Question: What was the holding return for RM for the year 2022? b) If the expected market risk premium on the market portfolio is 6%,

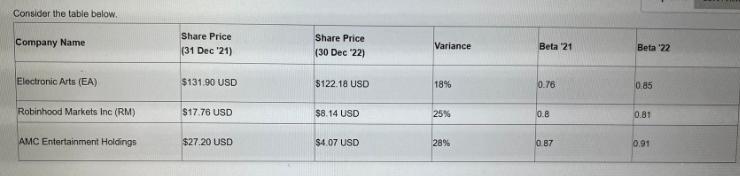

What was the holding return for RM for the year 2022? b) If the expected market risk premium on the market portfolio is 6%, estimate the expected return of the three stocks using the average beta of '21 and 22. The yield of a 10-year US government bond is 1.5%. c) Explain the difference in your findings for RM in question a) and b) d) All the three companies are in a similar sector. If you invested in these three stocks only, what would that mean for the unsystematic and systematic risk exposure of your portfolio? How could you decrease both risks?

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

a Determine the holding return for RM Robinhood Markets Inc for the year 2022 Based on the provided information the share price of RM on December 31 2... View full answer

Get step-by-step solutions from verified subject matter experts