Question: What would a segmentation graph look like with this information? Please help me create a segmentation graph based on the below information, for Goldman Sachs.

What would a segmentation graph look like with this information? Please help me create a segmentation graph based on the below information, for Goldman Sachs. I also have another sample below.

Horizontal Axis

1Individual Investors:

- These are private individuals who manage their own money, possibly with the help of financial consultants. They tend to seek reliable returns, wealth preservation, and growth. Goldman Sachs often serves this group via wealth management services, guiding them on how to invest, where to allocate their resources, and what financial strategies to adopt.

2Institutional Investors:

- Comprising of hedge funds, pension funds, mutual funds, and insurance companies, institutional investors usually manage larger sums of money. They require robust financial tools, vast research resources, and sophisticated trading platforms. Their investment decisions can influence market movements significantly due to the sheer volume of capital they handle.

3Corporations:

- From startups to multinational corporations, these entities require investment banking services, whether it's for mergers & acquisitions, raising capital, or financial advisory. They might also seek insights on market trends and strategic investment directions, especially during pivotal business decisions like expansions or diversifications.

4Governments and Public Sector:

- Governments and public entities seek services from institutions like Goldman Sachs for a variety of reasons, from issuing bonds to financial advisory on large-scale projects. Given the scale and implications of their financial actions, their operations often intertwine with macroeconomic factors.

Explanation:

Individual Investors seek wealth growth. Institutional Investors manage large funds. Corporations require financial services. Governments seek advisory and capital-raising assistance.

Step 2/3

Vertical Axis (Uses):

1Asset Management:

- Here, Goldman Sachs would oversee the investments of their clients, ensuring optimal returns and minimized risks. This includes a mix of equities, fixed incomes, commodities, and alternative investments. The goal is to grow the assets over time and align with the financial objectives of the client.

2Investment Banking:

- This refers to a segment of Goldman Sachs that assists organizations, individuals, and governments in raising capital by underwriting or acting as the client's agent in issuing securities. Additionally, the investment banking division often advises on mergers and acquisitions.

3Wealth Management:

- This service is more tailored to individual investors or high-net-worth entities. Wealth management not only focuses on investment strategies but also looks into retirement planning, tax strategies, and estate planning.

4Securities and Trading:

- Goldman Sachs has a significant presence in the securities trading world. This involves buying and selling financial instruments, both on behalf of clients and for the bank itself.

5Research Services:

- Goldman Sachs offers research services, providing insights, data, and analysis on various sectors, equities, and commodities. These insights can be pivotal for clients making informed investment decisions.

Explanation:

Asset Management oversees investments. Investment Banking raises capital. Wealth Management tailors strategies. Securities Trading facilitates transactions. Research Services provide market insights.

Step 3/3

Expansion of the GridNew Uses and Users:

1Digital Banking Services:

- As the financial world continues its march towards digitalization, Goldman Sachs can leverage its vast resources and expertise to offer seamless digital banking solutions. This can range from online savings accounts to robust digital trading platforms.

2ESG (Environmental,Social,Governance) Investment Solutions:

- With the increasing focus on sustainability and ethical investing, Goldman Sachs can curate investment portfolios focusing on ESG factors, appealing especially to the newer generation of investors.

3Blockchain/Cryptobased Financial Services:

- Cryptocurrencies and blockchain technology are revolutionizing the financial sector. By offering blockchain-based solutions or even banking services for cryptocurrencies, Goldman Sachs can tap into an entirely new market segment.

New UserStartups/Entrepreneurs:

- With the startup culture booming globally, these new-age businesses require specialized services - from capital raising to financial advisory. Goldman Sachs can play a pivotal role by being the financial backbone for these startups.

TwoBox Move for Goldman SachsSMEs and Supply Chain Financing Solutions:

- Small to Medium-sized Enterprises (SMEs) form the backbone of many economies. By offering supply chain financing solutions, Goldman Sachs can ensure that these businesses maintain liquidity, mitigate risks associated with extended payment cycles, and ensure a smooth operational flow.

In essence, the financial landscape is ever-evolving, and institutions like Goldman Sachs continually adapt by identifying new user segments and offering innovative solutions to meet their unique needs. This ensures that they remain at the forefront of the financial world, driving innovation and influencing market movements.

Explanation:

Digital Banking modernizes finance. ESG solutions for ethical investing. Blockchain services tap crypto market. Startups need tailored support. SMEs benefit from supply-chain financing.

Final answer

Goldman Sachs Grid: Horizontal - Individual wealth growth, Institutional large funds, Corporations' finance, Governments' advisory. Vertical - Asset management, Capital raising, Wealth strategy, Trading, Research. Expansion: Digital banking, ESG, Blockchain, Startup support, SME supply-chain finance.

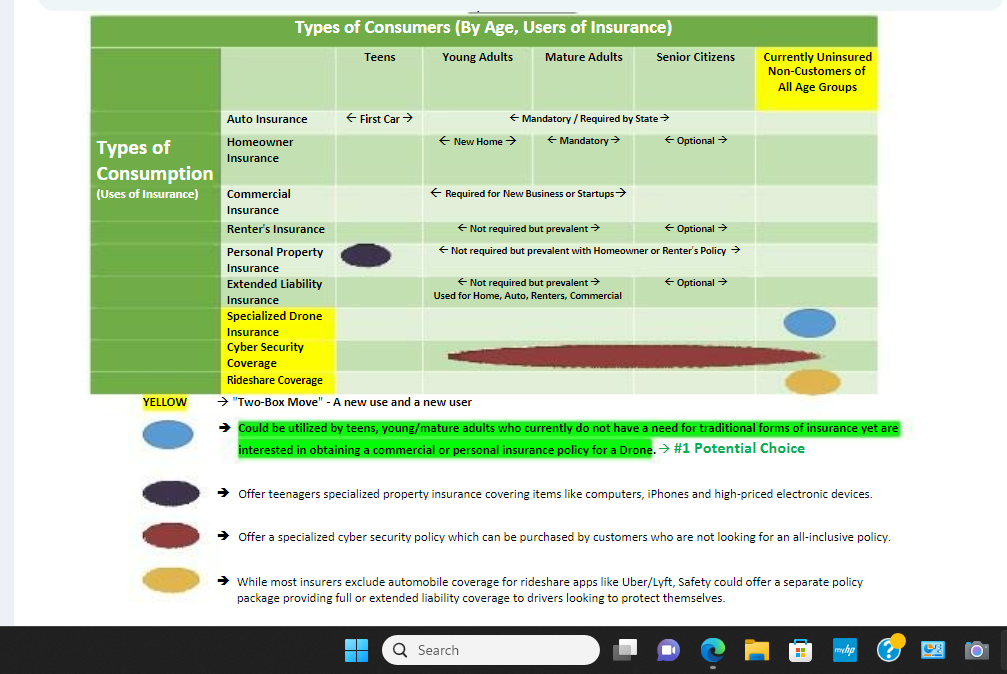

"Two-Box Move" - A new use and a new user Could be utilized by teens, young/mature adults who currently do not have a need for traditional forms of insurance yet are interested in obtaining a commercial or personal insurance policy for a Drone. \#1 Potential Choice Offer teenagers specialized property insurance covering items like computers, iPhones and high-priced electronic devices. Offer a specialized cyber security policy which can be purchased by customers who are not looking for an all-inclusive policy. While most insurers exclude automobile coverage for rideshare apps like Uber/Lyft, Safety could offer a separate policy package providing full or extended liability coverage to drivers looking to protect themselves. "Two-Box Move" - A new use and a new user Could be utilized by teens, young/mature adults who currently do not have a need for traditional forms of insurance yet are interested in obtaining a commercial or personal insurance policy for a Drone. \#1 Potential Choice Offer teenagers specialized property insurance covering items like computers, iPhones and high-priced electronic devices. Offer a specialized cyber security policy which can be purchased by customers who are not looking for an all-inclusive policy. While most insurers exclude automobile coverage for rideshare apps like Uber/Lyft, Safety could offer a separate policy package providing full or extended liability coverage to drivers looking to protect themselves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts