications for Prada to is. sue the IPO in Hong Kong? Are there any downsides to their decision to list in Hong Kong? 11-5. Many of the other luxury fashion companies are also largely family owned. What is the impact to Prada of diluting the family ownership, and is this a model that other companies can be expected to follow? 11-6. Given the downturn in the economy in Hong Kong and China. what do you think Prada's future is in the region? MvManagementLab