Question: What would the answers be? 6.7 X + education.com/ext/map/index.html?_con=con&external browser=0&launchurl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questio 5,710,EX 3-11 Seved Help Save & CH Required Information Use the following information for the

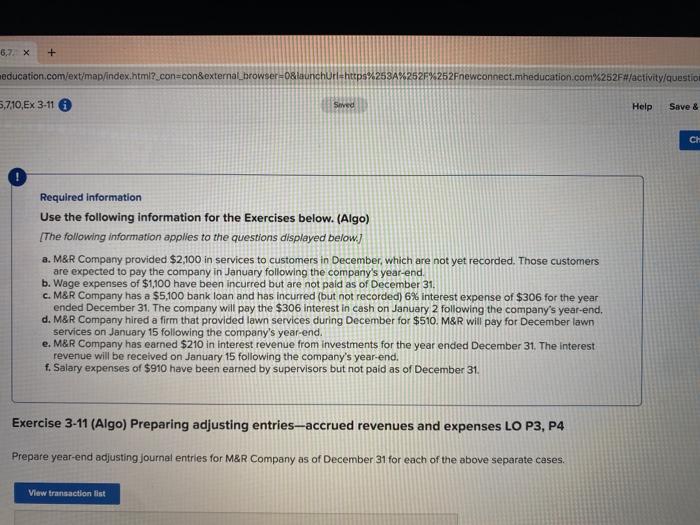

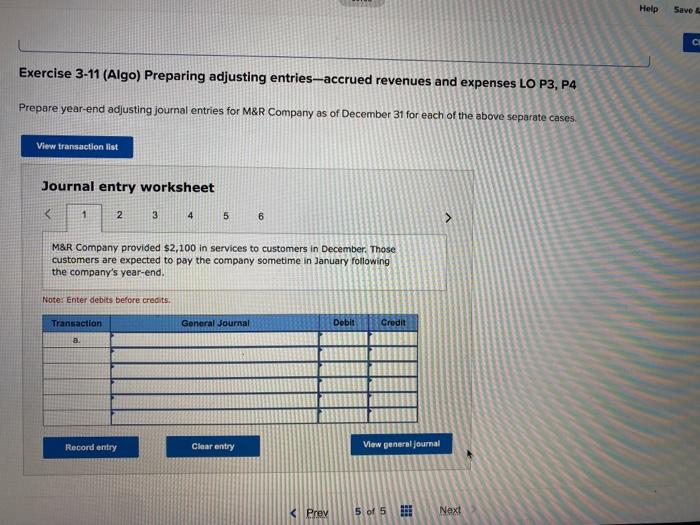

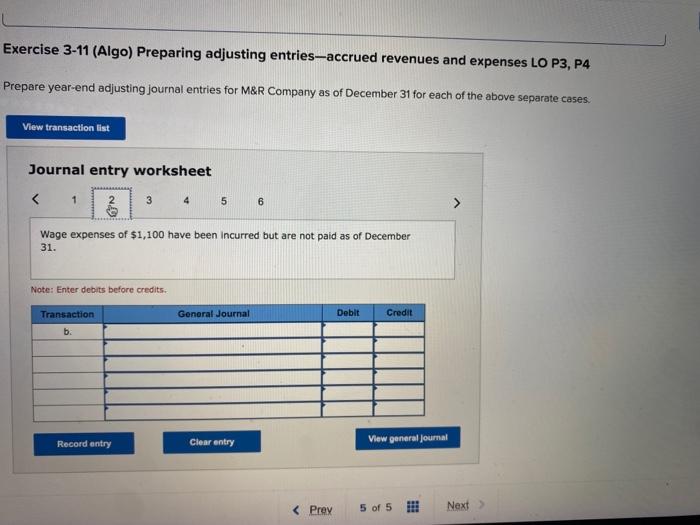

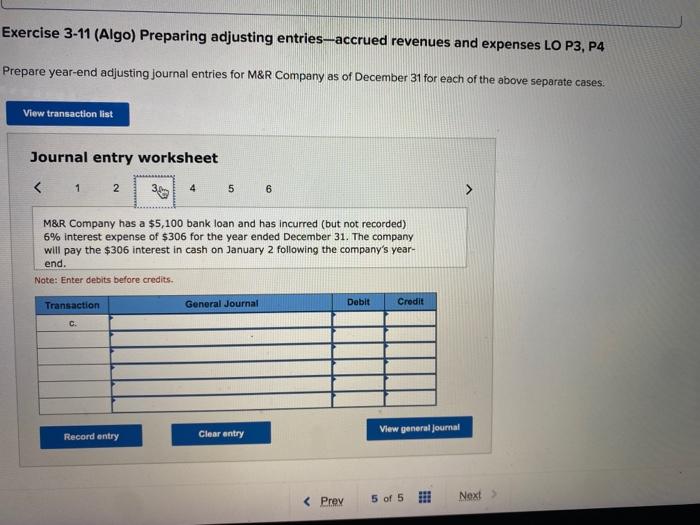

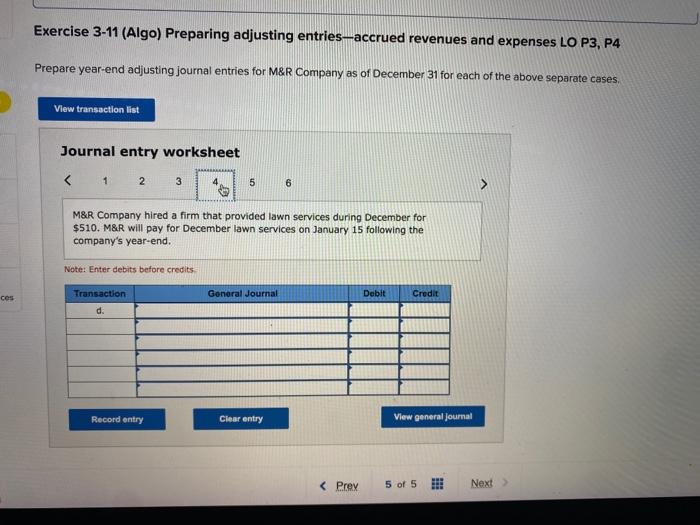

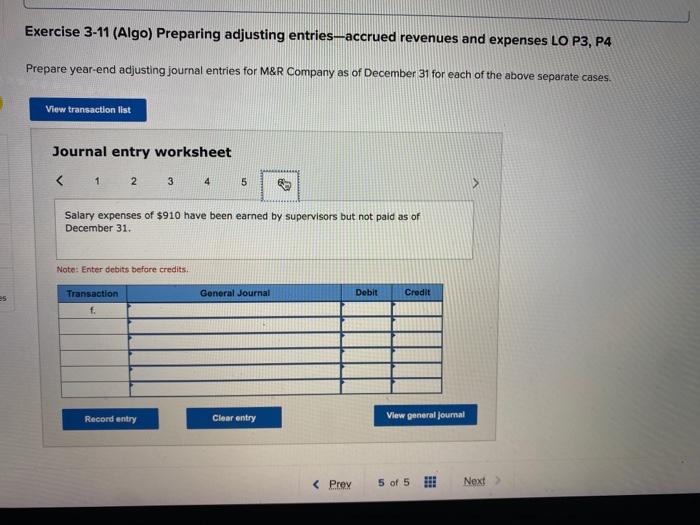

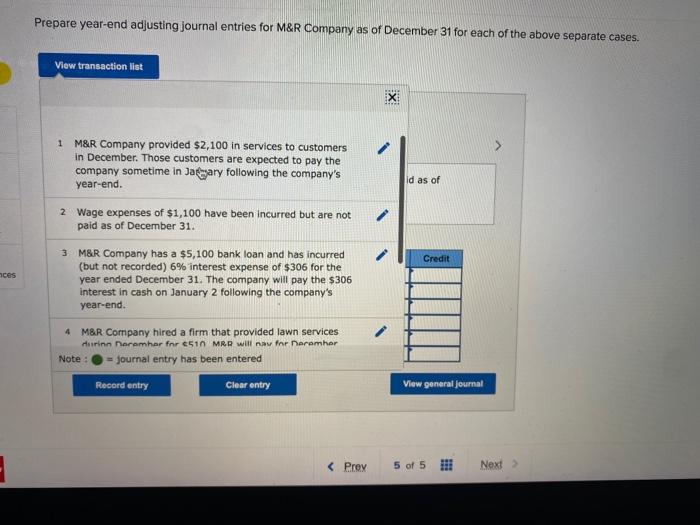

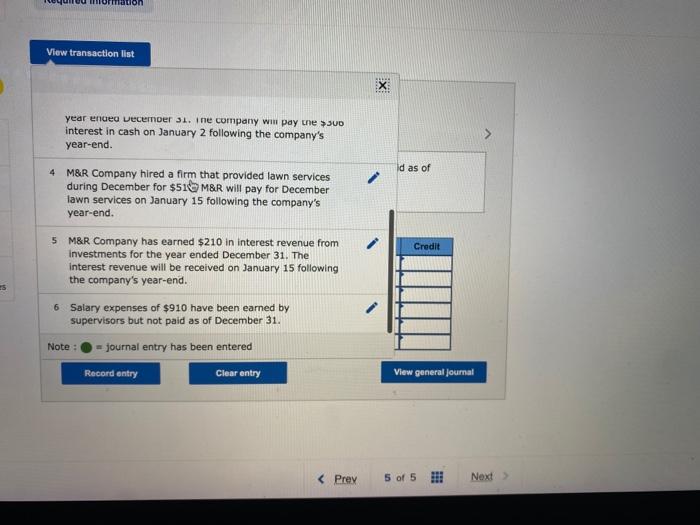

6.7 X + education.com/ext/map/index.html?_con=con&external browser=0&launchurl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/questio 5,710,EX 3-11 Seved Help Save & CH Required Information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below) a. M&R Company provided $2,100 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end b. Wage expenses of $1,100 have been incurred but are not paid as of December 31. c. M&R Company has a $5,100 bank loan and has incurred (but not recorded) 6% interest expense of $306 for the year ended December 31. The company will pay the $306 Interest in cash on January 2 following the company's year-end. d. M&R Company hired a firm that provided lawn services during December for $510. M&R will pay for December lawn services on January 15 following the company's year-end. e. M&R Company has earned $210 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. f. Salary expenses of $910 have been earned by supervisors but not paid as of December 31. Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Help Save CH Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet M&R Company provided $2,100 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. Note: Enter debits before credits Transaction General Journal Debit Credit a. Record entry Clear entry View general journal Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list X: 1 M&R Company provided $2,100 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. id as of Credit ces 2 Wage expenses of $1,100 have been incurred but are not paid as of December 31. 3 M&R Company has a $5,100 bank loan and has incurred (but not recorded) 6% interest expense of $306 for the year ended December 31. The company will pay the $306 interest in cash on January 2 following the company's year-end. 4 M&R Company hired a firm that provided lawn services Hurinn eremhar fnr 4510 MRR will nav for neramher Note: = journal entry has been entered Record entry Clear entry View general Journal 300 interest in cash on January 2 following the company's year-end. Id as of 4 M&R Company hired a firm that provided lawn services during December for $51M&R will pay for December lawn services on January 15 following the company's year-end. Credit 25 5 M&R Company has earned $210 in interest revenue from Investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. 6 Salary expenses of $910 have been earned by supervisors but not paid as of December 31. Note : = journal entry has been entered Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts