Question: What us the LIFO ? I am having difficulty remembering. Lopez Company reported the following current-year data for its only product. The company uses a

What us the LIFO? I am having difficulty remembering.

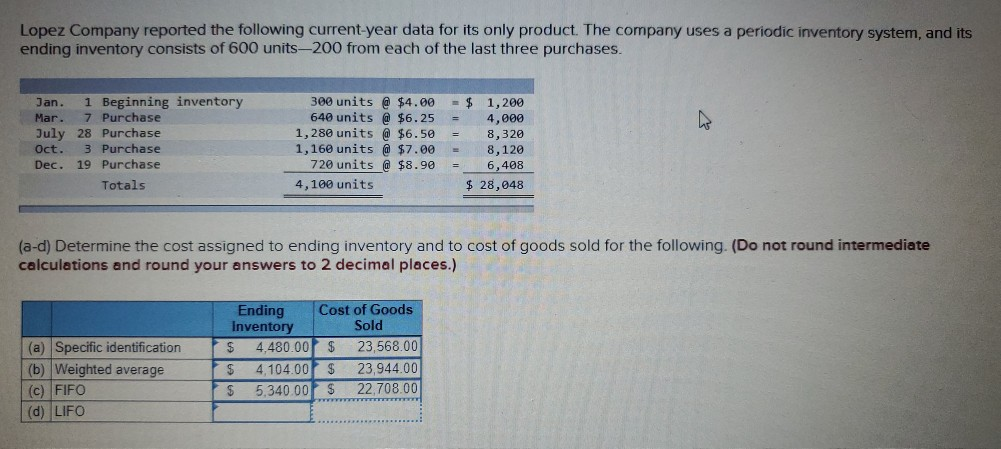

Lopez Company reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 600 units-200 from each of the last three purchases. = Jan 1 Beginning inventory Mar. 7 Purchase July 28 Purchase Oct. 3 Purchase Dec. 19 Purchase Totals 300 units @ $4.00 640 units @ $6.25 1,280 units @ $6.50 1,160 units @ $7.00 720 units @ $8.90 4,100 units $ 1,200 = 4,000 8,320 8,120 6,408 $ 28,048 (a-d) Determine the cost assigned to ending inventory and to cost of goods sold for the following. (Do not round intermediate calculations and round your answers to 2 decimal places.) (a) Specific identification (b) Weighted average (c) FIFO (d) LIFO Ending Cost of Goods Inventory Sold $ 4.480.00 $ 23,568.00 $ 4,104.00 $ 23,944.00 $ 5.340.00 $ 22,708.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts