Question: What to do The students are required to take single 3 stocks and develop the hypothetical options and forward contract and evaluate different trading strategies

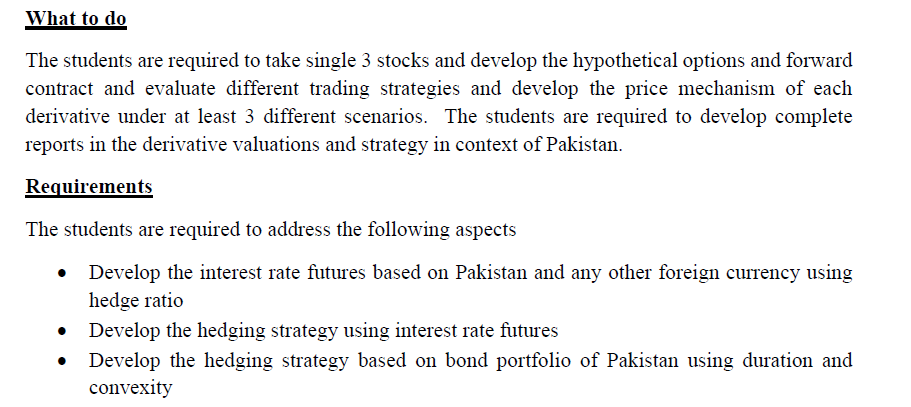

What to do The students are required to take single 3 stocks and develop the hypothetical options and forward contract and evaluate different trading strategies and develop the price mechanism of each derivative under at least 3 different scenarios. The students are required to develop complete reports in the derivative valuations and strategy in context of Pakistan. Requirements The students are required to address the following aspects Develop the interest rate futures based on Pakistan and any other foreign currency using hedge ratio Develop the hedging strategy using interest rate futures Develop the hedging strategy based on bond portfolio of Pakistan using duration and convexity What to do The students are required to take single 3 stocks and develop the hypothetical options and forward contract and evaluate different trading strategies and develop the price mechanism of each derivative under at least 3 different scenarios. The students are required to develop complete reports in the derivative valuations and strategy in context of Pakistan. Requirements The students are required to address the following aspects Develop the interest rate futures based on Pakistan and any other foreign currency using hedge ratio Develop the hedging strategy using interest rate futures Develop the hedging strategy based on bond portfolio of Pakistan using duration and convexity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts