Question: what would be the year end for situation one and on situation 2 I need help. During the current year, supplies were purchased for $5,250cash.

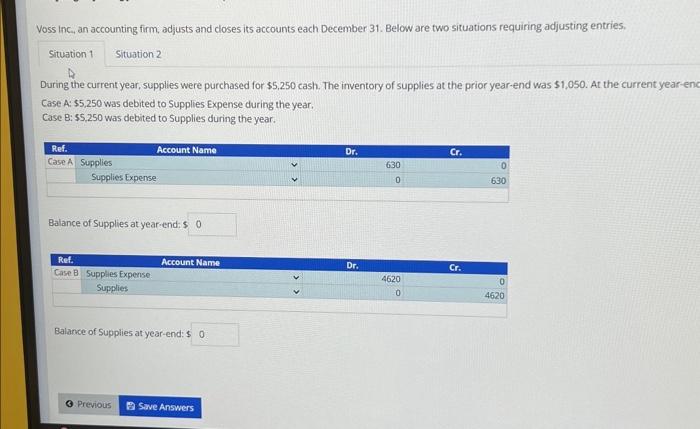

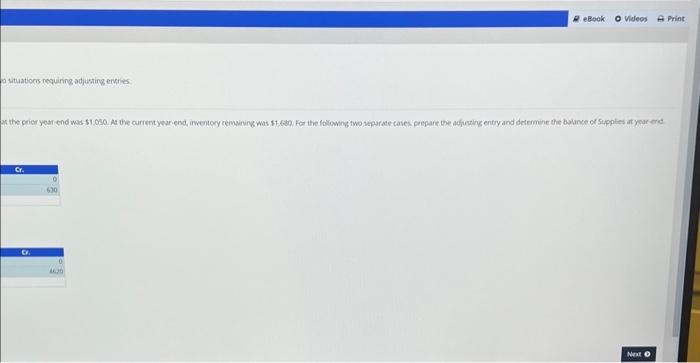

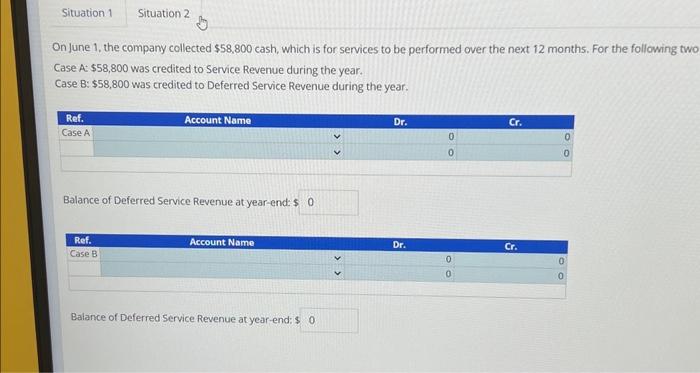

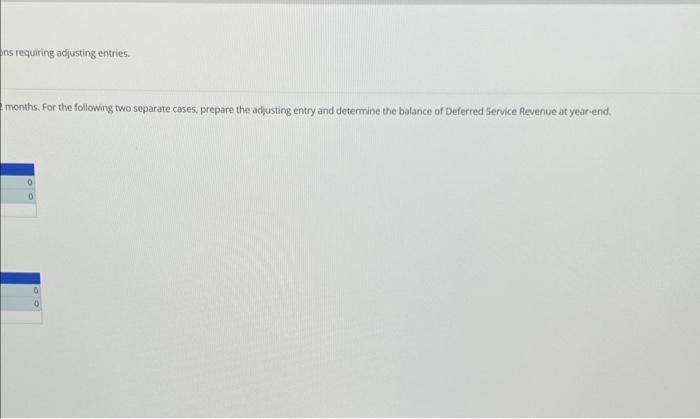

During the current year, supplies were purchased for $5,250cash. The inventory of supplies at the prior year-end was $1,050. At the current year-en Case A. \$5,250 was debited to Supplies Expense during the year. Case B: 55,250 was debited to Supplies during the year. Balance of Supplies at year-end: 5 Balance of Supplies at year-end: 5 po situations requining adjusting encres. On June 1, the company collected $58,800 cash, which is for services to be performed over the next 12 months. For the following two Case A: $58,800 was credited to Service Revenue during the year. Case B: $58,800 was credited to Deferred Service Revenue during the year. Balance of Deferred Service Revenue at year-end:s Balance of Deferred Service Revenue at year-end: \$ ons requiring adjusting entries. months. For the following two separate cases, prepare the adjusting entry and determine the balance of Deferred Service Revenue at year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts