Question: What trends do you see? How does YTM change when prices change? Why? How does YTM change when coupon frequency changes? Why? Cakulation YTM using

What trends do you see? How does YTM change when prices change? Why? How does YTM change when coupon frequency changes? Why?

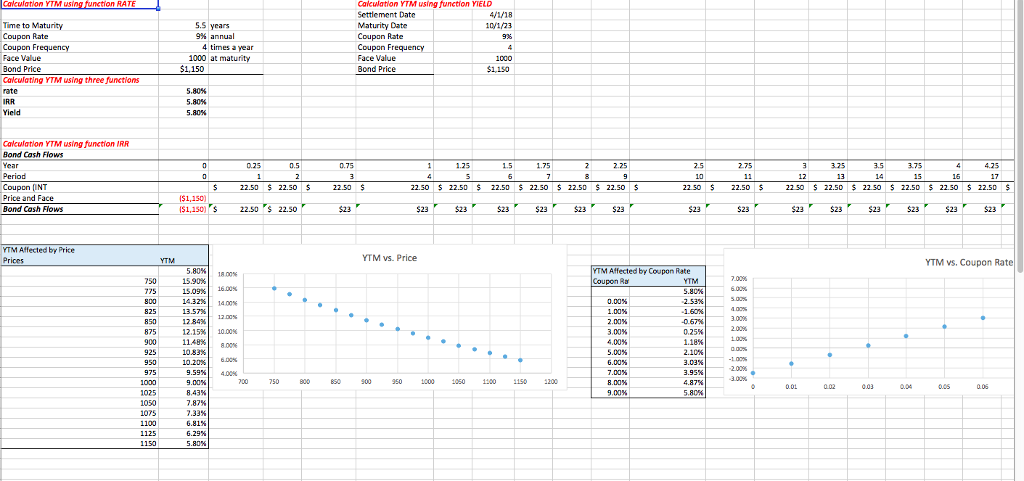

Cakulation YTM using function RAT Cakwation YTM using function YIELD Settlement Date Maturity Date oupon Rate Coupon Fre Face Value Bond Price Coupon Rate 9% annual 4 times a year 1000 at Calculating YTM using three functions Calculation YTM using function IRR 0.25 .5 0.75 2.25 2.75 3.75 16 22 50$ 22.50 $ Coupon INT Price and Face Bond Cash Flows 22.50 22.50 $ 22.50 S 22.50 22.50 $22.5022.50 22.50 22.50 S 22 50 22.50 22 50 22.50 22.50 22.50 $1,150 ($1,150) ' $ S22.50 22.50 $23 $23 YTM Alfected by Price YTM vs. Price YTM vs. Coupon Rate Affected by Coupon Rate L000 1050 100 150200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts