Question: Whatcha Mining Ltd has recently restructured its outstanding bond issue. The bond issue has 10 years remaining to maturity and an annual coupon rate of

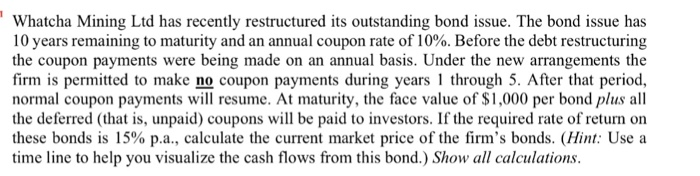

Whatcha Mining Ltd has recently restructured its outstanding bond issue. The bond issue has 10 years remaining to maturity and an annual coupon rate of 10%. Before the debt restructuring the coupon payments were being made on an annual basis. Under the new arrangements the firm is permitted to make no coupon payments during years 1 through 5. After that period, normal coupon payments will resume. At maturity, the face value of S1,000 per bond plus all the deferred (that is, unpaid) coupons will be paid to investors. If the required rate of return on these bonds is 15% p.a., calculate the current market price of the firm's bonds. (Hint: Use a time line to help you visualize the cash flows from this bond.) Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts