Question: What would the horizontal and vertical analysis be? H&R Block financ om nePage layoud fermRa Cut General Copy Format Painter te BIU Clipboard Font Alignment

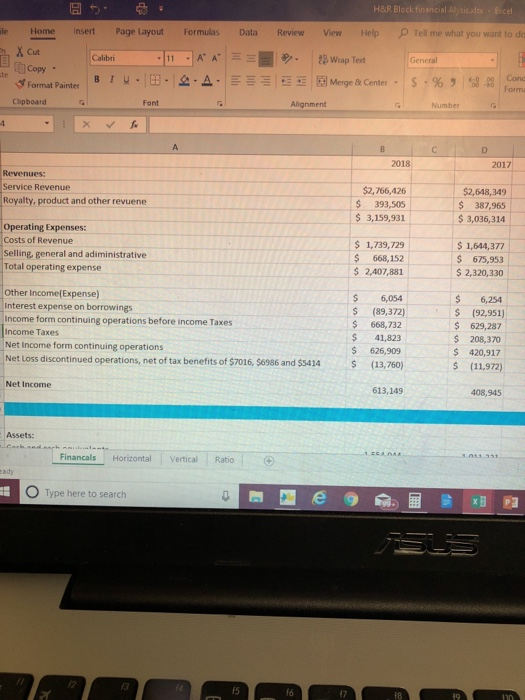

H&R Block financ om nePage layoud fermRa Cut General Copy Format Painter te BIU Clipboard Font Alignment Number 2018 2017 Revenues: Service Revenue Royalty, product and other revuene $2,766,426 S 393,50S 3,159,931 $2,648,349 $ 387,965 3,036,314 Operating Expenses Costs of Revenue Selling, general and adiministrative Total operating expense 1,739,729 $ 668,152 2,407,881 1,644,377 S 675,953 $ 2,320,330 Other Income(Expense Interest expense on borrowings income form continuing operations before income Taxes Income Taxes Net income form continuing operations S 6,054 (89,372) $668,732 41,823 626,909 (13,760 $ 6,254 S (92,951) $ 629,287 S 208,370 $ 420,917 s (11,972) Net Loss discontinued operations, net of tax benefits of $7016, $6986 and $5414S Net Income 613,149 408,945 Assets: Financals HorizontalVertical Ratio O Type here to search 15 f6 17 F8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts