Question: What would the basic and diluted earnings per share for XYZ for 2024 be? 1. On January 1, 2024, XYZ Company had 200,000 shares of

What would the basic and diluted earnings per share for XYZ for 2024 be?

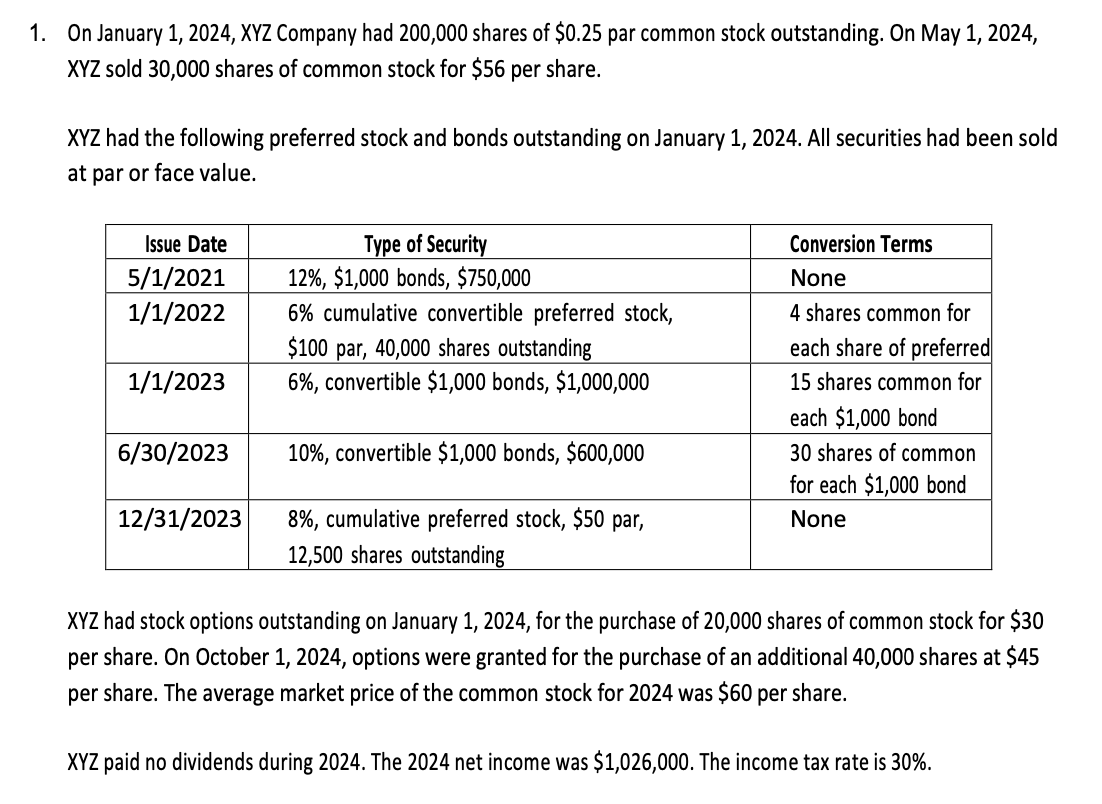

1. On January 1, 2024, XYZ Company had 200,000 shares of $0.25 par common stock outstanding. On May 1, 2024, XYZ sold 30,000 shares of common stock for $56 per share. XYZ had the following preferred stock and bonds outstanding on January 1, 2024. All securities had been sold at par or face value. Issue Date 5/1/2021 Type of Security 12%, $1,000 bonds, $750,000 1/1/2022 1/1/2023 6% cumulative convertible preferred stock, $100 par, 40,000 shares outstanding 6%, convertible $1,000 bonds, $1,000,000 6/30/2023 10%, convertible $1,000 bonds, $600,000 12/31/2023 8%, cumulative preferred stock, $50 par, 12,500 shares outstanding Conversion Terms None 4 shares common for each share of preferred 15 shares common for each $1,000 bond 30 shares of common for each $1,000 bond None XYZ had stock options outstanding on January 1, 2024, for the purchase of 20,000 shares of common stock for $30 per share. On October 1, 2024, options were granted for the purchase of an additional 40,000 shares at $45 per share. The average market price of the common stock for 2024 was $60 per share. XYZ paid no dividends during 2024. The 2024 net income was $1,026,000. The income tax rate is 30%.

Step by Step Solution

There are 3 Steps involved in it

To calculate the basic and diluted earnings per share for XYZ for 2024 we need to consider the changes in the number of common shares outstanding due ... View full answer

Get step-by-step solutions from verified subject matter experts