Question: What would a financial statement analysis for Coca-Cola 2022 look like? December 31, Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents

What would a financial statement analysis for Coca-Cola 2022 look like?

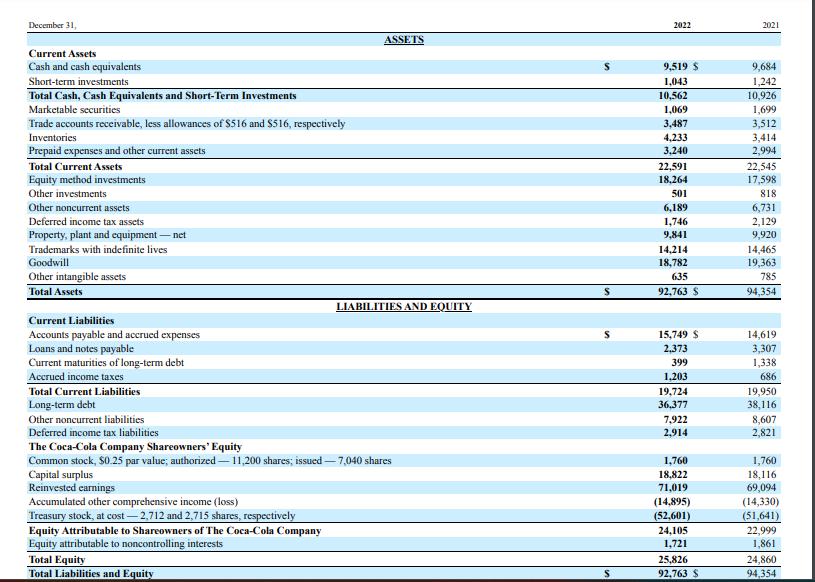

December 31, Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $516 and $516, respectively Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments Other investments Other noncurrent assets Deferred income tax assets Property, plant and equipment-net with indefinite lives Trademarks Goodwill Other intangible assets Total Assets Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost-2,712 and 2,715 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests ASSETS The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized-11,200 shares; issued -7,040 shares Capital surplus Total Equity Total Liabilities and Equity LIABILITIES AND EQUITY S 2022 9,519 $ 1,043 10,562 1,069 3,487 4,233 3,240 22,591 18,264 501 6,189 1,746 9,841 14,214 18,782 635 92,763 S 15,749 S 2,373 399 1,203 19,724 36,377 7,922 2,914 1,760 18,822 71,019 (14,895) (52,601) 24,105 1,721 25,826 92,763 S 2021 9,684 1,242 10,926 1,699 3,512 3,414 2,994 22,545 17,598 818 6,731 2,129 9,920 14,465 19,363 785 94,354 14,619 3,307 1,338 686 19,950 38,116 8,607 2,821 1,760 18,116 69,094 (14,330) (51,641) 22,999 1,861 24,860 94,354

Step by Step Solution

There are 3 Steps involved in it

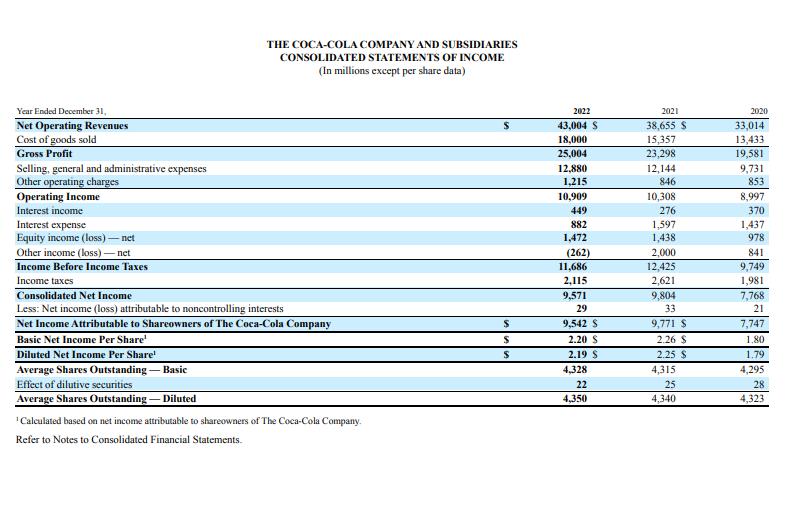

A financial statement analysis for CocaCola 2022 would look at the companys financial performance and health over the course of the year This would include analyzing the companys balance sheet income ... View full answer

Get step-by-step solutions from verified subject matter experts