Question: whats th answer? The following table summarizes the yields to maturity on several one-year Zero-coupon securities: a. What is the price (expressed as a percentage

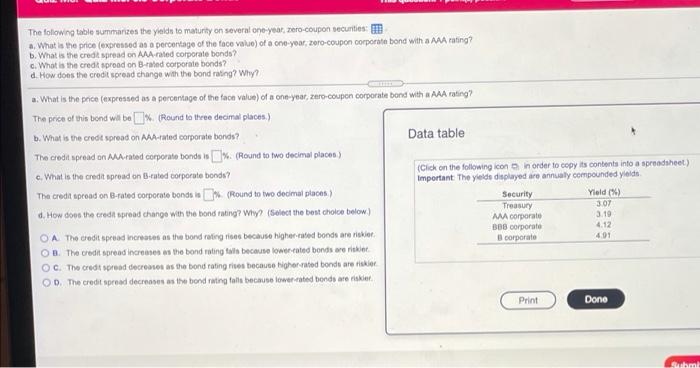

The following table summarizes the yields to maturity on several one-year Zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one year 2000-coupon corporate bond with a MA rating? b. What is the credit spread on AAA rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? .: What is the price (expressed as a peronntage of the face value of a one-year, zaro-coupon corporate bond with a AAA rating? The price of this bond wit be % (Round to three decimal places) b. What is the credit spread on AA rated corporate bonds? Data table The credit spread on Marated corporate bonds 0% (Round to two decimal place) c. What is the credit spread on B-rated corporate bonds? (Click on the following icon in order to copy its contents into a spreadsheet) Important. The yields displayed are annually compounded yields The credit aproad on B-rated corporate bonds is Round to two decimal places) Security Yield (%) Treasury 3.07 d. How does the credit spread change with the bond rating? Why? (Select the best choice below) MM corporate 308 corporate 4.12 OA The credit spread increases as the bond rating is because higher rated bonds are rider corporate 491 OB. The credit spread increases the bonding to because lower rated bonds oreille OC. The credit spread decreases the bond rating is because higher rated bonds are like OD. The credit spread decreases as the bond rating oils because lowercated bonds are takie Print Dono 3.10 Subm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts