Question: What's the answer please? Please do not use any sort of AI as they provide wrong/different answers! Thank you Firm A is analyzing the possible

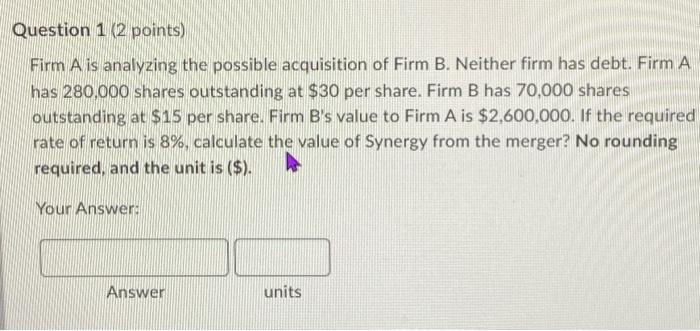

Firm A is analyzing the possible acquisition of Firm B. Neither firm has debt. Firm A has 280,000 shares outstanding at $30 per share. Firm B has 70,000 shares outstanding at $15 per share. Firm B's value to Firm A is $2,600,000. If the required rate of return is 8%, calculate the value of Synergy from the merger? No rounding required, and the unit is (\$). Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts